Disney Earnings Preview: Focus on International Market Recovery and Continued Growth in Streaming Subscribers

Introduction

Eastern Time on May 7th before the market opens, The Walt Disney Company $Disney (DIS.US)$, a mega entertainment conglomerate, is set to report its latest quarterly earnings. This will be the group's first quarterly report since winning last month's proxy battle against Nelson Peltz. The market's current estimates for the company's quarterly revenue are generally expected to be flat or slightly down from the previous quarter, mainly due to seasonal factors from the last period. In the medium to long term, the market remains generally optimistic about Disney's future development.

Consensus estimates from Bloomberg predict that for the first quarter of 2024, the company is expected to report:

- Total revenue of approximately $22.1 billion, a 1.38% YoY increase and a 6.13% QoQ decrease;

- Net income of about $1.876 billion, a 26% YoY increase and a 1.84% QoQ decrease;

- Adjusted earnings per share of $1.10, an 18.58% YoY increase and a 9.6% QoQ decrease.

I. Business revenue analysis

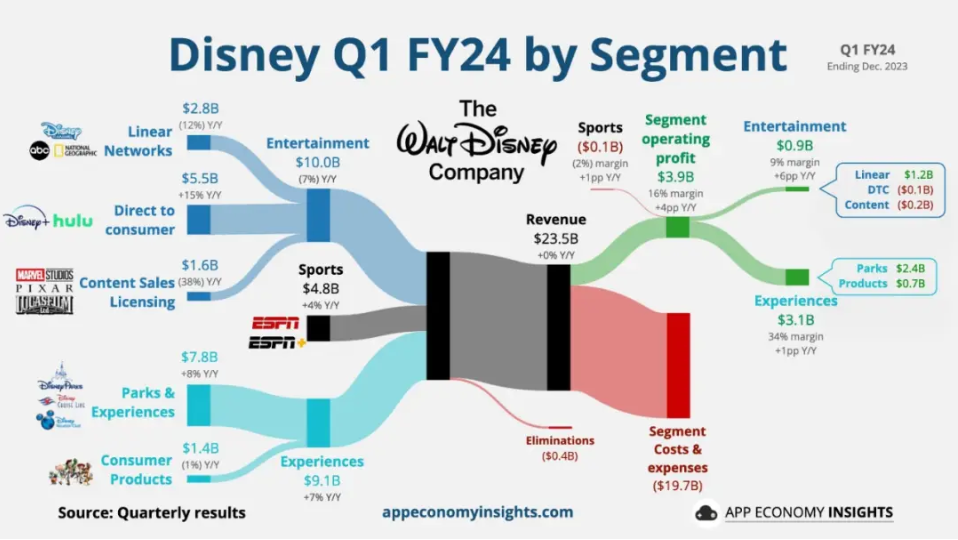

As one of the world's largest media and entertainment groups, Disney's Main Business can be divided into three parts: entertainment, experience, and sports. Next, we will conduct a forward-looking analysis of Disney's upcoming financial report from these three aspects.

Chart: Revenue Composition for The Walt Disney Company for Q1 FY24 as of December 31, 2023

Experiences Division Sees International Market Recovery, Future Growth Momentum Remains Strong

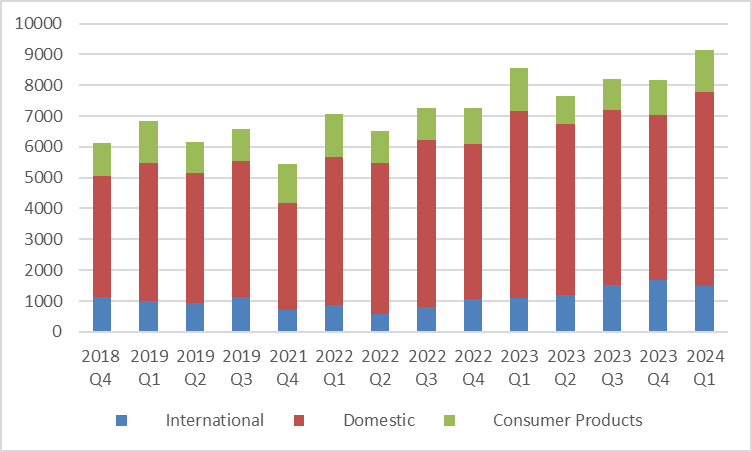

Disney's Experiences Division, which includes offline businesses such as Disney Parks, is divided into Parks & Experiences and Consumer Products. Within the Parks revenue, it can be further broken down into domestic and international markets.

Chart: Revenue by Business Segment for Disney's Experiences Division (in millions of USD)

Building on a strong performance in the previous quarter, according to consensus estimates from Bloomberg, the division's business is expected to generate total revenue of $8.18 billion in the first quarter, a 6.99% increase YoY and a 10.4% decrease QoQ. Of this, domestic parks are expected to bring in revenue of $5.74 billion, a 3.03% increase YoY and an 8.83% decrease QoQ; international parks are expected to generate about $1.595 billion, a 34.77% increase YoY and an 8.1% increase QoQ; consumer product revenue is estimated at $892 million, a 0.31% increase YoY and a 34% decrease QoQ.

