Dow Still HItting Highs While Earnings Roll In | Herd on Wall Street

Morning traders, the heat is cranked up in Jersey City, and the Dow is hitting fresh highs on earnings results. My name is Kevin Travers, and here are stories from the moomoo herd on Wall Street today.

$Trump Media & Technology (DJT.US)$ fell about 7% Tuesday morning, facing a pullback after a major spike in trading Monday following violence at a Trump rally that left two dead and the former president wounded.

$Match group (MTCH.US)$ climbed 6%, the highest on the S&P 500, after news that activist investor Starboard Value owns 6.6% of shares, according to a regulatory filing. In a letter to Match CEO Bernard Kim, Starboard Exec Jeff Smith said the company should cut costs and update its dating apps, Tinder and Hinge, or possibly go private.

$Charles Schwab (SCHW.US)$ fell 6% Tuesday after the firm reported weaker Q2 metrics, including bank deposits, net interest revenue, and new brokerage accounts. Revenue was in line of estimates at $4.7B, but EPS was just 73C. CEO Walt Bettinger said the bank would adjust accordingly.

$UnitedHealth (UNH.US)$ was leading the Dow higher, up 5% after the firm reported earnings above expectations by 20C, but lower revenue after one of its subsidiaries faced a cyberattack earlier in the year.

This week will see a deluge of earnings reports from financial companies but $Netflix (NFLX.US)$ will be the first of the major tech companies to report on Thursday.

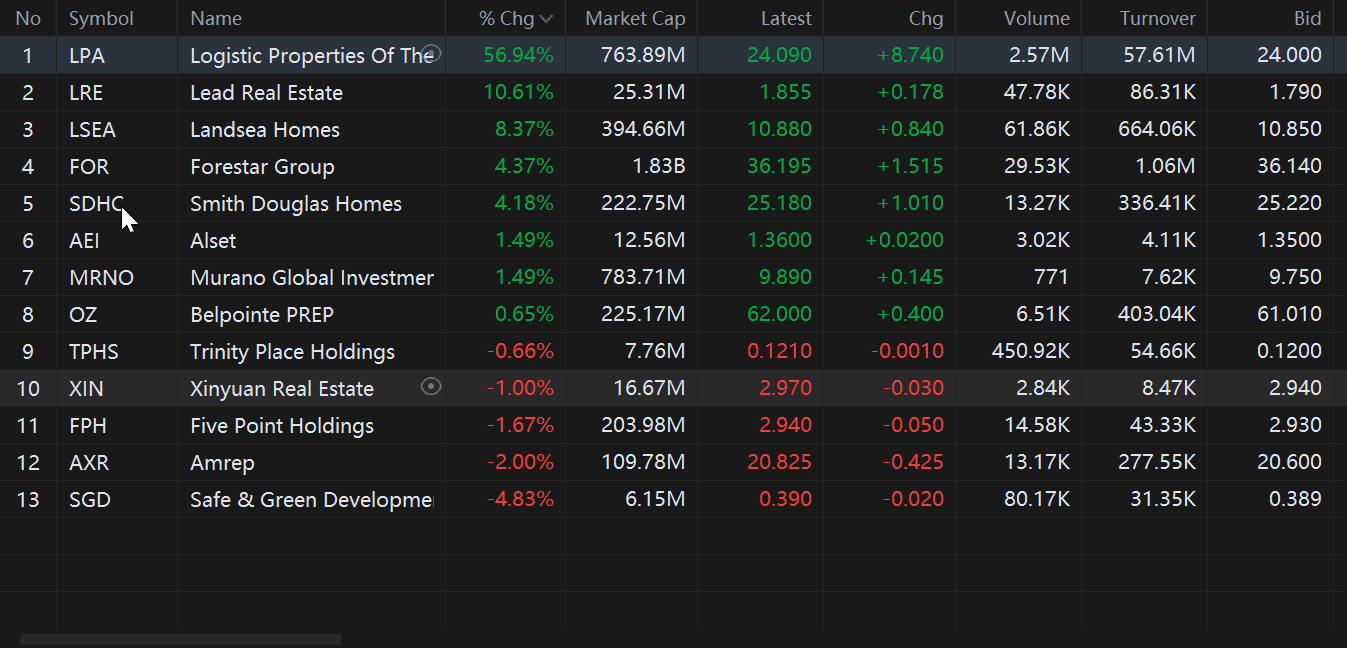

Within industries tracked by moomoo, real estate development was flying higher, led by $Logistic Properties Of The Americas (LPA.US)$ up a whopping 56% after placing two new board of directors members.

In commodities Tuesday, crude oil futures climbed 1.21% Bitcoin fell back about 1% to $63k, silver and gold both climbed and gold hit a record high while the U.S. 2-year and the U.S. 10 years both fell back.

Tuesday the market overall was advancing, and indexes were on their way to record highs after the S&P 500 and Dow Jones Industrial Average hit intraday highs Monday. Shortly after 10:50 am EST, the market was climbing, with 7400 equities in the green and 2800 falling.

The $S&P 500 Index (.SPX.US)$ climbed 0.41%, the $Dow Jones Industrial Average (.DJI.US)$ climbed 1.47%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 0.05%.

This week will be a light one for macroeconomic news, with a myriad of Federal Reserve speakers and Initial Jobless claims on Thursday.

Tuesday, retail sales data showed that consumers have not slowed down. Excluding a one-time hack that affected auto dealerships, data from the Census Bureau released Tuesday found that purchases of motor vehicles rose 0.4%. At the same time, overall retail sales remained unchanged month over month in June.

Federal Reserve President Jerome Powell spoke Monday, saying the Fed would likely lower rates before inflation to lowers to 2%.

"Today, I am not going to be sending any signals, one way or the other, on any particular meeting. So, just to ruin the fun," Powell said.

Last week, investors saw lower CPI numbers by about 0.1% than last month, and Producer Price Index numbers came out Friday, showing core producer prices grew at a rate of 0.4%, more than last month. Consumer confidence indicators from the University of Michigan showed that consumer sentiment on the economy fell to an eight-month low.

Tuesday, Federal Reserve Chair Jerome Powell said he would like more data supporting rate cuts, but the Fed keeps its options open. He said that, compared to two years ago, the labor market had cooled significantly to just above where it sat in 2019, and that inflation was not the Fed's only concern.

Yesterday, users were watching Sofi, watching stocks facing market fear from all-time highs like Nvidia, and one user even told me that traders don't set prices, prices just are the way they are on their own.

Mooers, what are you watching today? Comment below and I may feature your comment tomorrow!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

101550592 :

104166257 : hi

103983157 : Watching SHOP

Kevin Travers OP 103983157 : good call I'll put up a story on it now

105535782 : ok