Crowdstrike's Global Outage Sparks Ongoing Effects: What's Next?

Last Friday, a flawed software update released by the cybersecurity company $CrowdStrike (CRWD.US)$ caused widespread PC crashes globally, resulting in a large number of users experiencing "blue screen of death". This led to a chain of failures and sustained impacts in various fields such as aviation, banking, healthcare, retail, ports, enterprises and governments. $Microsoft (MSFT.US)$ estimated that approximately 8.5 million Windows devices worldwide were affected by this global IT outage.

Although CrowdStrike's CEO, George Kurtz, announced that the issue had been identified, isolated, and repair measures had been deployed, experts predict that the recovery process will be lengthy. As of Sunday, FlightAware.com reported that about 1,700 flights within, into, or out of the U.S. were canceled, and over 9,000 flights were delayed.

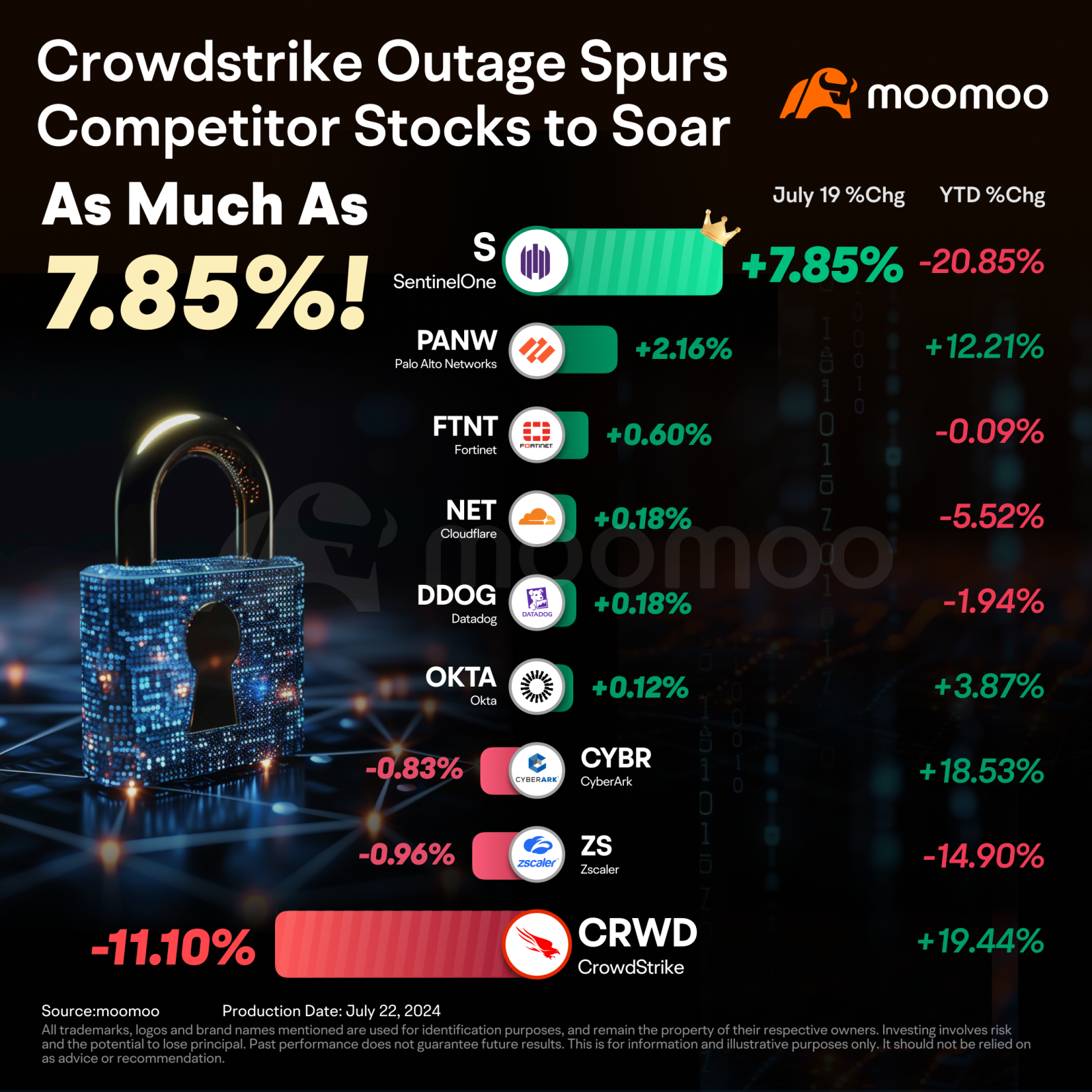

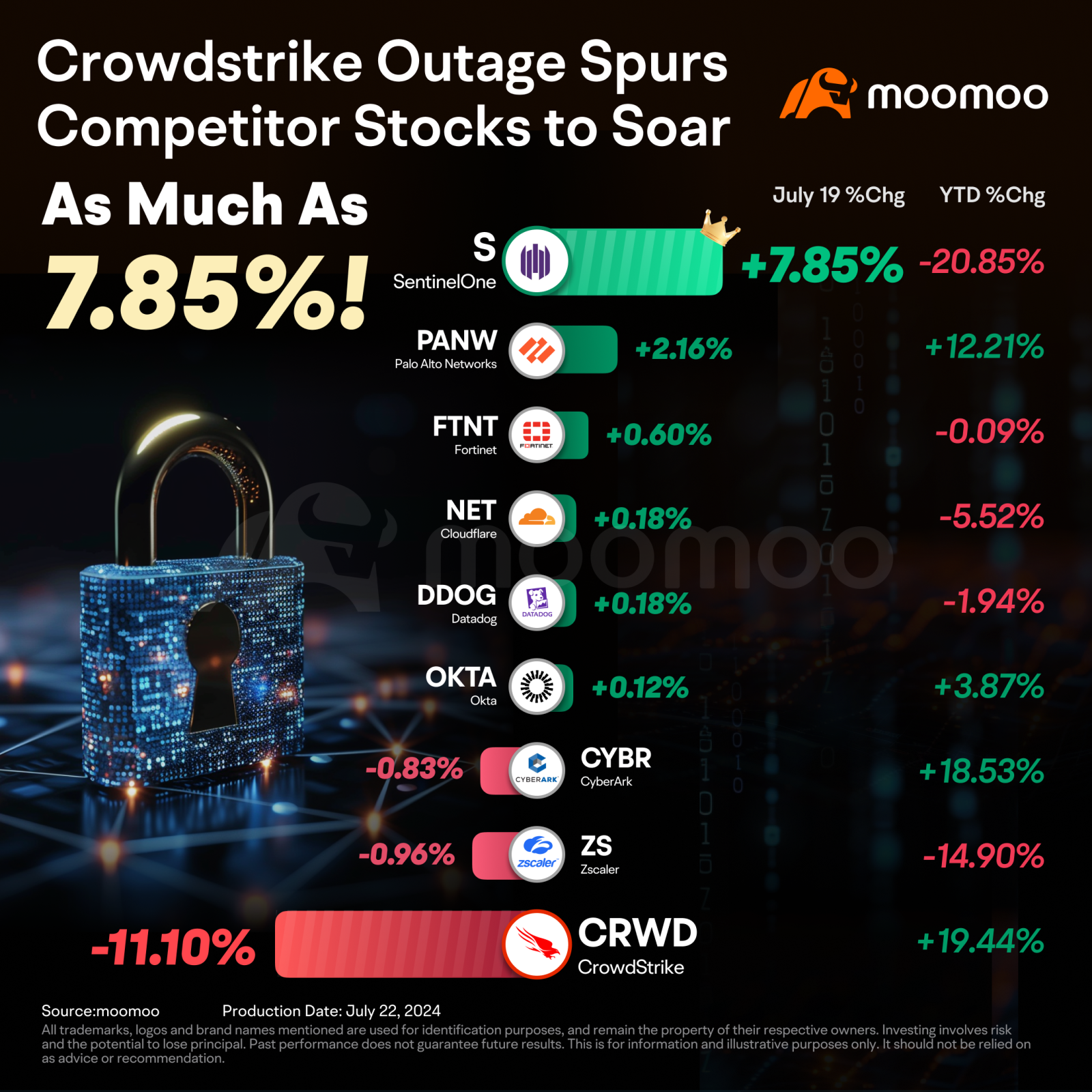

Following the chaos caused by CrowdStrike, the company's stock price plummeted by 11%, the worst in nearly two years. Microsoft's stock price experienced a slight decline of 0.7%. Meanwhile, some other cybersecurity stocks saw varying degrees of increase, with $SentinelOne (S.US)$ increasing by 7.85% and $Palo Alto Networks (PANW.US)$ up by 2.16%.

With the market's expectation of a big uptick in demand for cybersecurity services and its highest market share in the endpoint protection market at 23.89%, CrowdStrike used to be one of the most favored stocks on Wall Street. Its earnings results for the first quarter of the 2025 fiscal year ending on April 30, 2024 achieved a record-breaking performance, with net new annual recurring revenue (ARR) of $212 million growing 22% yoy and ending ARR growing 33% yoy to reach $3.65 billion. Moreover, the company delivered a record operating cash flow of $383 million and record free cash flow of $322 million. It is noteworthy that the stock was just added to the benchmark S&P 500 index in June. The impressive profitability and inclusion in a major index demonstrate the company's industry leadership and recognition in the capital market. Before the outage last Friday, the company's stock price has accumulated a rise of over 30% this year, significantly outperforming its peers. According to Moomoo data, 94% of analysts rate the stock as a buy, which is higher than Palo Alto Networks' 88%.

As the outage occurred in the last two weeks of the second fiscal quarter of the company and existing customers of CrowdStrike may seek compensation for losses incurred due to the interruption, analysts predict that this incident may have an impact on the business operations of CrowdStrike, including setbacks in order acquisition and potential compensation. Concerns about damage to corporate reputation may also put pressure on CrowdStrike for a period of time.

