Does Canada 1.6% Inflation Call for More Aggressive Rate Cuts?

September inflation brings 3Q Average To 2.0%, topping BOC's 2.3% projection

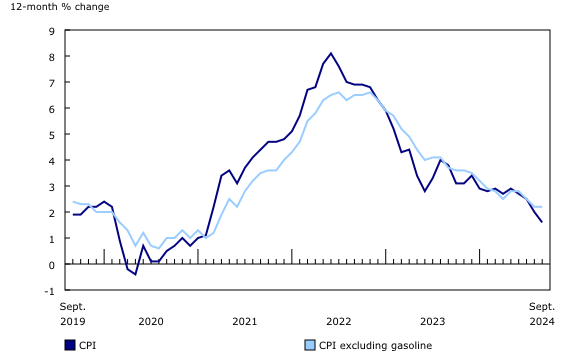

Lower gasoline prices brought down Canada's 12-month inflation rate to 1.6% in September from 2.0% in August. The average for the third quarter is 2.0%, down from 2.8% in the second quarter, and below the Bank of Canada's July projection of 2.3%.

Should the Bank of Canada be more aggressive?

The answer requires to look at the bigger picture.

Source: Statistics Canada

Shelter and services inflation slow

The CPI report was the last significant statistics before the Oct. 23 interest rate decision.

While the headline inflation rate reached its lowest level since February 2021, when excluding a 10.7% 12-month drop in gasoline prices, consumer prices were still up 2.2% from a year earlier, the same rate as in August.

The central bank's own three core measures of inflation averaged 2.3% in September, up from 2.2% in August, as the CPI-common increased to 2.1% from 1.9%, while the two other measures - CPI-median and CPI-trim - remained stable.

Still, when focusing on two particular areas of concern of the BOC - services and shelter - September's data should bring relief to the central bank:

- To be sure, mortgage interest cost, up 16.7% and rents, up 8.2%, were the two largest contributors to September's 12-month CPI increase. However, shelter inflation eased to 5.0% from 5.3%, including a slowdown in rent increases from 8.9% in August.

- Services inflation overall slowed to 5.0% from 5.3% and the CPI excuding mortgage interest cost came down to 1.0%.

Easing inflation expectations

September's inflation report materializes business and consumer moderating inflation expectations.

One of the most influencial pieces of information comes from the Business Outlook Survey (BOS) that was conducted by the central bank itself from August 8 to 30. At the time, the BOC had already cut rates by a cumulative 50 basis points and there were widespread expectations of another rate cut on September 4.

Business inflation expectations have moderated

The BOS pointed to muted inflationary pressures consistent with firms' reports of weak demand, excess capacity, and slowing price growth.

Source: Business Outlook Survey - Bank of Canada

- Firms expect more rate cuts than in the Q2 survey

Businesses' own expectations of rate cuts have changed since the second quarter survey conducted between May 9 and 29, right before the first rate cut of the current cycle on June 5. At that time, Canadian businesses expected the key policy rate to decline by 0.5 to 1.0 percentage points over 12 months.

In the third quarter survey, respondents think interest rates will decline by more over the coming year than those surveyed in the previous quarter.

So far, the BOC has delivered three interest rate cuts of 25 basis points each in June, July and September.

- Consumers' inflation expectations have declined

The Canadian Survey of Consumer Expectations, a sister survey of the BOS and conducted between September 3 and 12, shows that consumer inflation expectations for the next year have also moderated.

Source: Canadian Survey of Consumer Expectations - Bank of Canada

- Actual and expected wage growth easing

Likewise, consumers' perception of labor market conditions has weakened, with wage growth expectations down for the first time since the second quarter of 2023.

On the business side, hiring intentions remain weak and most businesses anticipate that wage growth will slow over the next 12 months.

As it turns out, the latest Labour Force Survey shows that wage growth slowed down in September to 4.6% year-over-year from 5.0% the previous month, even though the economy added 46,700 jobs on the month, driving the unemployment rate down to 6.5% from 6.6% in August.

Will the BOC double down?

Will the BOC double down?

The Bank of Canada has two more meetings this year, on Oct. 23 and Dec. 11.

The central bank has increasingly voiced the need to avoid inflation dropping too far below 2%. One way it plans on doing so is by supporting growth.

With the headline inflation at 1.6%, will the BOC double down and go for a 50-basis point rate cut in October?

In remarks on September 24, Governor Tiff Macklem said some indicators suggested growth may not be as strong as we expected. At the same time, he stressed that the BOC was looking for "continued easing in core inflation, which is still a little above 2%".

The September CPI report did deliver on slowing shelter cost inflation, but not so much on core inflation. Still, with wage growth slowing, hiring and investment expectations moderating, easing inflation anticipations, and the 50-basis-point Fed rate cut in September, the central bank has room to act aggressively if it wants to.

Bank of Canada policy interest rate

Source: Bank of Canada

Stay up to date with the latest news from Moomoo News Canada.

#monetarypolicy #bankofcanada #ratecuts

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

hanxi shang : Canada's inflation rate is 1.6%? That's nonsense.

735919637 : Don't know where they get the numbers from...things are still getting pricier everyday

far008 : Canada's inflation is a lie. we pay more compared to the rest of the world. also we have too many monopolies. only the select few elite in Canada own grocery, farming, banking, mobile networks. I would say 3 in 5 live paycheck to paycheck. cuts are imminent and would also say that we are in a recession!!!