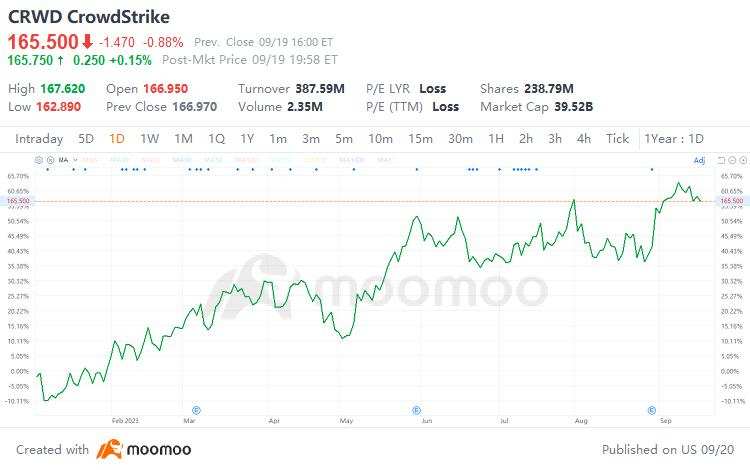

CrowdStrike Stock: Headed to $200?

This cloud-native cybersecurity giant is positioned to grow rapidly in the coming years.

Fatima Boolani, an analyst at Citigroup, expressed her positive outlook on $CrowdStrike (CRWD.US)$ by maintaining a Buy rating and increasing the price target from $175 to $200. This signifies Citigroup’s belief in the stock’s potential as a profitable investment, with an anticipated future price of $200.![]()

📊 ARR +37% Y/Y to $2.93B.

📈 Net new ARR $196M (+13% Q/Q).

🔒 Net Retention rate at 120%.

• Revenue +37% to $732M ($7M beat).

• Operating loss margin 2% (+7pp Y/Y).

• Non-GAAP EPS $0.74 ($0.18 beat).

• FY24 revenue ~$3,037M ($19M raise).

CrowdStrike is guiding for non-GAAP net income for fiscal 2024 to be between $680.4 million and $689.7 million, a considerable hike from its previous estimate of $562.8 million to $590.1 million. It's also guiding for fiscal 2024 revenue in the range of $3.03 billion to $3.04 billion, again higher than the previous estimate of $3 billion to $3.03 billion. This is indicative of the company's confidence in its deal pipeline and implementation capabilities, even in the current tough macroeconomic environment.

CrowdStrike estimates that its total addressable market (TAM) in 2023 is valued at $76 billion. Hence, based on its trailing 12-month revenue, the company has tapped only around 3.4% of this potential. It expects its TAM to grow to $97.8 billion by 2025. This expansion in market opportunity can help propel its top and bottom lines in the coming quarters.

The artificial intelligence (AI) market for cybersecurity is estimated to grow from $19.2 billion in 2022 to $154.8 billion in 2032. CrowdStrike is primed to harness this trend, thanks to the deep integration of AI in its offerings and focus on developing new AI-driven cybersecurity products and services.

Wall Street seems to be highly optimistic about CrowdStrike, with 35 of the 46 analysts tracking the company giving it their highest buy rating. The average price target of $184.9 is 8.3% higher than the company's current share price (as of Sept. 15, 2023), while the highest and lowest target prices estimated by analysts are $250 and $150, respectively.

CrowdStrike is currently trading at 15.5x trailing 12-month sales, significantly higher than the median software industry valuation of 2.3. The premium valuation seems justified, given the resilience of the company's Falcon platform (even in a tough macroeconomic environment), improving margins, network effect, and strong guidance for fiscal 2024.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment