Deploying Investment Strategies Amid Expectations of Further Canadian Rate Cuts

The Bank of Canada cut interest rates by 25 basis points to 4.5% for the second consecutive month, in line with market expectations, and hinted at further rate cuts in the future. This is the second action since the first rate cut in June, when Canada became the first G7 country to enter an easing cycle. The easing of inflationary pressure is the main reason for the rate cut, with CPI falling from a high in May to 2.7% in June. The core inflation indicator has been below 3% for several consecutive months, and price increases are close to historical normal levels.

The Bank of Canada pointed out that although wage growth remains high, this trend is beginning to reverse as the labor market slows down. Housing and service prices support CPI, while weak household spending suppresses inflation. Core inflation is expected to slow to 2.5% in the second half of 2024 and continue to cool in 2025. CPI inflation is expected to be lower than core inflation in the short term, and then gradually rise to the target of 2%.

Macklem, the governor of the central bank, said that if inflation continues to slow down, there may be further interest rate cuts. At the same time, the central bank will evaluate interest rate policy at each meeting. Oversupply and weak household spending in the economy have increased Downside Risk. The stance of the Bank of Canada has changed significantly, from focusing on evidence of cooling inflation to being convinced that price pressures are under control and more concerned about the possibility of a soft landing in the economy. This shift has led to a reaction from Financial Marekt, with the US dollar rising against the Canadian dollar and the yield on two-year Canadian government bonds falling.

Therefore, it is expected that the Bank of Canada may conduct consecutive interest rate cuts in September and December this year. So, with the expectation of continuous interest rate cuts by the Bank of Canada, how should we layout our investment strategy?

Ⅰ.Prioritize bond ETFs and high dividend ETFs - lock in high returns

Under the environment of interest rate cuts, newly published bonds offer lower interest rates, thereby increasing the relative value of existing bonds and causing bond prices to rise. Bond ETFs provide a convenient way to invest in a basket of bonds, potentially benefiting from the rise in bond prices. At the same time, due to the decline in deposit rates and bond yields, the relatively high dividend yield offered by high dividend stocks becomes more attractive.

1.BondETF:

VSC is a passively managed index fund that aims to provide investors with investment opportunities by replicating the performance of the Canadian Credit Bond Index. The ETF mainly invests in Canadian short-term investment-grade corporate bonds and is managed using an index sampling strategy. The goal of this ETF is to track the performance of its benchmark index, namely the Bloomberg Global Aggregate Canadian 1-5 Year Credit Bond Index or any subsequent alternative index, as accurately as possible. This strategy means that the ETF adjusts its investment portfolio based on the main risk factors and other key characteristics of its benchmark index.

In addition, the ETF has a low management fee of only 0.1%, making it an ideal choice for the Canadian short-term investment-grade corporate bonds market. As of July 25th, VSC's asset size reached CAD 910 million and the dividend yield was 3.38%.

ZAG is an ETF listed on the Toronto Stock Exchange (TSX) that mainly invests in various debt securities in the Canadian investment-grade Fixed Income market. These securities include federal government, provincial government, and corporate bonds, with maturities usually exceeding one year. It provides a relatively low-cost and diversified way to participate in the Canadian investment-grade Fixed Income market, and although its historical returns have fluctuated slightly, its overall performance remains stable.

As of July 25, the ETF's asset size reached 9.441 billion Canadian dollars, with a dividend yield of 3.52%, which is basically the same as TLT's dividend yield.

TLT is an ETF that tracks the performance of long-term US Treasury bonds, mainly investing in US government bonds with a remaining maturity of more than 20 years. As a long-term Treasury bond ETF, the yield of TLT is closely related to the trend of long-term interest rates, and it usually performs well when market risk aversion rises or expected future interest rates fall. It provides an effective tool for long-term interest rate risk exposure and is suitable for investors seeking stable cash flow and safe-haven asset allocation.

As of 2024, TLT's asset size has reached $54 billion and set a record for the largest single-day capital inflow since its establishment in 2002, attracting $2.70 billion in capital inflows on Monday alone. As of July 25th, its dividend yield is 3.88%, slightly higher than bank interest rates. As its underlying asset is US Treasury bonds, its price also has the potential to rise under the expectation of interest rate cuts.

2.High Dividend ETFs :

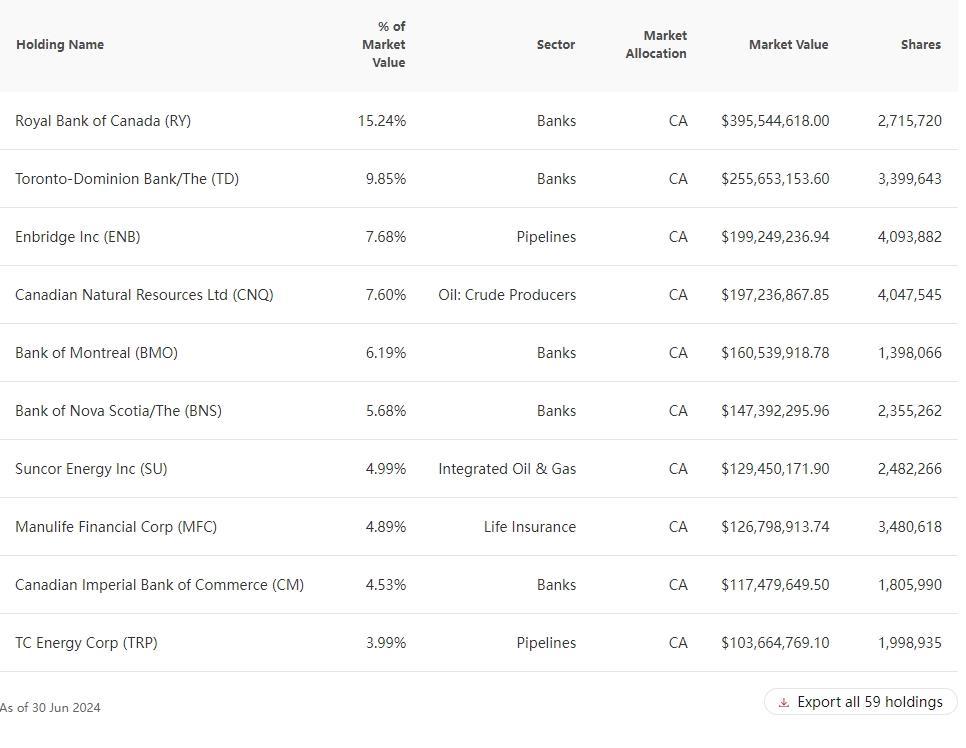

The ETF tracks the FTSE Canada High Dividend Yield Index and has the largest market capitalization among the ten products we surveyed. Currently, there are 56 high dividend stocks from global markets in its investment portfolio, mainly concentrated in the financial industry (with a focus on banks) and the energy industry, which account for more than 80% of the total holdings. The most direct impact of lowering interest rates on the banking industry is the reduction of deposit interest expenses, which has an overall positive impact. On the other hand, energy companies are less affected by macroeconomic conditions due to their industry nature, have stable operating conditions, and are willing to return shareholders. Therefore, it is expected that VDY will benefit from the central bank's interest rate reduction strategy.

As of July 25, the ETF has risen 31.15% over the past five years and currently has a dividend yield of 4.62%, both of which are relatively high in congeneric products.

Similar to VDY, XDIV also has a huge market value and is a high-quality product that combines quality, returns, and growth. It includes about 30 high-dividend stocks in the Canadian market, and the management team constantly adjusts the investment portfolio. It is a low-cost investment portfolio of high-dividend Canadian stocks, with a management fee of only 0.10%, the lowest among the ten products, and the best choice for investors seeking cost-effectiveness. XDIV mainly selects stocks with good overall financial conditions, including stable Balance Sheet stocks and stocks with small income fluctuations.

As of July 25th, the ETF has risen by 30.88% in the past five years, with a dividend yield of 4.39%. Its performance is outstanding.

The ETF tracks the Standard & Poor/Toronto Stock Exchange Composite High Dividend Index and currently holds 75 stocks, mainly concentrated in the energy sector. The top ten holdings are all around 5%, which means that compared to the first two products, XEI's investment portfolio is more diversified and less affected by individual stocks. This means higher risk diversification ability.

XEI's dividend yield is 4.86%, the highest among the ten products. However, as of July 25th, the ETF has only risen by 20.77% in the past five years, which is relatively low compared to other products. The main reason is that pursuing a stable diversified investment portfolio also weakens the direct upward pressure on stock prices of large companies. However, when interest rates fall and the market fluctuates, the ETF is expected to achieve long-term stable profitability in various cycles.

Ⅱ. It is recommended to focus onsafe-haven assets

Canada's interest rate cut usually triggers market expectations that other major economies will adopt similar Monetary Policies to deal with economic slowdown or inflationary pressures. For example, the European Central Bank has announced an interest rate cut, and the market generally expects the Federal Reserve to follow suit in the coming months. Therefore, based on the acceleration of the Federal Reserve's interest rate cut that may accompany Canada's interest rate cut, we expect the US dollar to weaken and recommend considering holding gold for appreciation and preservation.

In addition, although the cryptocurrency market has high uncertainty and volatility, its safe-haven properties are significant in some cases. Interest rate cuts usually lead to increased market liquidity, which may cause asset prices to rise or fall. In this case, cryptocurrency, as an investment tool relatively independent of traditional Financial Marekt, can provide an effective hedging method. Therefore, investors can consider paying attention to cryptocurrencies with strong safe-haven properties, such as Bitcoin and Ethereum. These cryptocurrencies, due to their decentralized characteristics and limited supply, can provide certain protection when economic uncertainty increases.

1.GoldETF

This is the world's largest physical gold ETF, tracking the gold price of the London Bullion Market Association (LBMA). Buying this ETF is equivalent to indirectly holding gold, which can directly enjoy the benefits brought by the rise in gold prices and provide investors with the opportunity to track the spot price of gold.

As of July 25th, GLD's asset size has reached $65.238 billion, with a year-to-date increase of 16.02%. However, its transaction expense ratio is high (0.4%), and the medium to long-term ROI may be affected.

This is also a large gold ETF in the US stock market, tracking the gold price of LBMA, providing investors with the opportunity to directly trade gold spot. Its current asset size is $29.721 billion, lower than GLD. The IAU has risen by more than 16% since the beginning of the year. The cost of IAU is lower than GLD (the transaction fee is only 0.25%), but the liquidity is relatively weak.

It is also a US stock ETF that invests in physical gold. Unlike the two physical gold ETFs mentioned above, GLDM's asset size is only $7.584 billion, which is more suitable for small investors. At the same time, its trading fee is very low, only 0.18%, with a year-to-date increase of 16.21%, higher than GLD and IAU.

2.Cryptocurrency ETF

BTCX.B holds Bitcoin, providing investors with a convenient way to directly invest in Bitcoin in the Canadian market. The ETF provides a direct investment channel for Bitcoin Spot Market, with certain transparency and regulatory protection. At the same time, as it is currently only listed in Canada, global investors may be limited by regional investment rules.

BTCX. B's management fee ratio is 0.87%, which is cheaper than other congeneric products such as BTCC. B's 1%. Its total return rate in the past year was 133.92%. Since its establishment, the average annual return rate, including dividends, has been 6.54%.

A Bitcoin exchange-traded fund that allows investors to indirectly participate in the Bitcoin market by purchasing fund shares. IBIT is directly linked to the Bitcoin price, providing investors with a convenient way to access Bitcoin assets without directly holding or managing cryptocurrency.

As of July 25, the ETF's Asset Under Management reached $19.261 billion, demonstrating its global reach and appeal.

GBTC is a closed-end investment tool that allows investors to indirectly hold Bitcoin. It is published and managed by Canary Release Investment Company, but is not an exchange-traded fund (ETF). GBTC's Net Asset Value is based on the value of its Bitcoin holdings. Similar to IBIT, GBTC is a good choice for institutional and individual investors seeking compliance channels to invest in Bitcoin and high liquidity. However, compared to other investment products, GBTC has higher management fees (1.5%), which may erode ROI.

Ⅲ. Interest rate cuts are expected to benefit the real estate industry, pay attention to Reits and related ETFs.

The interest rate cut by the Bank of Canada has reduced the monthly payment limit for home buyers, thereby reducing their financial burden. Lower loan interest rates have increased the attractiveness of the real estate market and promoted an increase in transaction volume between buyers and sellers. Overall, interest rate cuts help promote the recovery of the real estate market.

1.Reits:

NET Trust Fund acquires and holds multiple high-quality three networks (telecommunications network, radio and television network, Internet) and non-operating commercial real estate, with diversified investment targets including commercial real estate in retail, energy, catering and other industries.

As of July 25th, NET's total market value was CAD 112 million, with a dividend yield of 6.33%, which is much higher than the risk-free interest rate level in the US. NET's dividend is also one of the most attractive in the Canadian REIT field, with a current dividend of CAD 0.345 per unit per year, equivalent to a yield of 7%. In addition, the company has a good record of increasing dividends, with an average annual increase of 9.7% since 2012. Previously, due to the slowdown in growth caused by rising interest rates, we expected Canada's interest rate cuts to support its dividend growth.

CSH's main investment areas are Canadian nursing homes and long-term care homes, which provide care services to retirees through leasing and selling healthcare and retirement-type residences to earn income. The fund has a large scale, with a growth rate of over 25% in 23 years, and has good development prospects.

As of July 25th, CSH's total market capitalization was CAD 3.65 billion, with a dividend yield of 4.54%, slightly lower than the risk-free rate. CSH has distributed 250 dividends since its listing, with dividends paid in the middle of each month and a dividend amount of CAD 0.051 per share.

SGR's investment industry mainly focuses on supermarket retail properties. The assets invested by the company include Blundell Square, Elgin Square, Meres Town Centre, Oakridge Village, Salerno Village Square, etc.

As of July 25th, SGR's total market value is CAD 714 million, with a dividend yield of 9.69%, which is more than twice the US risk-free rate of 4.26%. In addition, SGR has a high dividend frequency, with regular dividends paid in the middle of each month, with a dividend amount of approximately CAD 0.07 per share.

NXR is a Canadian Real Estate Investment Trust whose management team enhances the value of unit holders through the acquisition and management of industrial, working and retail properties. The fund's investment direction is mainly industrial real estate, such as warehouses and logistics centers.

As of July 25th, NXR's total market value is CAD 555 million, with a dividend yield of 8.16%, far higher than the risk-free rate. In addition, NXR has distributed dividends 126 times since its listing. Starting from the second half of 2021, it has distributed dividends twice a month, with a total monthly dividend of CAD 0.16 per share, which is more attractive than TNT's dividend return.

2.REITs related ETFs:

In addition to direct investment in real estate funds, relevant ETFs are also a stable and safe investment choice. Through a diversified portfolio of REITs, risk diversification, investment transparency, and simplified operations can be achieved, allowing investors to achieve one-click diversified investment and flexibly respond to market changes.

Tracking 19 REITs in the Canadian market, with a maximum investment weight of 25%. The fund's investment concentration is in retail (36.6%) and residential (23.2%) REITs, and it does not hold any real estate service companies.

As of July 25th, the asset size of XRE Fund is CAD 1.213 billion, with a dividend yield of 4.44%, which is much higher than most index funds and comparable to some high dividend stocks. The fund pays dividends every month. However, the management fee of this ETF is 0.61%, and the transaction cost is relatively high, which is equivalent to paying CAD 61 for every CAD 10,000 invested.

ZRE tracks the Solactive equal weight Canadian Real Estate Investment Trust Index, which uses the equal weight method to allocate Constituent Stocks. This means that each Canadian real estate investment trust in the index is given the same weight in the calculation, regardless of its market value, which helps reduce reliance on large real estate investment trusts and increase portfolio diversity.

As of July 25, the ZRE fund had assets of CAD 562 million and a dividend yield of 5.07%. At the same time, the management fee of this Canadian REIT ETF is 0.61%.

Summary

Given the continuous interest rate cuts by the Bank of Canada and the possibility of further easing Monetary Policy in the future, investors should consider adjusting their investment portfolios to adapt to the low interest rate environment. Firstly, they can increase their allocation to bond ETFs and high dividend ETFs to seek relatively stable sources of income. Secondly, considering the increasing economic uncertainty, safe-haven assets such as gold and cryptocurrency may provide additional safety margins. Finally, interest rate cuts are usually beneficial to the real estate market, so REITs and related ETFs are also investment options worth paying attention to. In short, adopting a diversified investment strategy can help balance risk and return in the current economic environment.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101550592 :

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Laine Ford : no comment