CSOP USD Money Market Fund Wrap-20240819

Last week, July’s PPI report came out milder-than-anticipated as the headline final demand measure increased by 0.1% monthly, below the expected 0.2%, and the core index remained steady, dropping to 2.4% year-on-year from June's 3.0%.

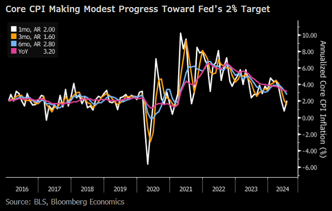

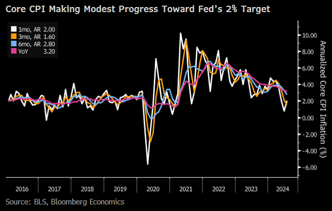

Additionally, we also saw mild CPI reading, with the headline CPI and core index rising 0.2% and 0.165% respectively, meeting expectations, thereby contributing towards Fed’s 2% target.

We saw better-than-anticipated domestic data where initial claims dropped to 227k, not significantly higher than previous summers when considering factors like Hurricane Beryl and seasonal auto plant closures. Retail sales also surpassed predictions, with a 1.0% increase in July and the control group rising by 0.3%. This data suggests a stronger start to 3Q real consumer spending than expected.

With soft PPI and CPI data increasing Fed officials’ confidence level that inflation is falling, the Federal Reserve can maintain its focus on the labor market in future policy decisions.

We expect $CSOP USD Money Market Fund (SGXZ96797238.MF)$ to continue to deliver stable yield in the near term. As of 20240816, the fund has gross yield of 5.53% and net yield at 5.11%. ^

Source: CSOP, Department of Labor, Bloomberg, as of 20240816. ^ Gross yield is based on annualized yield of underlying holdings. 8-day net yield is calculated based on calendar days and NAVs in 5-decimal.

Disclaimers

“The investment product(s), as mentioned in this document, is/are registered under section 286 of the Securities and Futures Act (Cap. 289) of Singapore (the “SFA”).This material and the information contained in this material shall not be regarded as an offer or solicitation of business in any jurisdiction to any person to whom it is unlawful to offer or solicit business in such jurisdictions. This document is not to be construed as recommendations to buy/sell any above-mentioned securities, or any securities in the above-mentioned sectors or jurisdictions.

CSOP Asset Management Pte. Ltd. (“CSOP”) which prepared this document believes that information in this document is based upon sources that are believed to be accurate, complete, and reliable. However, CSOP does not warrant the accuracy and completeness of the information, and shall not be liable to the recipient or controlling shareholders of the recipient resulting from its use. CSOP is under no obligation to keep the information up-to-date. The provision of this document shall not be deemed as constituting any offer, acceptance, or promise of any further contract or amendment to any contract. The information herein shall not be disclosed, used or disseminated, in whole or part, and shall not be reproduced, copied or made available to others without the written consent of CSOP.

Advice should be sought from a financial adviser regarding the suitability of the investment and/or investment product before making an investment. Investment involves risk. The value of investments, and the income from them, can go down as well as up and an investor may get back less than the amount invested. Past performance is not necessarily indicative of future performance. Investor should read the prospectus and product highlights sheet, which can be obtained on CSOP website or authorized participating dealers, before deciding whether to invest. This document has not been reviewed by the Monetary Authority of Singapore

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment