The report shows that last week, consumer goods is the largest U.S. net short position in the sector, the size of short selling is four times the size of long buying, in the non-essential consumer goods sector underperforming the broader market, hedge funds sold the sector at the fastest pace in 11 weeks.

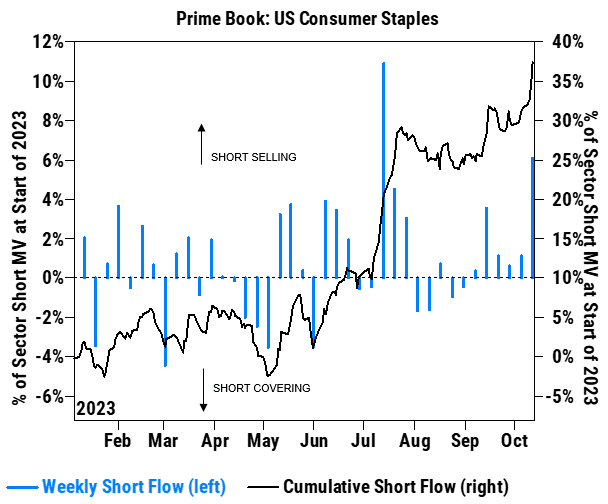

Short-selling flows into the consumer staples sector increased for the sixth consecutive week, with the nominal value of short-selling the largest in three months, exceeding 98% of the level over the past five years.