D&O stock: Is it too late to buy?

D&O is mainly engaged in the manufacturing and sales of semiconductor devices, as well as the development of semiconductor application technology. The company operates in the semiconductor industry and exports its products to different regions such as Asia, Europe, and the USA.

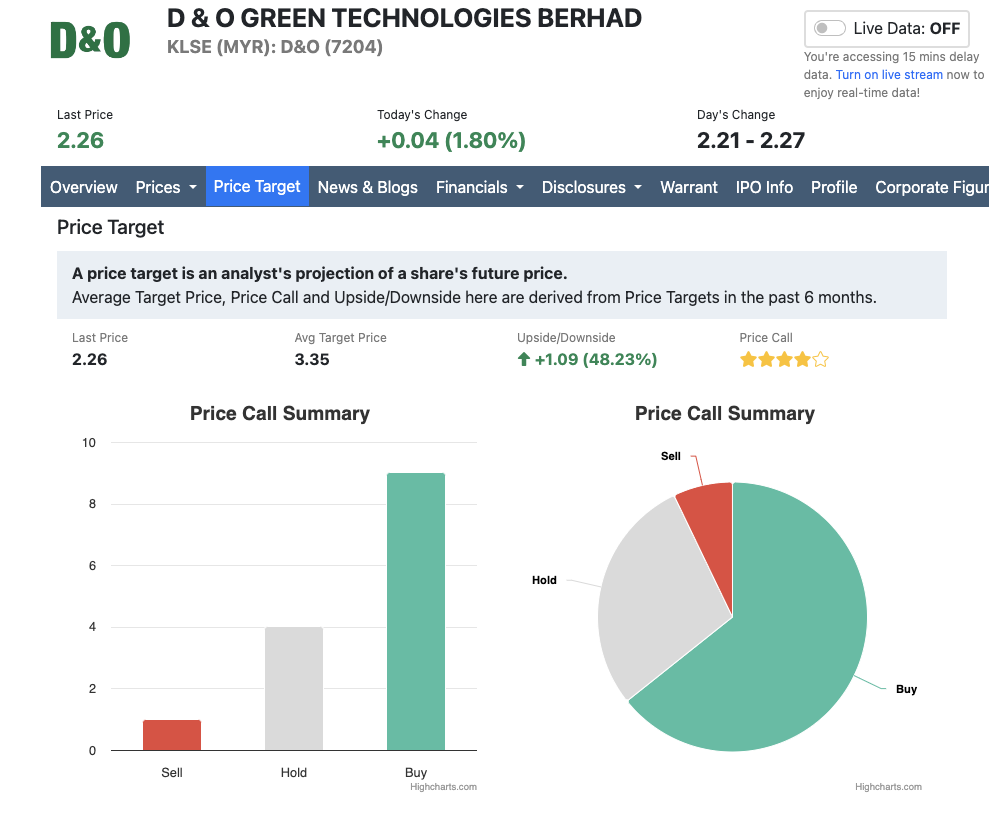

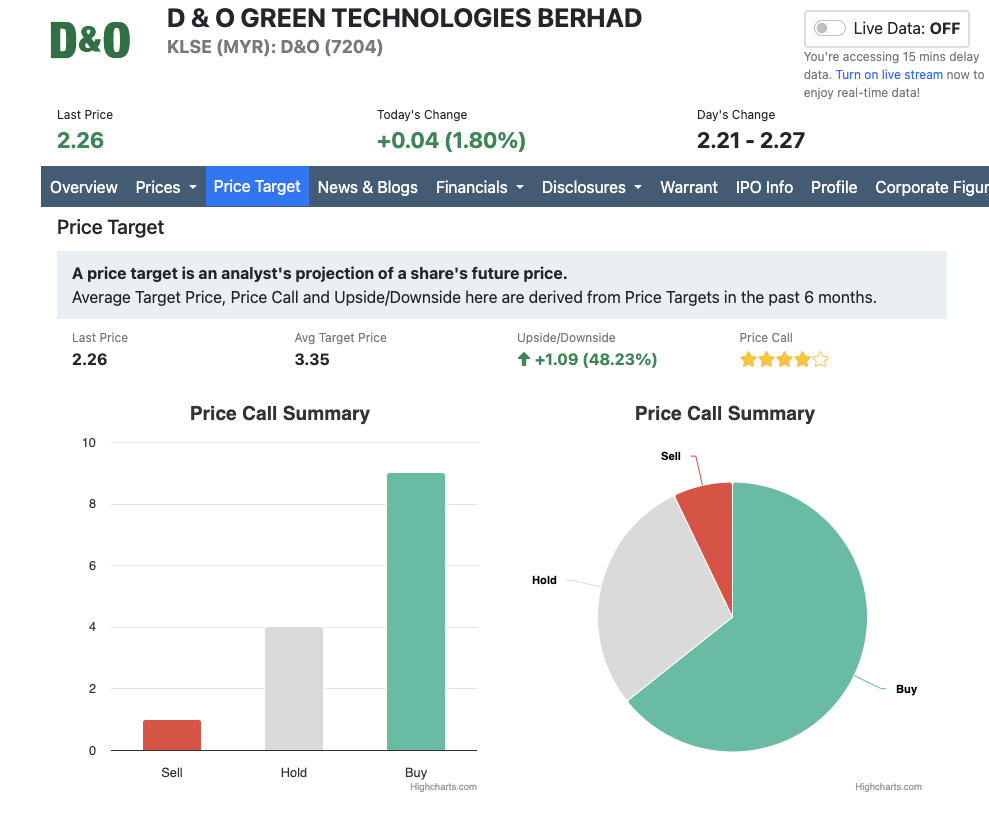

D&O Green Technologies Bhd (DOGT MK) is expected to see higher customer loadings and a stronger product portfolio in 2025, leading to improved utilization rate and profit growth. However, profit margin recovery is expected to slow down due to rising costs and operational challenges. The company's new PCBA module business is expected to contribute to revenue starting in the fourth quarter of 2024. Despite the challenges, PhillipCapital remains optimistic about D&O's prospects and maintains a "buy" rating with a lower target price of RM3.00.

Whether it is too late to buy D&O stocks depends on your investment goals and risk tolerance. If you are looking for quick returns, it may be too late. However, if you are a long-term investor, D&O's future growth potential may make it a worthy investment.

Consider the following factors:

– **52-week high:** Compare the current price with the 52-week high to see if the stock is overvalued.

– **Future growth potential:** Evaluate its growth prospects based on D&O's business, industry, and market trends.

– **Your investment horizon:** Determine if your investment horizon aligns with the expected growth timeline of D&O.

Ultimately, the decision to buy D&O stocks depends on you.

D&O is primarily involved in the manufacturing and merchandising of semiconductor components, as well as the development of semiconductor application technology. The company operates in the semiconductor industry sector and exports its products to various regions, including Asia, Europe, and the USA.

D&O Green Technologies Bhd (DOGT MK) is expected to see higher customer loadings and a stronger product portfolio in 2025, leading to higher utilization rates and earnings growth. However, margin recovery is expected to be slower due to rising costs and operational challenges. The company's new PCBA module business is expected to start contributing to revenue in the fourth quarter of 2024. Despite the challenges, PhillipCapital remains positive on D&O's outlook and maintains a buy rating with a lower target price of RM3.00.

Whether buying D&O stock is too late depends on your investment goals and risk tolerance. If you're seeking quick gains, it might be too late. However, if you're investing for the long term, D&O's potential for future growth could make it a worthwhile investment.

Consider the following factors:

– 52-week high: Compare the current price to the 52-week high to see if the stock is overvalued.

– Potential for future growth: Evaluate D&O's growth prospects based on its business, industry, and market trends.

– Your investment horizon: Determine if your investment horizon aligns with D&O's expected growth timeline.

Ultimately, the decision of whether to buy D&O stock is up to you.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

KK寿司 : How good is it to buy too early? What do you think of the one I bought three years ago?

Goodjobguys OP KK寿司 : My advice to myself: Don't get too attached to a particular stock. When it is time to let it go, let it go! If you don't, you will locked your fund and miss out using those fund to reinvest to something else! Just my own advice to myself!