Did You All Catch A Piece of These Profits?

Somebody suggested that I outline an options trade "beforehand" so others could partake in the gains that I post about on occasion. So, over the weekend, I made a post about potential trade opportunities with Tesla.

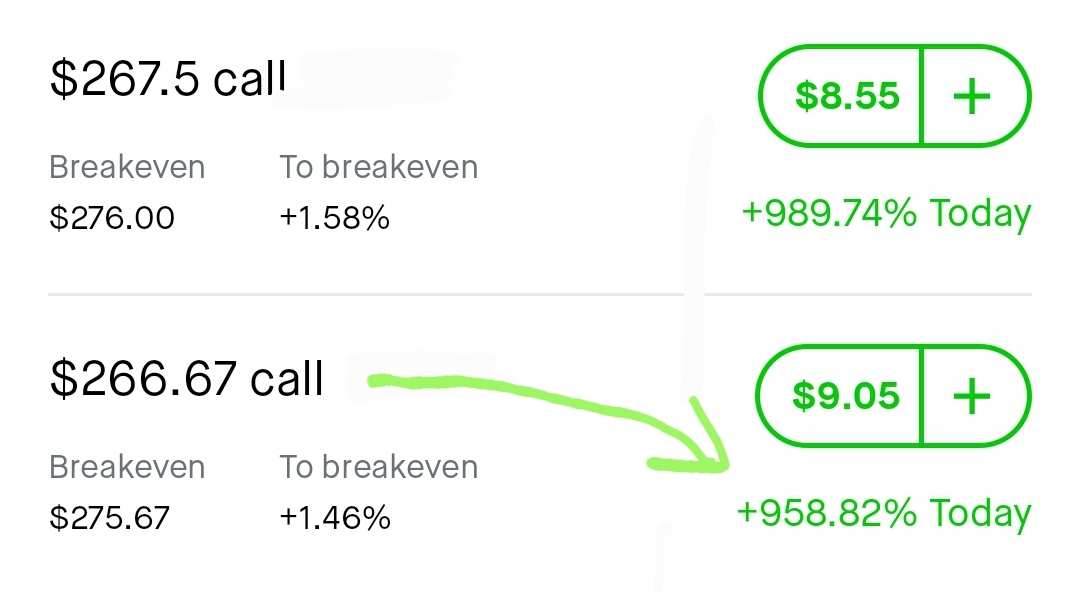

The trade to the long side worked out perfectly. You can check out the post in the link below. I hope a lot of you were able to catch a little of these profits.

Market Catalysts

There was a solid news catalyst to add momentum to TSLA's gap-and-go. I mentioned in the post that I would be looking for a news catalyst. A price upgrade on a great company from a reputable investment firm is a great catalyst. The weekly options premiums ripped!

I was only able to catch half of what my contracts made. I was late to the party due to the fact that TSLA gapped up big time overnight. But that still equated to a 100% gain.

No Fomo Buying

If you joined the ride, which I hope a lot of you did, then you already know that it was not an easy trip. I jumped the gun after the first dip at open. Apparently, Euro traders were taking profits at US open. So I was down big.

No Panic Selling

Luckily, investors were bullish in this name, while a lot of the market was performing relatively poorly. I almost panicked out of the trade shortly after placing it. Luckily, I held, and the next hour was very profitable.

Lock In Gains

During the emotional roller coaster, I was pretty much ready to take some profit the whole time. After seeing my entire investment account climb 30%, I converted most of my contracts into long debit spreads to lock in my gains. I left a couple of contracts sitting to ride it out.

Did I Miss Out on More Profit?

There very well might be more steam to this one day rally. Personally, I was more bearish in the short term until this price upgrade hit the headlines. Europe was buying up TSLA like madmen overnight. But I was still weary.

Whether or not the rally continues, I hope a lot of you that follow me were able to capitalize from the outline of my trade ideas.

As always, this is not investment advice. Good luck trading. Be careful and be patient. Dont anticipate the market. Rather, participate in the market. Give your investments time. Don't be greedy. Don't invest in anything you don't understand. Don't put all of your eggs in one basket. Don't listen to the hype. Don't fomo or panic into or out of trades. Do your own due diligence. And just follow the trends. A trend is your friend.

So did any of you ride the Tesla train today?

$Invesco QQQ Trust (QQQ.US)$ $iShares Russell 2000 ETF (IWM.US)$ $VIX Index Futures(JAN5) (VXmain.US)$ $SPDR S&P 500 ETF (SPY.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Gold Futures(FEB5) (GCmain.US)$ $E-mini Dow Futures(MAR5) (YMmain.US)$ $E-mini S&P 500 Futures(MAR5) (ESmain.US)$ $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $E-mini S&P MidCap 400 Futures(MAR5) (EMDmain.US)$ $E-mini Russell 2000 Index Futures(MAR5) (RTYmain.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $VIX Index Futures(JAN5) (VXmain.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

SpecklesS : Nice!

SpyderCall OP SpecklesS : Thanks [Thumbs Up][Paper Hands] I got lucky again.

I had the right idea but the move was much bigger than I was thinking, luckily. I thought I would've needed to wait a few days for those types of gains

CMLIN : What is the intrinsic for Apple ?

SpyderCall OP CMLIN : I will remove apple from the tags.

SpyderCall OP CMLIN : sorry about that

股市里的牛 CMLIN : Do you know why every stock software has Apple stock? This shows that Apple is still relatively meaningful among US stocks, but it only says that the increase will be slow but will not affect later trends. Now that Apple 15 is ready, China will not let officials use it to clearly state that it wants to fight a trade war

SpyderCall OP 股市里的牛 : I agree completely. There has always been varying degrees of trade war between the US and China. Whether it be through sanctions, terrifs, import quotes, or embargos, etc. I think this will be going on for a very long time as the two top economies compete for wealth and geopolitical power.