Discover AI stocks that are stronger than NVIDIA! 9 stocks that stand out for their “sense of purchase security” in turbulent market prices

Influenced by the US-August Consumer Price Index (CPI), which exceeded expectations, observations of drastic interest rate cuts receded, and the US stock market temporarily fell due to Wednesday's forward trading. However, NVIDIA CEO Jensen Huang's statement that strong demand for AI chips will lead to strained relationships with customers saved the sluggish market on his own and powerfully led a V-shaped reversal of the three major indices. Concerns about a decline in semiconductor demand were mitigated, and the company's stock soared by nearly 8%, $PHLX Semiconductor Index (.SOX.US)$It also rose sharply by nearly 5%.

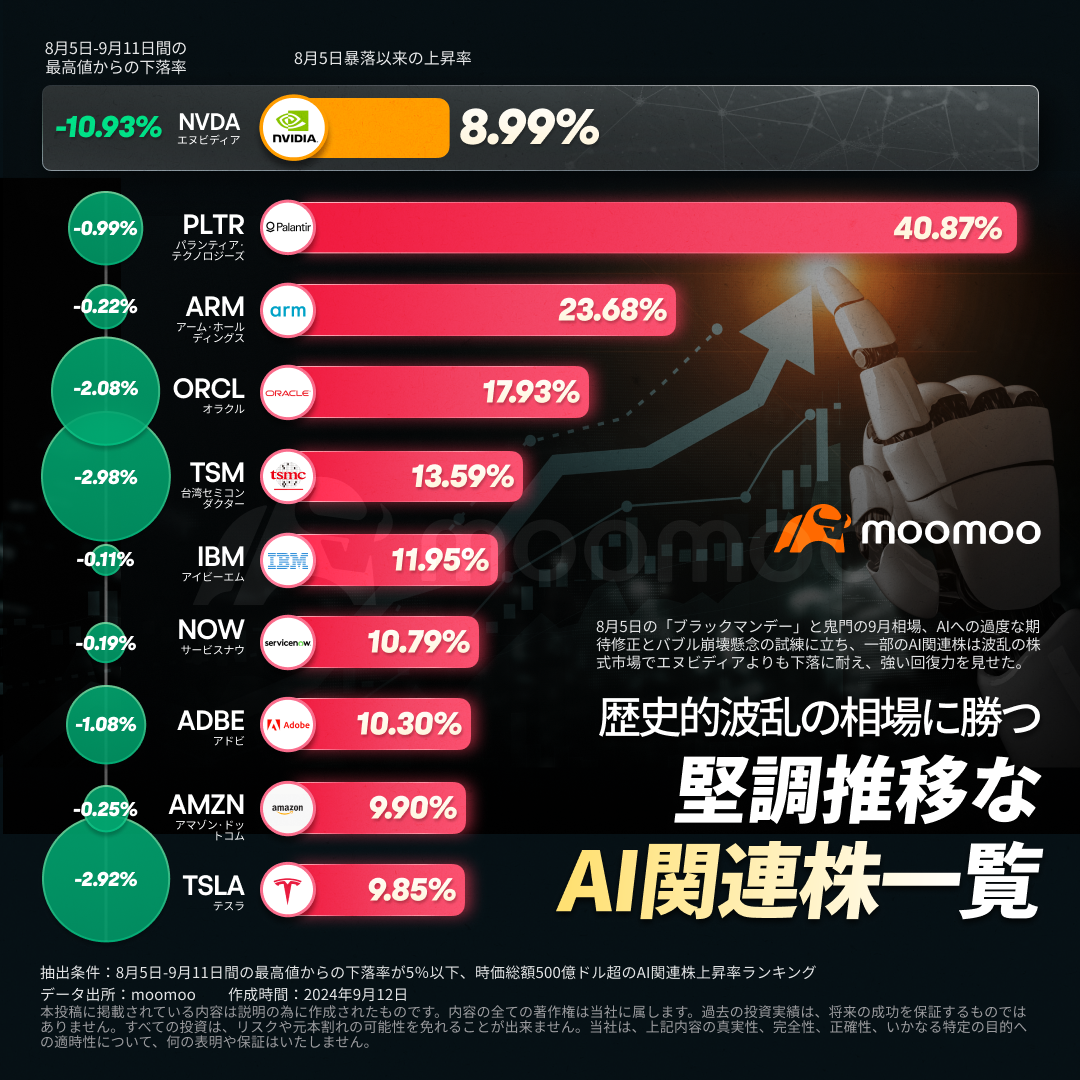

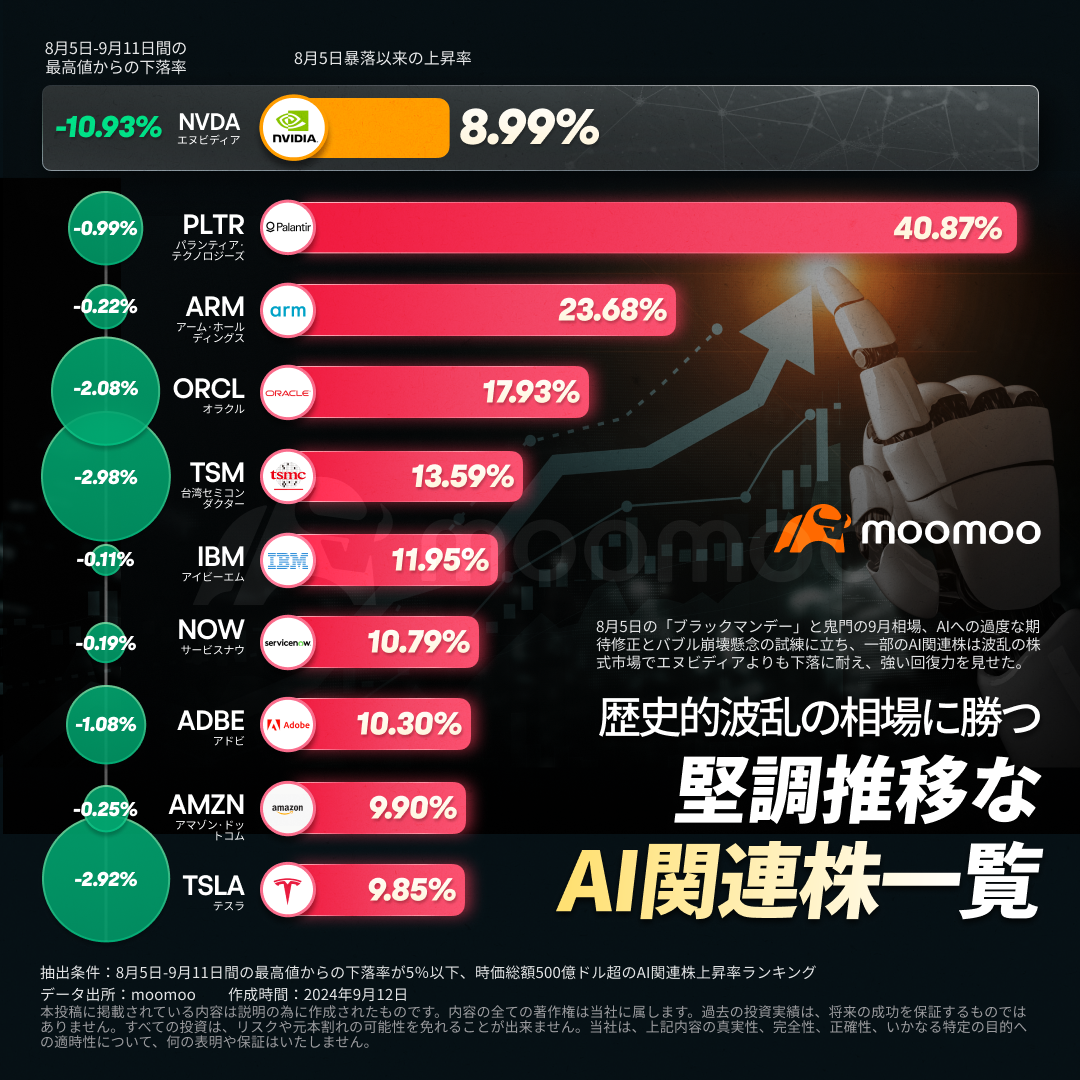

As the market's trust in AI is recovering, some investors are paying attention to AI-related stocks that are doing well even in the midst of the storm. While the market fluctuated, the decline from high prices over the past month was modest, showing stability, and achieved a stronger rise than NVIDIA.

