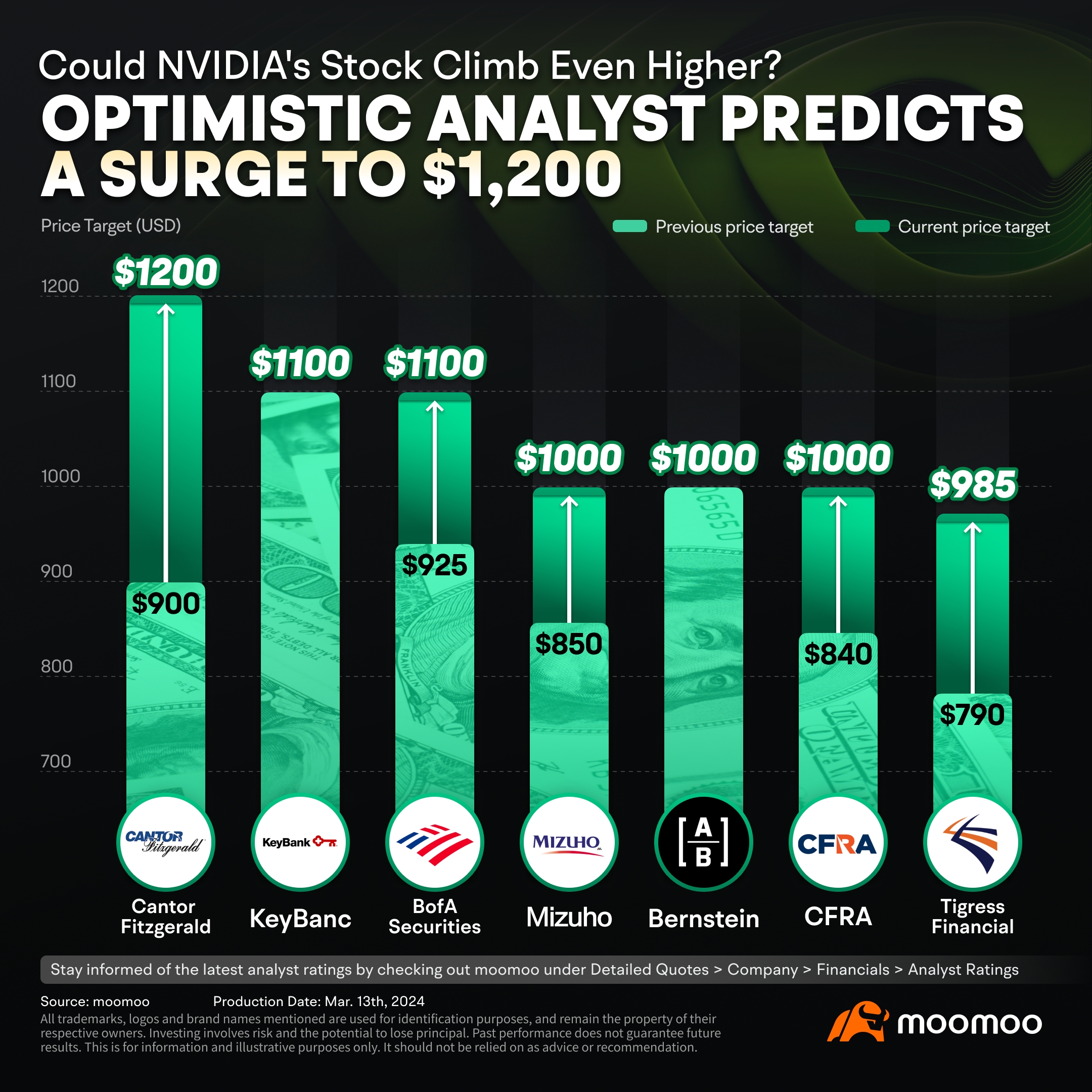

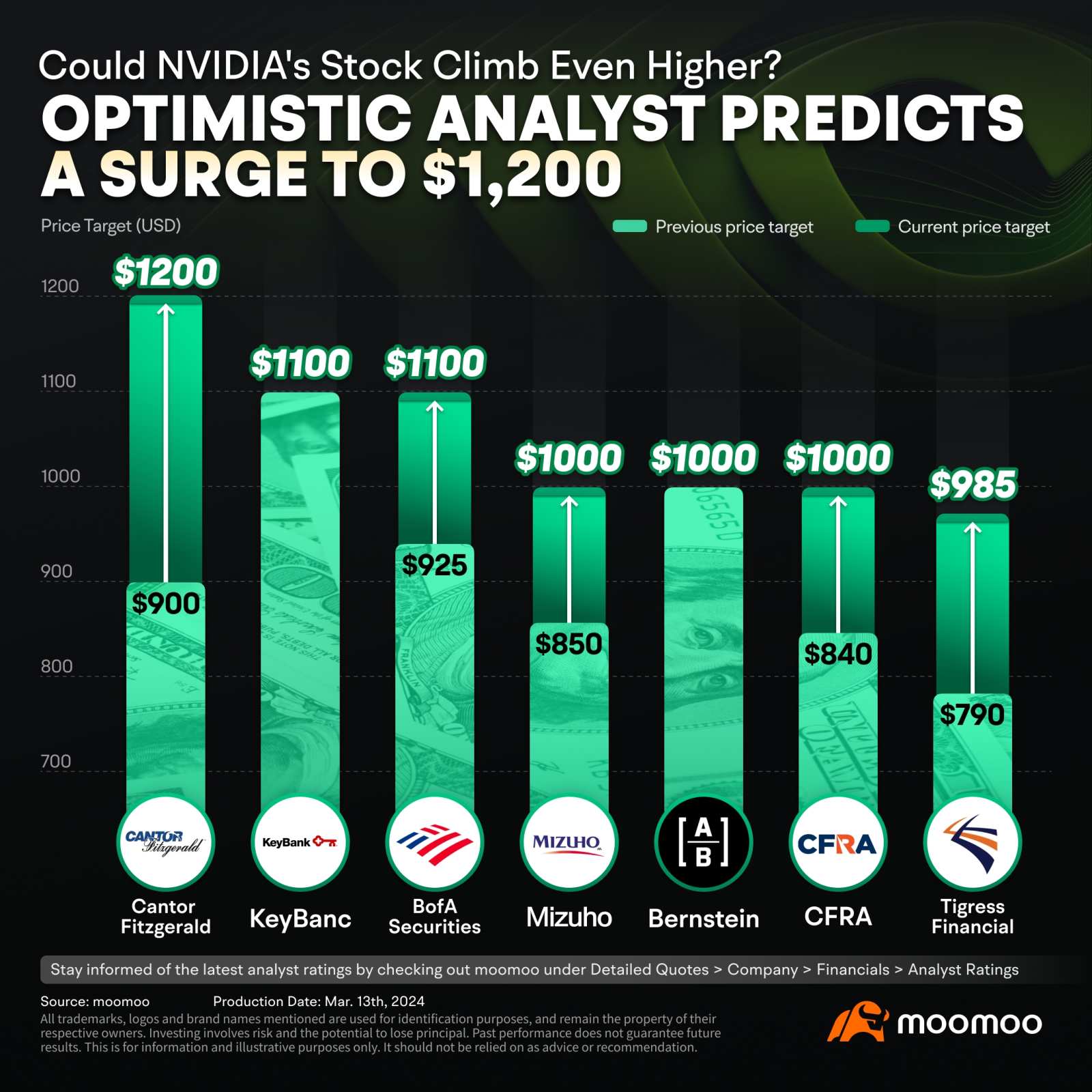

Could NVDA Climb Even Higher? Optimistic Analyst Predicts a Surge to $1,200

$NVIDIA (NVDA.US)$ experienced its worst trading day in nine months on a Friday, yet despite this, Cantor Fitzgerald analyst C.J. Muse remains highly optimistic about the company's prospects. Over the weekend, Muse increased his price target for Nvidia's stock from $900 to $1,200. He anticipates that the upcoming annual GTC conference will highlight the company's growth potential, including for some of Nvidia's less publicized ventures. Muse's new price target is one of the highest on record according to FactSet and suggests a potential 30% increase from the stock's current price.

Nvidia's software business recently hit a $1 billion annual run rate, which is relatively small compared to the company's total revenue of over $60 billion last year, with expectations to surpass $100 billion this year.

However, Muse believes the software segment is just getting started and predicts that Nvidia will focus heavily on its growth potential at the upcoming GTC conference. He is particularly optimistic about Nvidia's AI Enterprise offering, aimed at broadening access to AI. Muse also anticipates that Nvidia will highlight the importance of inference applications in AI, where systems make predictions using new data. He notes that there was surprise on Wall Street when Nvidia reported that inference demand had driven at least 40% of its data-center GPU demand over the past year, which in retrospect aligns with the strategic moves by companies like $Meta Platforms (META.US)$ and $Microsoft (MSFT.US)$ in this area.

We continue to expect NVIDIA to surprise to the upside with its share of the inference market"

Muse considers it a reasonable expectation that between 10% to 15% of servers will be enhanced with acceleration technology by the year 2025. He believes that once investors are convinced that 2025 will not be a peak year, Nvidia's stock could be justifiably valued between $1,200 and $1,400.

Source: MarketWatch, MorningStar, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

frank Crane_3546 : Go Nvidia!

mr_cashcow :

ET Rodriguez :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)