CPI and rate cuts around the corner: ETF to buy?

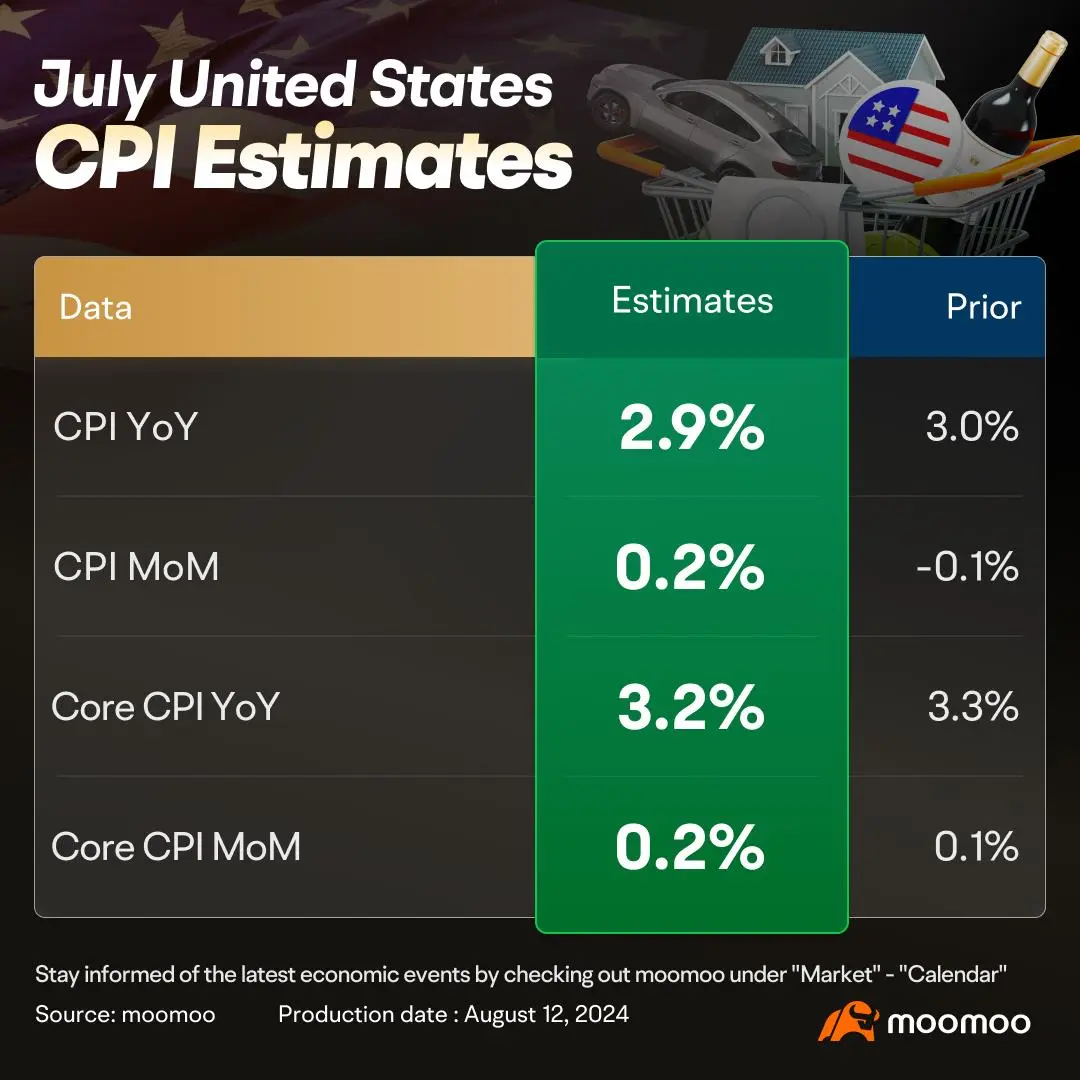

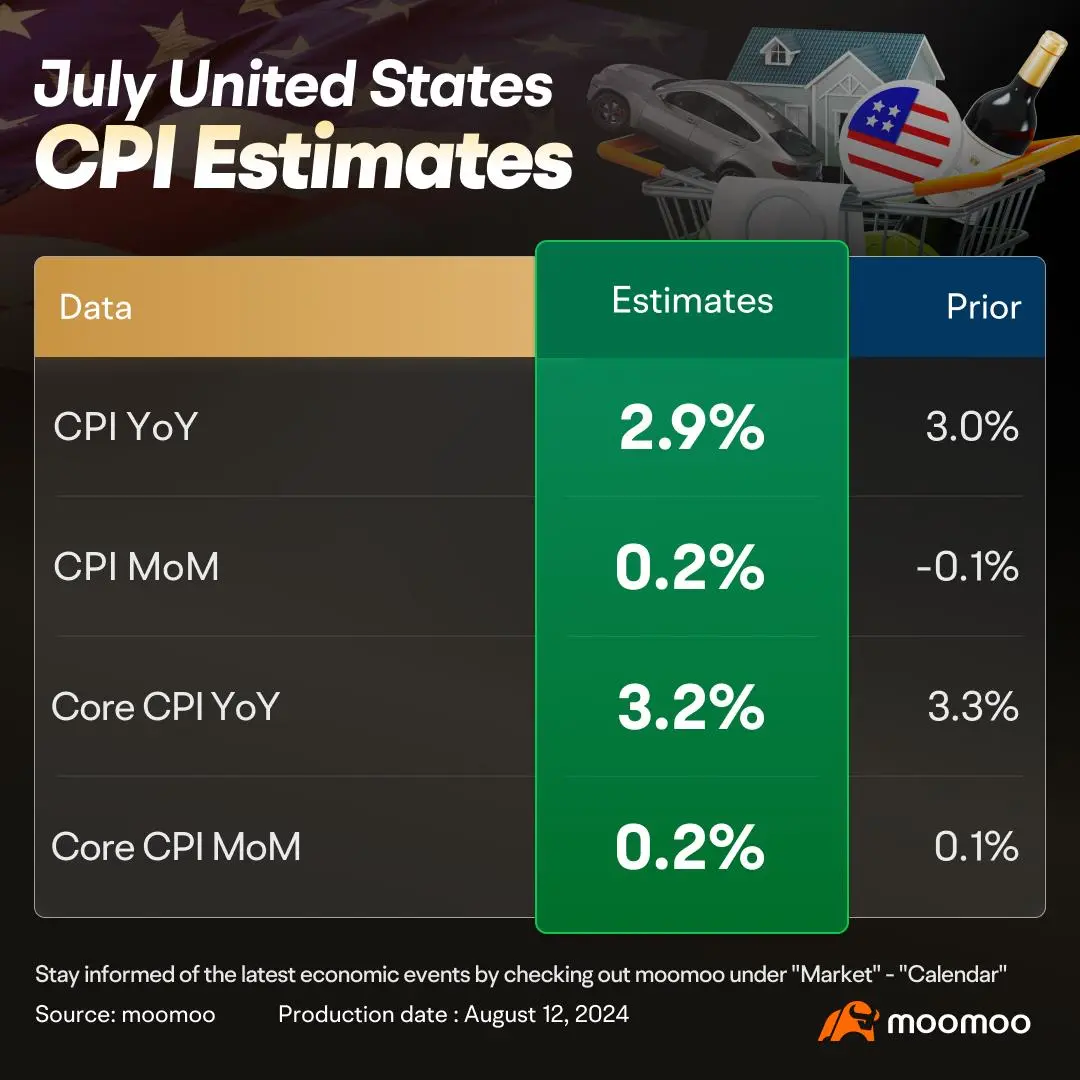

Recent U.S. economic reports, yen carry trade issues, and global tensions have rocked the stock market. A disappointing July jobs report caused market instability, but a positive update on jobless claims sparked the S&P 500's largest rally in nearly two years. Now, the upcoming release of July's CPI is drawing attention, with potential to cause significant market reactions.![]()

(1) Buying bond ETFs like the $iShares 20+ Year Treasury Bond ETF (TLT.US)$, as rate cuts typically raise bond prices. Selling put options for income and using cash sweeps to increase returns are also strategies to explore.

(2) Investing in cryptocurrency ETFs like the $iShares Bitcoin Trust (IBIT.US)$, since rate cuts can weaken the dollar and enhance the appeal of safe-haven assets like cryptocurrencies.

To assist you better find and select related ETFs mentioned above, click here to read and try ETF functions like "Index ETF" and "Thematic ETF">>

For more learning about US Treasury bonds and related ETFs, you can also check this one out!

If you want to be more expert in rate cut related ETF opportunities, check out our rich knowledge storage in the below readings!![]()

Tech Confidence Rebounds as Nvidia's Shares Jump 17% in Four Days

With U.S. Producer Price Index (PPI) figures falling short of forecasts, anticipation of a Federal Reserve rate cut has lifted spirits in the stock market. $NVIDIA (NVDA.US)$, an AI powerhouse, has seen its stock soar by 6.53% on a single day and over 17% across four days, adding $42 billion to its value. Meanwhile, the Semiconductor Index (SOX) has risen almost 12%, outperforming the Nasdaq's 6% increase. Wall Street giants like Bank of America view Nvidia as a strong recovery play, predicting a semiconductor industry bounce-back by late 2024.

Additionally, the $Rydex Exchange Traded Fd Trust Guggenheim S&P 500 Top 50 Etf (XLG.US)$ experienced record inflows, signaling robust investor confidence in major tech stocks.![]()

Now the questions are:

What ETFs can I invest in related to semiconductors or tech?

How to invest?

How can I earn?

How to invest?

How can I earn?

Don't worry, we have prepared these for you ![]()

For new mooers who want to learn more about ETF to invest smartly, we also have this for you: ![]()

An Exchange-Traded Fund (ETF) is a type of investment product that owns and manages an underlying basket of assets (equities, bonds, commodities, derivatives, etc.) and divides the ownership of those assets into individual shares. You can buy one share of an ETF and own many stocks, bonds and other investments.

Typically, ETFs passively track a major market index such as the TSX Composite Index. A passive investment mirrors the performance of its benchmark index and delivers those returns, minus a small fee.

Your experience matter! Tell me your thoughts!![]()

To better navigate and earn with ETF, we provide you with a toolbox of features to assist investment. Read our ETF Playbook series to boost up your earnings!![]()

To assist you better select the suitable ETFs, click here to check our ETF Playbook for guidance>>

How to grab the next opportunity?

Missed the latest investment wave? Don’t fret – the key is to focus on upcoming opportunities. Moomoo Learn is here to equip you with actionable trading strategies to help you spot and capitalize on future investment prospects.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Dart Board Picks : materials...especially gold and copper $GLOBAL X COPPER PRODUCERS INDEX ETF UNIT CL A (COPP.CA)$

73279472 : ok

john song : k

73431096 : buy Tesl ETF

71185702 : do you have Info for Canadian options??

Outpost : Yieldmax for max returns