last week $S&P 500 Index (.SPX.US)$Recruiting for has just been announced $Palantir (PLTR.US)$It has risen more than 50% year to date $Oracle (ORCL.US)$Of the “blue giant,” which is steadily advancing into the AI business $IBM Corp (IBM.US)$etc. came out of nowhere.

Other chip stocks $Arm Holdings (ARM.US)$Ya $Taiwan Semiconductor (TSM.US)$, cloud service company's $ServiceNow (NOW.US)$, a major software company $Adobe (ADBE.US)$and the US tech stock “Mag 7” $Amazon (AMZN.US)$, $Tesla (TSLA.US)$etc. also showed a steady trend over the past month.

“Expectations for AI” in the US stock market faced a test at the end of this summer. The details of financial results announcements from multiple major tech companies were poor, and even though huge sums of money were invested in AI research and development, growth in the core business is slowing down. The market raised questions about the ability of AI to be cashed out, and it changed to a mood of concern about a decline in AI demand and the collapse of the AI bubble.

Investors are $NVIDIA (NVDA.US)$I am concerned that if chip stock customers cannot generate the expected profits from AI investments, there is a possibility that huge capital expenses will be reduced on GPUs and other AI hardware. Also, delays in production of the next-generation semiconductor “Blackwell” were viewed as a problem, and Bankame analysts pointed out that the progress of shipments would affect the future course of the company's stock price.

Meanwhile, when NVIDIA CEO Juan attended the conference the other day, he once again emphasized the strong demand for AI-related products, saying “some customers are dissatisfied due to competition for the company's products where supply and demand are tight, and everyone wants to be at the top.”

Furthermore, he said, “It's important to understand what stage of the cycle generative AI is in. Infrastructure players like us and all cloud service providers place their infrastructure in the cloud. This is so that developers can use these machines to perform model training, fine tuning, guardrail settings, etc. This return is excellent, and since demand is extremely high, the $1 you pay to NVIDIA is equivalent to a $5 rental.”

This statement gave investors a sense of security, expectations for AI were rekindled, and semiconductor stocks and tech stocks were reviewed and bought. Goldman Sachs analysts pointed out that in order to bring about a sharp rise in large tech stocks, it is necessary to grow corporate profits by over 20% due to steady interest rate cuts and technological innovation by the Fed. In order to raise profits, tech companies must rely on advances in the artificial intelligence AI field.

Looking at individual stocks with investment opportunities, Morgan Stanley recently became a stock related to Edge AI $Arm Holdings (ARM.US)$has been selected as a new top pick stock. Reasons such as the recovery of the mobile market, new opportunities for edge AI, and the associated increase in loyalty revenue were cited. The bank maintains a “neutral” rating for the company's shares and a target share price of $175.

On the other hand, $Taiwan Semiconductor (TSM.US)$has been selected as a top pick stock by Morningstar, and since both cloud AI and edge AI are dependent on TSMC, they have been evaluated as the “main” beneficiaries of the AI boom. Also, the bank believes that TSMC and Samsung are still underestimated despite strong performance over the past year because there is a possibility that further profits can be obtained from the “huge market size” in AI and other advanced semiconductors.

Also, it showed strong performance recently $IBM Corp (IBM.US)$The stock seems to be emerging as a strong high-tech stock betting on the AI boom. It would be a good option for long-term investors with an investment horizon of 15 to 20 years, or investors seeking dividend income.

This article uses automatic translation for some parts

Source: Moomoo, MINKABU, The Fly

-MooMoo News Vicky

Source: Moomoo, MINKABU, The Fly

-MooMoo News Vicky

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment