DJT Experienced a Typical IV Crush. What's Next?

After Trump won the presidential election yesterday, the market value of Trump Media & Technology Group, the owner of Trump's social media company Truth Social, initially soared. However, by the close of trading yesterday, the stock price had given up most of its early gains, ending up 5.9%. In pre-market trading on Thursday, DJT fell more than 13%.

After the election ended, DJT saw a standard IV crush

For several months, Trump Media has been representing traders' views on the election outcome. Between September 23 and the end of October, the value of Trump Media more than doubled—a remarkable growth driven by bets on Trump's return to the White House.

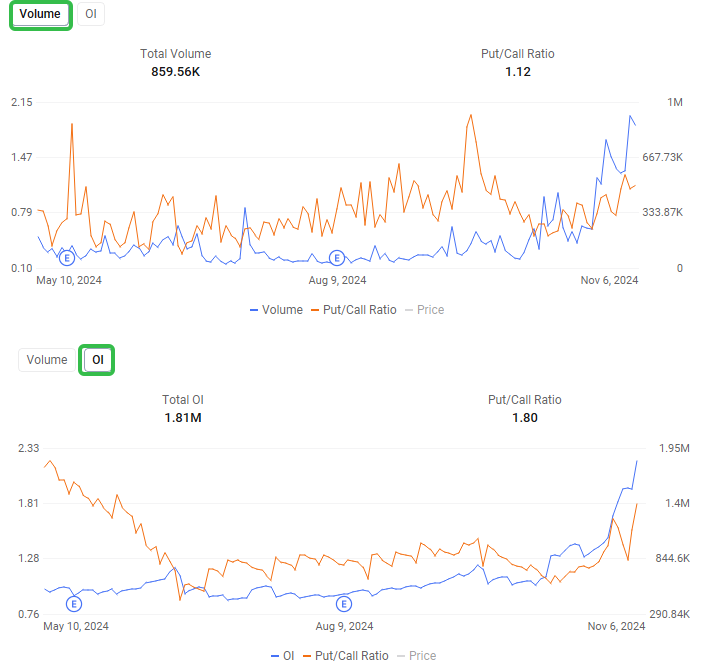

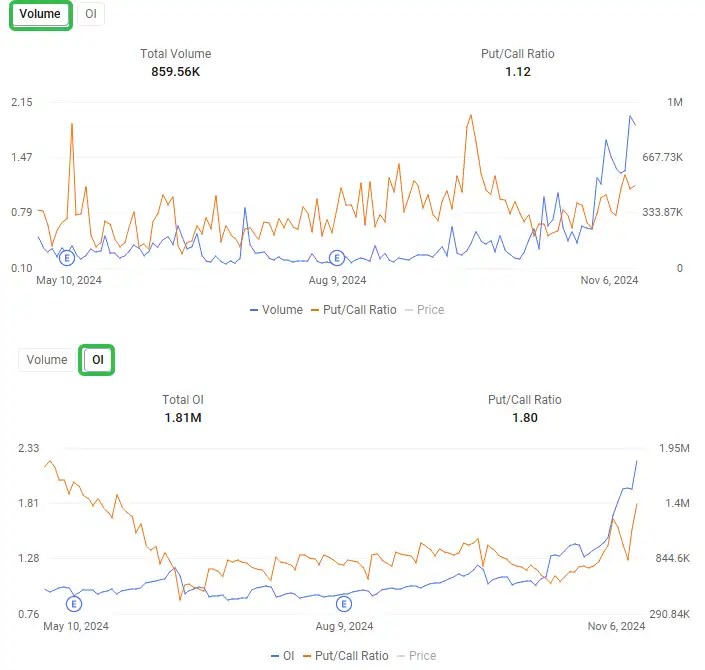

The volume and open interest in options also rapidly expanded during this period. Yesterday, the open interest even continued to rise to a new six-month high, representing increasingly frenzied trading sentiment towards this stock. Meanwhile, the PUT/CALL ratio also rose to a new high in recent months, indicating that some funds are also bearish on DJT, and market divergence is increasing.

After the pursuit of DJT options by investors, DJT's Implied Volatility (IV) rose to a peak of 319% on October 17th, then maintained at 294% on November 5th before the election. However, on the trading day following the election results, it dramatically fell to 181%. This is a classic example of IV crush.

For users unfamiliar with options, the IV crush can be observed through the specific performance of option prices. This is a call option on DJT expiring this Friday with a strike price of $40. Yesterday, when DJT opened up 24% and reached $42, this option merely opened flat and eventually closed down at $1.41, a 79% drop.

What causes IV crush?

If a particular event has been causing IV to rise, the need for a higher option premium disappears once the event takes place. In other words, once the uncertainty is gone and traders know what happened, the higher IV premium that compensated for the potential higher volatility is no longer necessary.

This is largely why DJT's call option price dropped sharply. Note that, in this scenario, it's likely that the IV of both puts and calls increased before the election result announcement and dropped after.

One way to avoid, reduce or take advantage of IV crush is to use strategies that involve both buying and selling options, such as vertical spreads(e.g. sell a low-priced call and buy a high-priced call) or iron condors(e.g. buy a put at strike A, sell a put at strike B, sell a call at strike C, buy a call at strike D, price a<b<c<d)

These strategies all contain one or more legs that benefit from a decline in an option's price. They can help reduce the impact of IV crush by offsetting the losses from an option that you're long, with the gains from another that you're short. Alternatively, you can focus just on strategies that involve selling options, such as covered calls, short straddles or short strangles. Note that these strategies may involve higher risks and may require more capital and margin.

What's next for DJT?

Trump Media is losing money, with minimal revenue. Its main product, the conservative social network Truth Social, remains small in scale. Trump Media announced on Tuesday that its revenue decreased by 6% year-over-year, amounting to only $1 million. The company lost another $19.3 million, though this is an improvement from the $26 million loss in the same period last year. Despite mounting losses, Trump Media ended the third quarter with no debt and $673 million in cash and short-term investments.

From a business perspective, the X platform has squeezed Truth Social's living space. Elon Musk has transformed X into a platform more friendly to views considered opposed to "political correctness". Trump's account on the X platform has also been restored.

However, some bullish views on DJT also hold water.

Devin Nunes, the former Republican Congressman who is now Trump Media’s CEO, said the company “continues to explore additional possibilities for growth,” including potential mergers and acquisitions with fintech or other firms. Nunes highlighted recent efforts to launch a digital TV service, Truth+, and introduce live TV streaming on Truth Social.

“Fundamentals don't matter,”said Michael Block, chief operating officer and co-founder at AgentSmyth, an autonomous AI agent platform for investment ideas. Block argued the market value reflects the value of a media company branded by “someone shaping up to be perhaps the most consequential person of the 21st century.”

Source:investorsedge, seekingalpha, CNN

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

terrance4 : With high volumn and the potential is huge for the company growth

103404706 : So much analysis for people wanting to take an advantage of an opportunity.

nameless1 : it was a meme, and we all took advantage of it. now it should go back to fundamentals

104126576 : ,,

kind Bat_4341 : X will be re-listed (merging with DJT) eventually however there will be a sell off immediately until after Trump’s inauguration:

1. Trump need to dispose off his share in DJT

2. DJT is just a vehicle to make $ whether he win or lose, the vehicle is not use to him

3. DJT itself has no value - it need to be merged

103775419 : what to do if i already own shares but not enough for options?

Shootingstar : hold for 1 to 4 years. dun buy options like what is stated in this report.

104088143 : What happened?

102566976 : great post will definitely consider incorporating option strategies that leverages on IV crush in the future. thanks for the wonderful explanation!

will definitely consider incorporating option strategies that leverages on IV crush in the future. thanks for the wonderful explanation!

Jovi9488 : Why do the option cards not work on pre-set options?

View more comments...