● Immediately after the incident, Musk said that he’s deleted CrowdStrike from systems after outage. Joseph Gallo from Jefferies also cautioned that the CrowdStrike incident could significantly limit the potential upward momentum of their F2Q, as new clients are awaiting assurance that the situation has been addressed. This means that in the medium term, the company's business activities may face challenges due to the disappointment of existing clients and the hesitation of potential new clients.

● Meanwhile, although Oppenheimer's Ittai Kidron maintains a long-term positive view on CrowdStrike, he believes that this incident is a major blow to the company's reputation which is likely to not only affect investor sentiment, but also impact business activities for the next few quarters. Oppenheimer expects that it will take time for CrowdStrike to regain customer and investor confidence through remedial measures, and the company's stock price will continue to be under pressure in the coming weeks. Evercore ISI is also lowering their expectations for the second half of the year, as the flawed software update indicates quality assurance issues at CrowdStrike, with too many unpredictable variables, including reputational risks.

● KeyBanc analyst Eric Heath predicts that the global outage may pose risks to CrowdStrike's second quarter, as affected clients may be compensated, and the win rate may be affected in the short to medium term. Peter Weed from Bernstein also expressed similar concerns and expects that legal disputes may arise after CrowdStrike helps clients launch and operate their systems.

Actually, prior to the recent outage incident, some analysts had already downgraded their rating or target price for Crowdstrike in July due to factors such as overvaluation and slowing demand prospects, indicating that the challenges faced by Crowdstrike are multi-faceted. Specifically, Piper Sandler downgraded Crowdstrike from "buy" to "neutral" because the significant increase in the stock price this year has made the risk/reward ratio of Crowdstrike shares less favorable, despite the fact that the institution acknowledges that Crowdstrike still has many incremental growth opportunities in the future. KeyBanc also lowered its target price for Crowdstrike from $440 to $420 because the institution lowered its 2024 IT budget outlook from the previously surveyed 2.6% to 1.6%, reflecting the impact of the macroeconomic deterioration in the past 90 days on the expected rebound time of IT spending; in addition, Redburn Atlantic downgraded Crowdstrike from "buy" to "sell" and lowered its target price from $380 to $275. The institution believes that Crowdstrike's valuation is "too high" and that its broad growth expectations have not yet reflected early signs of an economic slowdown, and any disappointment in sales or annual recurring revenue could lead to a significant downgrade in its rating.

It is worth noting that some Crowdstrike bulls see this event as a great opportunity to buy the dip. Ark Investment Management, led by the star investor "Cathie Wood," purchased 38,595 shares of CrowdStrike stock valued at approximately $13.24 million through its $ARK Next Generation Internet ETF (ARKW.US)$ and $ARK Fintech Innovation ETF (ARKF.US)$. Rosenblatt also believes that Friday's sharp decline is an "overreaction to a temporary setback," and predicts that the Crowdstrike outage will create a buying opportunity. Wedbush remains optimistic about CrowdStrike and the cybersecurity industry in the long term, despite the fact that the outage is clearly a major setback and has put pressure on the stock price.

Wall Street analysts seem to downplay any significant impact of the CrowdStrike outage on Microsoft's business, as evidenced by the less than 1% dip on Friday. On the one hand, Microsoft has long been favored by many value fund managers for its predictable revenue levels and cash flow, with about 44% of large value fund managers holding Microsoft stock, significantly higher than Meta Platforms' 25% and Amazon's 10%, and they are unlikely to change their strategy due to such short-term events. On the other hand, Citigroup analysts believe that this outage is not Microsoft's problem, and theoretically, Microsoft's security business is a beneficiary, a view that is in line with KeyBanc's analyst.

Jefferies analyst Joseph Gallo stated on Friday that given the short duration of this incident and the fact that the outage does not seem to be caused by any security vulnerabilities, the impact on Microsoft's recent momentum is minimal.

Concerns over the excessive concentration of a few cybersecurity giants have been sparked by global incidents caused by a single company, especially a leading one like CrowdStrike. However, this situation could provide an opportunity for other cybersecurity stocks to develop new customers and expand their market share.

According to Wedbush, the interruption may create opportunities for some competitive replacements. KeyBanc predicts that $SentinelOne (S.US)$ and $Palo Alto Networks (PANW.US)$ will be the biggest beneficiaries as they are competitive in security. Palo Alto, which is expanding its platform and even offering certain features to competitors' customers for free, aims to occupy a larger share of the IT spending budget in the long term.

Source: Bloomberg, CNBC, moomoo

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Paul Anthony : https://theedgemalaysia.com/categories/Malaysia

104074349 : bring them to court

101550592 :

搞经济 抄底 加仓 : it means.. all searching for alternatives backup operating systems. lesson learned, so never make the same mistake twice

Laine Ford : okay

Hamdog258 : interesting

Bmwbatman : i got our just in time, still monitoring when to reinvest.

Joey Bagadonuts : ok

Willzway : ok

Laine Ford : you make money I don't make no money I ready to much to trade I will to make money like all don't

View more comments...