CSOP USD Money Market Fund Wrap-20240715

•Last week, during Fed Chair Powell’s dovish remarks to the Senate Banking Committee. Powell noted the labor market's return to balance, contrasting with his previous comments. While he didn't provide a timeline for rate cuts, he highlighted signs of a slowing job market following data showing rising unemployment for three consecutive months.

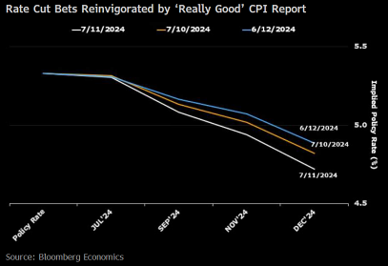

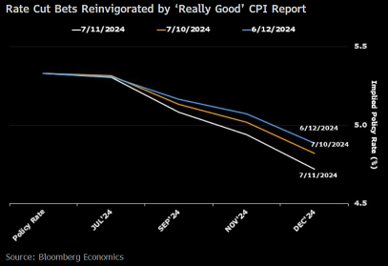

•Furthermore, June’s CPI report came in mild with core CPI rising by just 0.06% monthly (consensus: 0.2%), with rent components showing the slowest growth since 2021. Given recent inflation data and labor market trends, JPMorgan now predicts a Fed rate cut in September (vs. November previously), followed by quarterly cuts until the Fed funds rate reaches neutral. Money markets fully pricing a 25bp cut in September, 60bp in 2024, and 170bp by the end of 2025.

•Despite the near-term disinflation momentum, we expect $CSOP USD Money Market Fund(SGXZ96797238.MF$ to continue to deliver stable yield in the near term. As of 20240712, the fund has gross yield of 5.57% and net yield at 5.16%. ^

Source: CSOP, Department of Labor, Bloomberg, as of 20240712. ^ Gross yield is based on annualized yield of underlying holdings. 7-day net yield is calculated based on calendar days and NAVs in 5-decimal. For illustration purpose only. Not to be construed as recommendation to buy/sell securities in the above-mentioned industries.

Disclaimers

“The investment product(s), as mentioned in this document, is/are registered under section 286 of the Securities and Futures Act (Cap. 289) of Singapore (the “SFA”).This material and the information contained in this material shall not be regarded as an offer or solicitation of business in any jurisdiction to any person to whom it is unlawful to offer or solicit business in such jurisdictions.

CSOP Asset Management Pte. Ltd. (“CSOP”) which prepared this document believes that information in this document is based upon sources that are believed to be accurate, complete, and reliable. However, CSOP does not warrant the accuracy and completeness of the information, and shall not be liable to the recipient or controlling shareholders of the recipient resulting from its use. CSOP is under no obligation to keep the information up-to-date. The provision of this document shall not be deemed as constituting any offer, acceptance, or promise of any further contract or amendment to any contract. The information herein shall not be disclosed, used or disseminated, in whole or part, and shall not be reproduced, copied or made available to others without the written consent of CSOP.

Advice should be sought from a financial adviser regarding the suitability of the investment and/or investment product before making an investment. Investment involves risk. The value of investments, and the income from them, can go down as well as up and an investor may get back less than the amount invested. Past performance is not necessarily indicative of future performance. Investor should read the prospectus and product highlights sheet, which can be obtained on CSOP website or authorized participating dealers, before deciding whether to invest. This document has not been reviewed by the Monetary Authority of Singapore.”

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment