Delta Air Sees Financial Giants Pile on Bullish Options Ahead of Earnings

$Delta Air Lines (DAL.US)$ options are seeing the heaviest trading volume since May as financial giants pile on positions that could pay off should the share price rebound after the company reports second quarter earnings Thursday.

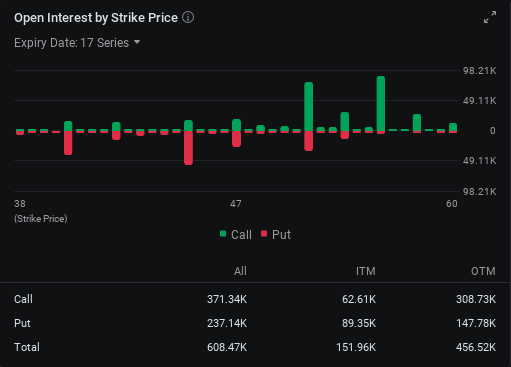

Total volume rose to about 150,100 contracts as of 2:36 p.m. in New York from about 70,130 a day earlier. The open interest, or the tally of outstanding contracts, are heavily concentrated on call options that give the holders the right to buy Delta shares at $55, which could signal investor optimism that the stock could rebound from Tuesday's price of $46.52.

On average, analysts expect Delta to report adjusted revenue of $15.4 billion for the three months ended June, climbing from $14.6 billion a year earlier, according to estimates compiled by Bloomberg. Rising costs are seen shaving profit, with the adjusted earnings expected to drop to $2.38 a share for the second quarter, down from $2.68 a year earlier.

"Higher wages and fuel costs heighten the effect of lower fares on Delta's 2Q earnings as capacity continues to rise," Bloomberg Intelligence analysts including Melissa Balzano wrote in a note dated June 20. "Rising wages, especially for pilots, may lift labor expenses 11.8% from a year ago, trimming margin by 140 basis points."

Still, Delta, along with $United Airlines (UAL.US)$, could perform best among their peers, according to the analysts. That's because "premium and long-haul international fares hold up better than economy short- and medium-haul flights both domestically and to Latin America," the analysts said.

Almost a quarter of the 371,340 outstanding call contracts are in options that give the holder the right to buy Delta shares at $55 across the 17 expiration dates, data compiled by moomoo showed. Delta holders are positioning further out, with the majority of those calls expiring on Aug. 16 and Sept. 20.

That's in stark contrast to the most popular options like Nvidia, whose most active options are those with strike prices near the current stock price expiring soon. In this case, these are the $135 calls expiring in two days.

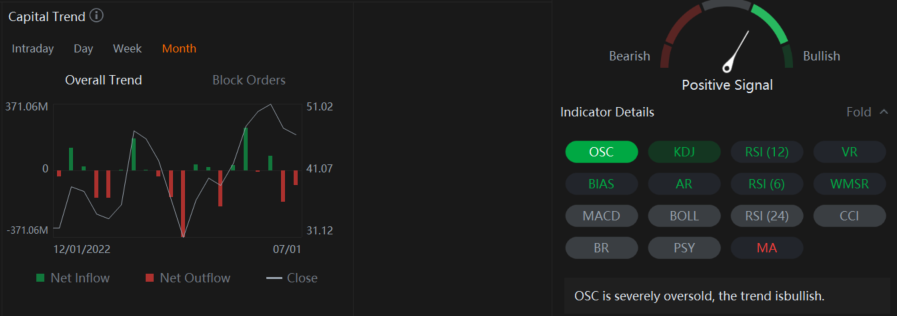

Delta has seen two monthly net outflows, spurring a slump in shares from a four-year high. After a 13% decline from that peak, eight of the 15 technical indicators tracked by moomoo now show the stock could be oversold could turn bullish.

Share your thoughts on Delta Air Lines below.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See thislinkfor more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Positiveenergizer : Loaded up 50 contracts for next week! $50-$55 let’s go!!!

73108835 : hello

103819410 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103613928 : I see

103677010 : noted

104327919 : good

103562106 : thank you

71221488 : what does this translate to