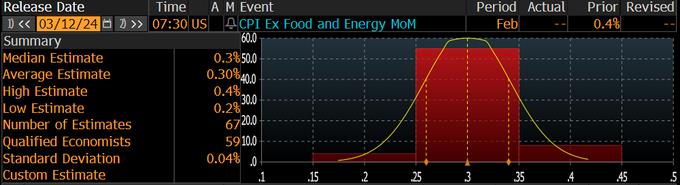

In January, US consumer prices climbed at a rate surpassing forecasts, driven largely by a significant increase in rental housing costs. This news triggered a 1.4% fall in the benchmark stock index on February 13, the day the figures were made public. "Following the unexpectedly robust report from last month, there's definitely a heightened sense of apprehension about the upcoming figures. This anxiety is likely to contribute to today's jitteriness in the options market," commented Matthew Tym, the chief of equity derivatives trading at Cantor Fitzgerald.

CᖇYᑌI᙭ : @104025852 @CashbenderGG

104025852 CᖇYᑌI᙭ : Sus tmr all moon

CᖇYᑌI᙭ 104025852 :