DraftKings (DKNG) Monetization Trends Would Be In Focus

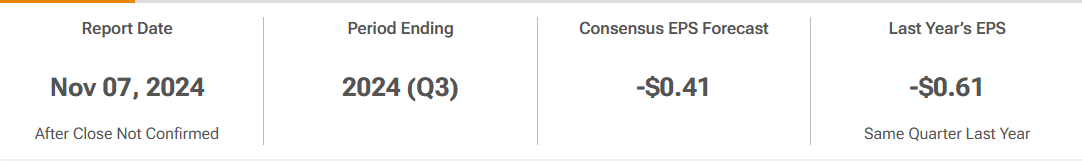

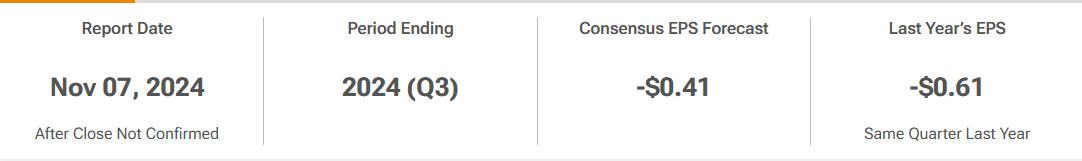

$DraftKings (DKNG.US)$ will be reporting its third quarter earnings results for 2024 after market close on Thursday (07 Nov).

This online betting company have a forecast of a slight third-quarter earnings beat and full-year guidance raise, "driven by slightly favorable sport outcomes and healthy user acquisition, retention, and monetization trends."

Wall Street expects DraftKings to disclose a third-quarter loss of 41 cents per share – an improvement over the 61 cents per share it lost in the year-ago period. Revenue estimates are for $1.1 billion (+39.2% YoY).

Institutions Influence On DraftKings (DKNG) Significant

The ownership structure of DraftKings (DKNG) stock is a mix of institutional, retail, and individual investors. Approximately 43.85% of the company’s stock is owned by Institutional Investors, 2.18% is owned by Insiders, and 53.97% is owned by Public Companies and Individual Investors.

Institutions' substantial holdings in DraftKings implies that they have significant influence over the company's share price. 47% of the business is held by the top 25 shareholders

Investors should be aware of the most powerful shareholder groups. And the group that holds the biggest piece of the pie are institutions with 74% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

A good portion of institutional money invested in the company is usually a huge vote of confidence on its future.

Is Hedge Funds Looking For Signs Of Profitability For DraftKings (DKNG)?

In the last quarter, we are seeing hedge funds decreasing their holdings by 4.2 million shares, this might signalled the confidence they are having on this stock.

Though we are seeing consumer discretionary sector growing, but there might be some concerns on how DraftKings might be growing their user acquisition, retention and monetization trends.

Investors Negative On DraftKings (DKNG) Stock Price

Even though there have been performance improvement on the S&P 500 Consumer Discretionary sector, it does not really help DraftKings investors to change their sentiment for this stock.

Over the past 30 days, we are seeing investors reducing their portfolio with DraftKings by 1.8%. This could signal that there might be profit taking or sell-off if there is any slight stock price improvement.

DraftKings last close at $36.45 with more than 2% gains, so we might want to watch the price action and buying strength on DraftKings.

Technical Analysis - Buying Strength Seems To Come Back

We are seeing investors into buying mood in the after-hours on Tuesday (05 Nov), and if this trend could continue into Thursday (07 Nov), then we might be able to see a strong upside move for DraftKings.

But I would look at the overall trend on how market might react to its earnings.

Technical Analysis - MACD and Multi-timeframe (MTF)

If we looked at the multi-timeframe, we are seeing that DKNG MACD is trying to make a bullish crossover, but concerns of DKNG is still trading below short-term and long-term MA despite with more than 2% increase.

The MTF is showing a downtrend signal.

Summary

While we might be seeing DraftKings stock price performing ahead of its earnings, we need to be aware of what to look out for.

I would be watching the price action for DKNG today (06 Nov) and also watch the monetization trend on DKNG earnings.

Appreciate if you could share your thoughts in the comment section whether you think DKNG could provide an earnings surprise with better user acquisition and retention, with good monetization trends.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment