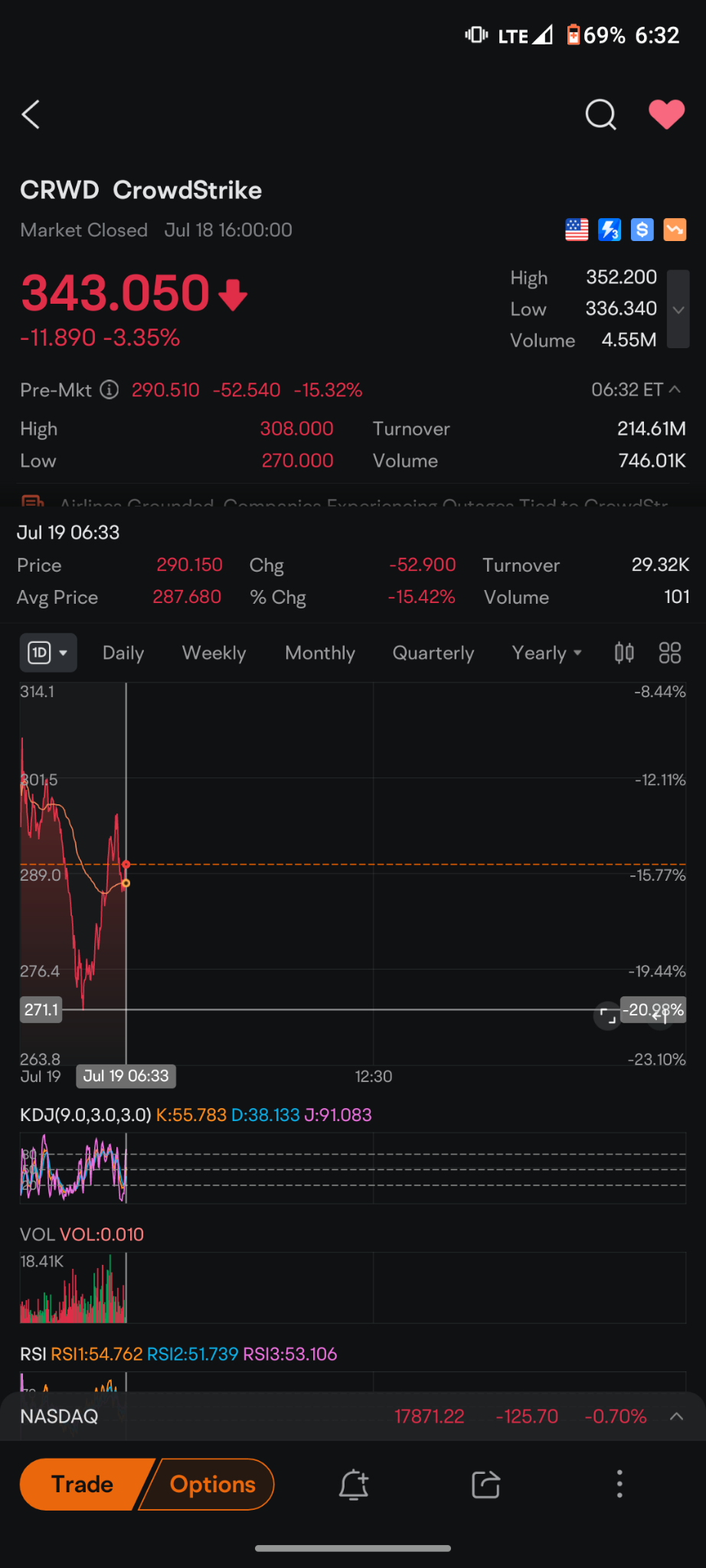

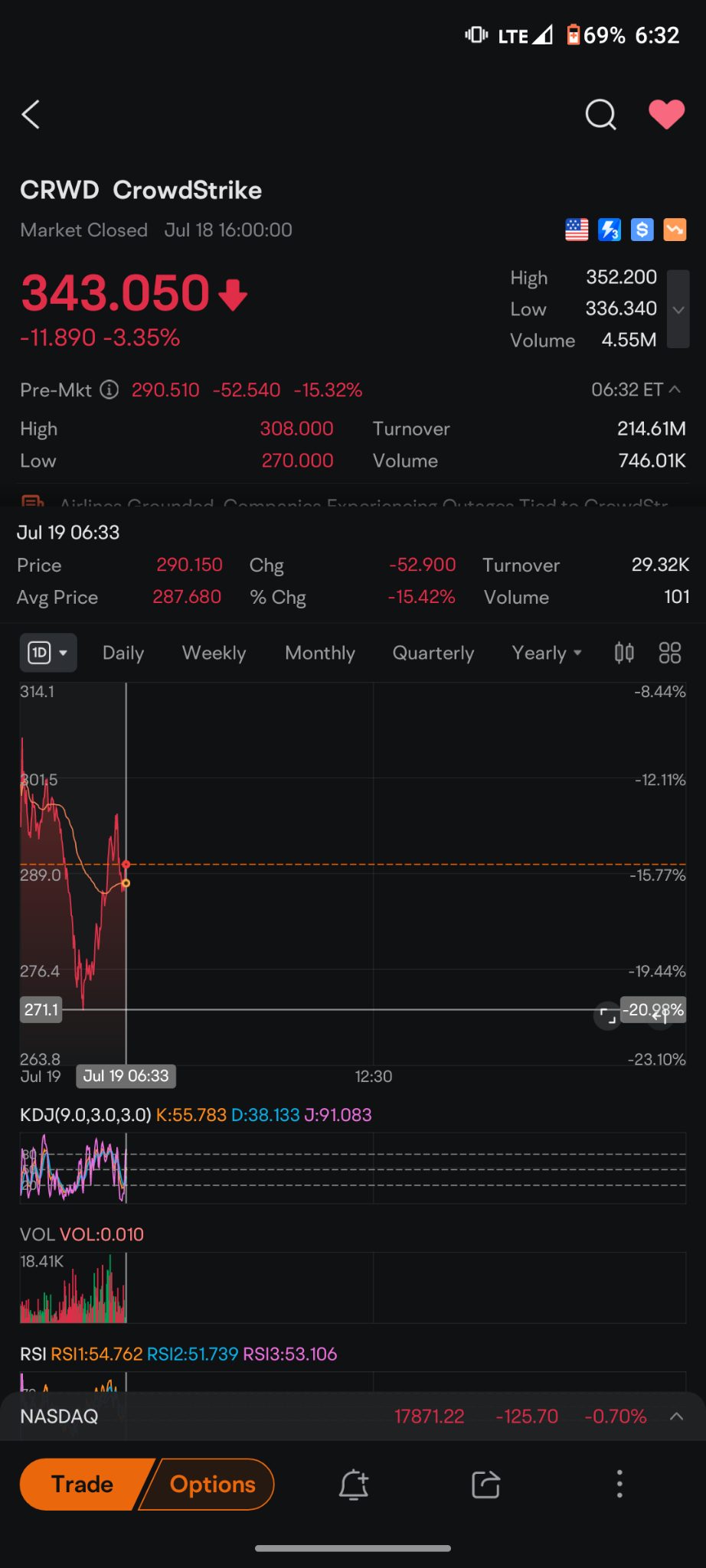

$CrowdStrike (CRWD.US)$ so for those with some brass ones.. ...

$CrowdStrike(CRWD.US$ so for those with some brass ones.. if you think the bottom was put in on the minute tick chart, when the option Market opens pick your poison. I literally mean that and sell a put (pick you out of the money strike price carefully) because the premiums will be HUGE.. today they expire so you're literally betting on 4:00 expiration. you're going to be able to collect a very very large premium but understand if you don't have the money to cover it when it's put to you you're going to be forced to buy it back and take a loss PRIOR TO THE CLOSE TODAY. the option chain that you see the prices are not accurate obviously they will all update at 9:30 when the bell opens and you'll see very large premiums on the out of the money puts I mean you're going to probably be 8 10 $12 on some of these. for ones that are $5 or so out of the money you could probably see 15 or $20 because of the potential for volatility any bad news downgrades revision of earnings anything like that lawsuits could reverse an upward trend in a millisecond it's going to be a very very fast Market.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

倔强的小韭菜 : 50% of my positions will be buying puts today thanks

102379107 : What would be your position? Sell a put means bullish on the company though if its 0dte, means you are targetting a rebound.

10baggerbamm OP 102379107 : correct you see when you have a massive implosion on a stock or stocks that are declining which The magnificent seven have been butchered this past week the volatility premium and the put premium is up significantly compared to the call premium. so even if you think a stock's going to go up 10 points you would make more money by selling a put naked because of the implied volatility the risk that's built into that put option because it has declined so much so severely so quickly you'll make more by selling that put than if the stock does recover 10 points. and the reason is because it's declined on the call side the premium has been stripped away. so it's a bullish stance to take but understand you have a tremendous amount of risk your risk is far greater than the premium you collect the risk is you better want to own that company number one because if it halts trading and gaps down you own it baby or you better be prepared to take the loss and buy back the put so if you don't have that liquidity if you don't have that intestinal fortitude to take on the potential downside then obviously you either buy the stock outright and your risk is it just gaps down or you buy a call option in which case you know exactly what your losses will be which is the price you pay for your contracts

10baggerbamm OP 102379107 : also a doesn't necessarily mean that I need to see a rebound I just need it to expire higher than the strike price of the put that I sold so it does not need to continue a v bottom it just needs to be higher than my strike so I won't be assigned the stock and or I won't be forced to go in and buy back the puts at a loss

102379107 10baggerbamm OP : ic, thanks for the insight!