The market's expectation for a QoQ decline in Disney Parks revenue is due to seasonal demand driven by holidays and festivals in the previous quarter, while the YoY growth is mainly due to a strong recovery in international markets. Since FY 2022, Disney Parks' international market revenue has been on a steady upward trend. With the launch of the Frozen-themed area in Hong Kong Disneyland and the Zootopia-themed area in Shanghai Disneyland, the recovery of consumer spending in China, and increases in both visitor numbers and ticket prices, the market is equally optimistic about the international market this quarter.

In the medium to long term, Disney's senior management has stated that the company plans to fully utilize its existing intellectual property to continuously introduce new theme parks, such as those themed around "Coco" and "Wakanda". Additionally, Disney plans to undergo comprehensive capacity expansion within the next 10 years, consolidating its industry competitiveness through expansion of existing parks and development of new ones, thereby painting a promising picture for investors.

The Entertainment Division Should Focus on Streaming User Growth

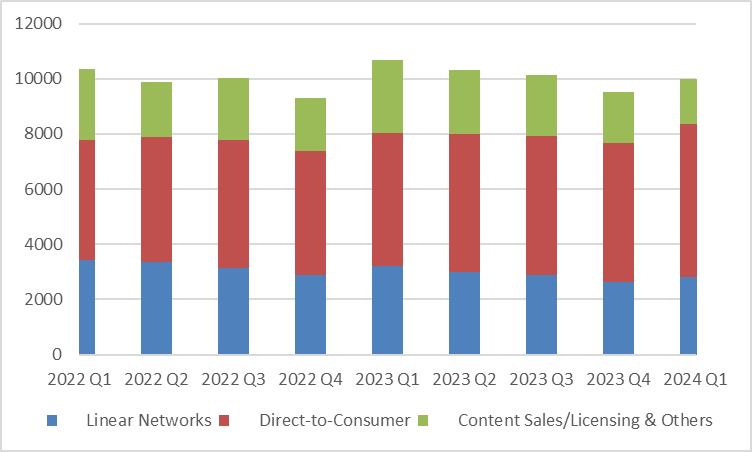

Disney's Entertainment Division mainly includes three parts: Linear Networks, Direct to Consumer (primarily streaming), and Content Sales/Licensing.

Chart: Revenue by Business Segment for Disney's Entertainment Division (in millions of USD)

For the Linear Networks segment, it still faces industry pressure in the short term, with revenue for the second quarter expected to be around $2.75 billion, a decrease of 8.28% YoY, and also a decrease from the previous quarter's $2.8 billion. This is mainly due to a 12.5% decline in advertising revenue and a 6% reduction in affiliate fee income from operators. In the long term, due to structural changes in the traditional TV market and advertisers shifting to short video platforms (such as YouTube and TikTok), linear TV subscriptions are expected to continue to decline, with a projected decrease of 7% by 2024.

Direct to Consumer, the streaming segment which is a core business focus for Disney, is highly anticipated to show improvement this quarter. The new user additions for Disney's various streaming platforms mainly come from marketing strategies that bundle the streaming products together, such as offering more attractive bundled pricing. A survey by JPMorgan shows that Disney's bundle sales continue to grow: 26% of respondents have Disney+, Hulu, and ESPN+. This has been referred to by analysts as "the highest proportion to date." According to consensus estimates from Bloomberg, for Q1 of FY24, Disney's flagship platform Disney+ is expected to add 155.7 million core subscribers, an increase over the previous quarter's 149.6 million; another streaming platform, Hulu, is expected to add about 49.78 million subscribers, also maintaining a steady growth trend.

In addition to the increase in new users, there has also been an increase in average revenue per user (ARPU) per month due to overall price increases implemented in August 2023. Among them, Disney+'s ARPU is $5.59, a 26% increase YoY; ESPN+'s ARPU is $6.10, an 8.17% increase YoY; Hulu's ARPU is $12.28, a 4.74% increase YoY. Regarding shared account situations, Disney plans to follow the lead of its competitor, Netflix, and is currently planning to implement measures to increase revenue (such as monitoring login locations, the number of devices, and frequency) by summer 2024, with the positive effects expected to materialize in FY 2025.

Overall, Disney's streaming platform revenue for Q1 of FY24 is expected to see a significant improvement. In the long term, Disney hopes that its DTC business will eventually achieve a double-digit profit margin, which will require success in both revenue growth and cost control.

In the Content Sales and Licensing segment, revenue for Q1 of FY24 is expected to be $1.632 billion, a 29% decline YoY and flat QoQ compared to the previous quarter. This is mainly due to Disney films still facing some challenges this quarter, as well as the continued impact of the Hollywood strike in 2023.

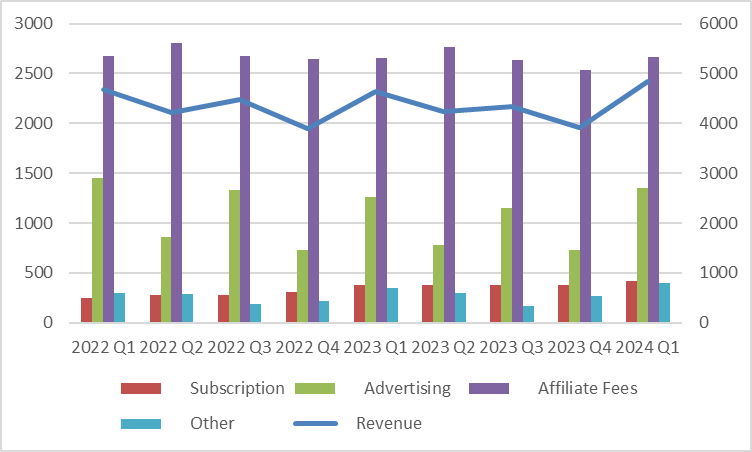

The sports department is expected to perform well, and ESPN advertising revenue growth is strong

As a young new business under Disney, its sports platform ESPN has shown good resilience in the face of pressure from the traditional linear TV Ecosystem. It is expected that the sports revenue in the first quarter of 2024 will be about $4.33 billion, a year-on-year increase of 2.47%. This is mainly due to the strong advertising demand of sports LIVE and pricing power in information delivery.

Chart: Disney Sports Revenue by Business (in millions of US dollars)

Benefiting from the US College Football Playoffs (CFP) and subsequent additional games, as well as ESPN's continued promotion in the US, Disney's domestic sports advertising and subscription revenue are expected to grow significantly this quarter. According to Bloomberg's expectations, advertising revenue is about $851 million, a year-on-year increase of 8.98%; subscription revenue is about $426 million, a year-on-year increase of 12.32%.

Overall, for indicators such as new subscriptions, park traffic counting, and advertising that the market is generally concerned about, we expect Disney to give a satisfactory answer in this quarter.

Continue to reduce costs and increase efficiency, increase dividend payouts, and restart repurchase plans

In the previous quarter, Disney's net profit attributable to the parent company was about $1.911 billion, a year-on-year increase of 49.41%, mainly due to the company's newly launched cost reduction and efficiency improvement measures. In the entertainment department, Disney is responding to the pressure faced by the linear TV network business through cost restructuring measures, especially the problem of declining advertising revenue and reduced alliance fees. At the same time, the company is also taking measures such as international expansion, reducing User Churn, improving content quality, adjusting prices, increasing advertising, and cracking down on password sharing to promote profitability in this sector.

Meanwhile, Disney resumed dividend payments at the end of last year after a three-year suspension. In January, it paid a dividend of $0.3 per share, and in February, it increased its semi-annual dividend payment by 50% to $0.45. At the same time, Disney also approved an annual $3 billion stock buyback plan, which is the first buyback plan reopened by the company since its performance plummeted during the 2020 epidemic.

Overall, driven by cost control and revenue growth, it is expected that Disney's profitability will improve in the short and long term, and shareholder returns will also increase.

Stock price trend analysis

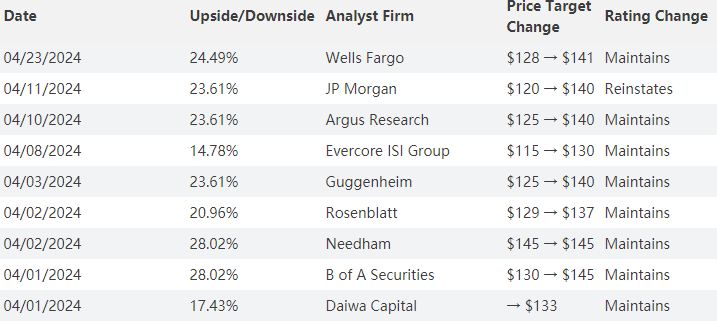

As of Friday's close, Disney's stock price has risen 23.7% since the beginning of this year, and its current stock price is $113.66.

The starting point of this stock price rise is the increase in Disney's return to shareholders after the release of last quarter's financial report and the announcement of the 2024 buyback plan. After the defeat of activist investor and "barbarian" Nelson Peltz in the shareowner election, Disney CEO Bob Iger returned, indicating that Disney's progress will be more moderate and the interests of shareholders will be more secure, which once again boosted Disney's stock price.

Given that over 70% of Disney's earnings come from high P/E ratio businesses, the company's forward P/E ratio can reach 20-25 times. Currently, the consensus on Wall Street for Disney's forward P/E ratio for FY24 is 24.288, and its current P/E ratio stands at 69.73. Although the valuation is high, most analysts believe it is still reasonable given that there are some strong catalysts that could drive profit growth.

This means that if Disney's performance this quarter meets or exceeds expectations, there is still room for the stock price to rise, given the market's continued optimism about Disney's prospects. A modest increase in share price is anticipated. However, due to seasonal factors and intense competition in the streaming industry, there are still some downside risks.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment