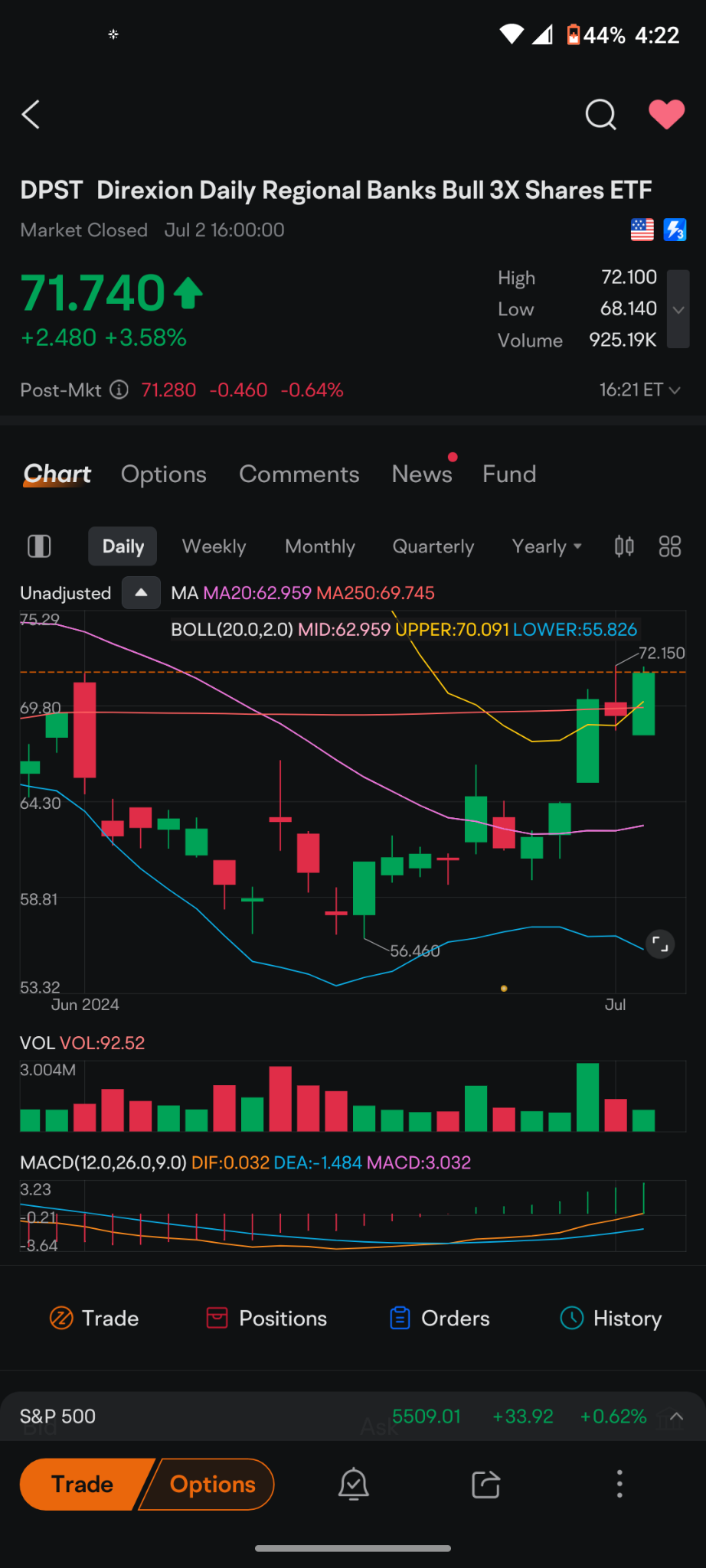

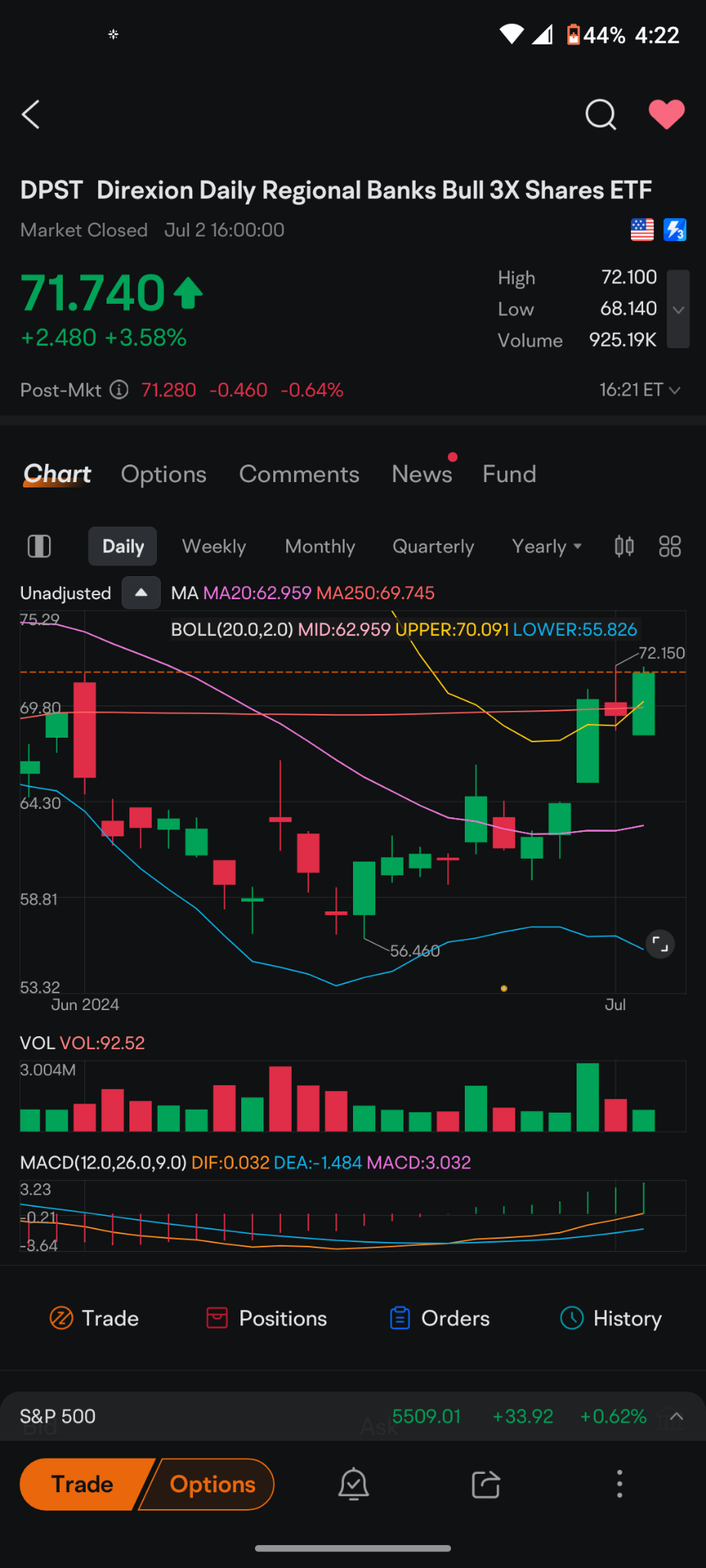

$Direxion Daily Regional Banks Bull 3X Shares ETF (DPST.US)$...

$Direxion Daily Regional Banks Bull 3X Shares ETF(DPST.US$ look at this chart it made a freaking perfect cup now if it makes a handle I'm going to throw up.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Tesla 1st : May I ask your interpretation that it will rise now , and if a handle appears, will it fall? thanks

, and if a handle appears, will it fall? thanks

10baggerbamm OP : for a year and a half Tesla has done nothing it was down 30% this year so the magnificent seven became the magnificent six and terrific two whatever. the point is once the shareholder meeting took place you pretty much put the cards on the table and told everybody at that time where the future will be with Tesla and if you didn't believe in autonomous driving don't be a shareholder sell the stock. and where the future lies with optimist. and then come August we have robo taxi. so what's happening obviously is everybody that was underweighted in Tesla is now accumulating a position in it. it's going to dip it absolutely will but I believe that Dan Ives is right, this week he raised his Target was it 290 and there's another on the street at 320. so I think any dip is going to be a by the dip

MomentumPython1337 : it just formed a handle and in the process of breaking the handle damn

10baggerbamm OP MomentumPython1337 : yuppers...

MomentumPython1337 : do you have to pay an interest every day for buying leveraged etfs? never owned them before and moomoo isn't telling me anything

10baggerbamm OP MomentumPython1337 : when you say paying interest there's no cost associated with it directly you have to think of its indirect no different than if you were to buy a mutual fund and they charge a 1% management fee if you have $100,000 in it at the end of the year they don't all of a sudden say okay we're going to Mark the market and now you have $99,000 it's factored into the net asset value on a daily basis. secondly there's a lot of people that do not buy The leverage ETFs because they say oh there's a decay Factor and if you hold them long term you're going to lose money I hear it all the time I hear it practically daily from people that I speak to about using leverage ETFs. is there a decay short because they use options internally to leverage the positions and options have a decay Factor and options have a cost to it however, and maybe my philosophy is wrong and my approach is wrong but if I'm bullish on a company or bullish on a sector and I think there's significant upside and I'm not talking five or 10%.

10baggerbamm OP 10baggerbamm OP : I'm talking I think there's 50 to 100% upside if not more then what the hell do I care about a cost of ownership of 1%, when I'm able to obtain that much additional leverage for such a nominal fee a nominal expense.. I have people that send me their calculations see I told you there's a decay yeah okay and analysis is paralysis.. because I've owned soxl for over a year is there a decay sure is there a management fee sure but look at the return. I own utsl traded it bought it back is there a cost yep I've owned TNA multiple times same thing is there a cost yep but look at the movement of it. I owned nugt and then all the bobbleheads on TV start saying oh gold's going up the miners are going to make all this money and money piles in to the mining companies because the price of their commodity gold goes up. so maybe I don't agree with these people that don't buy the leverage ETFs because when they go down it's extremely painful and I sell naked puts routinely and I've been put a lot of these ETS when the trade goes against me short term for example I got put 10,000 shares of Tesla at 8 bucks and the stock closed at 794 and I had sold naked puts on it a couple of times and that was the third week of June I wish I would have sold a thousand contracts naked at this point. so compared to buying an option that has a defined expiration date and a strike price so you have to be right on both the leverage ETFs give you unlimited amount of time and 2X or 3x leverage.. for about 1% factored into the price that you pay I'm fine with that.

MomentumPython1337 : thanks mate

10baggerbamm OP MomentumPython1337 : you're welcome

MomentumPython1337 : congrats mate your profits are exploding by the day