Make money fast with options! Earned nearly $200,000 in just 2 trading days!

Everyone has a dream: to earn money without working, ideally amassing a large fortune in a short span of time, and then "kicking back to enjoy the world"! However, how can one make money quickly and legally?

Generally, investing is regarded as one of the legitimate and rapid ways to make money, but different investment strategies or instruments can yield varying results in terms of speed! Now, let's explore some investment tools in the world of finance that can potentially lead to quick profits: day trading stocks, foreign exchange trading, cryptocurrency trading, futures trading, and options trading, among others!

But be aware, money that comes quickly can also disappear just as fast. The easier the money is to earn, the greater the risk involved!

My Money-Making Method

AI development is advancing by leaps and bounds. For me, entering 2024, the AI sector continues to have unlimited upside potential, especially the leader NVIDIA! On January 16th of this year, the financial website Forexlive reported that NVIDIA may have more investment potential than Apple Inc. Therefore, on that day and the 17th, I bought NVIDIA's weekly expiring Call options with a strike price of $560. After the leverage of options, betting small for a big return, I seized the opportunity of high volatility and earned nearly $200,000 in just 2 trading days.

How to Make Money with Options Step by Step

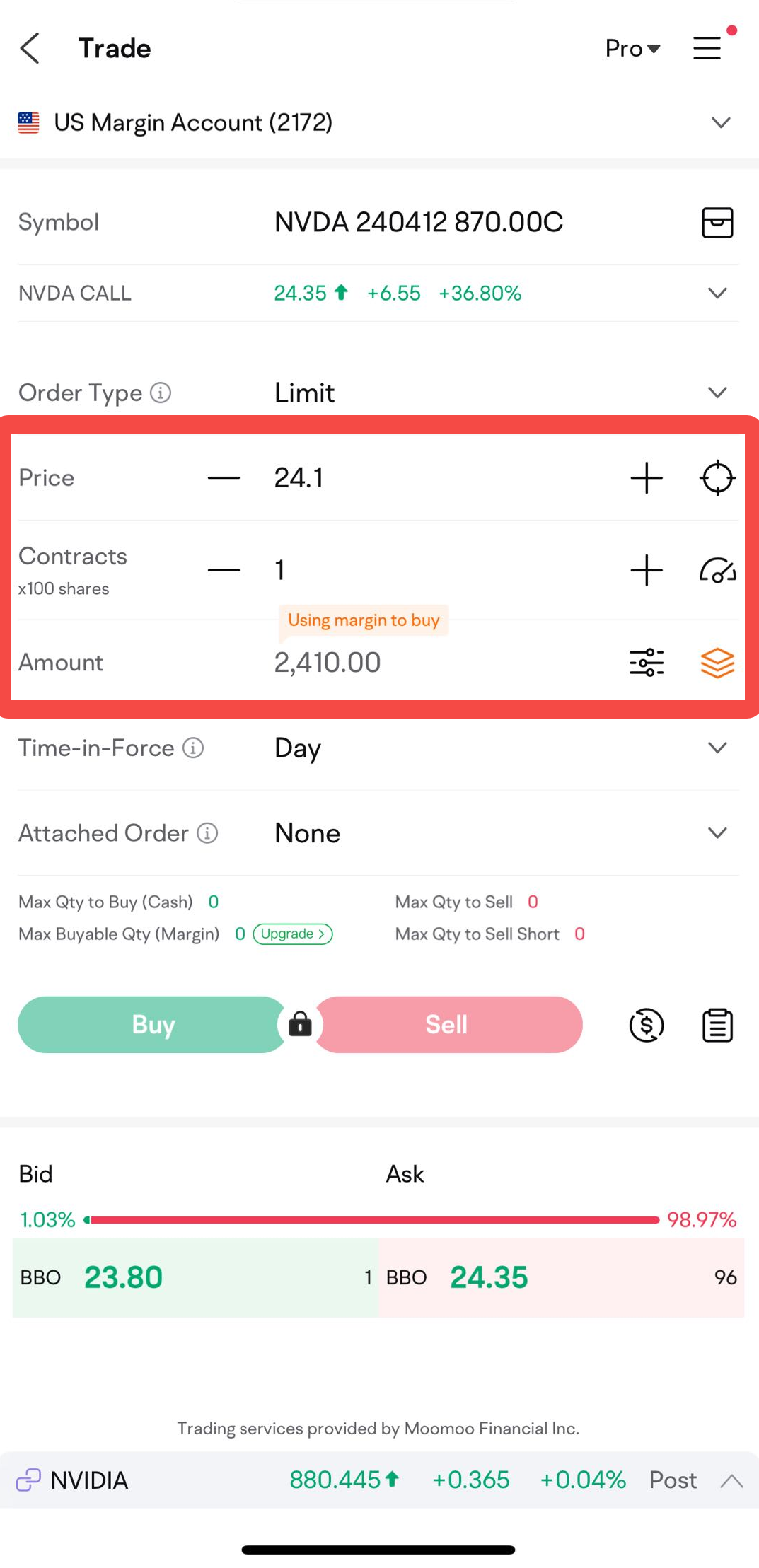

If you want to make quick money, you can try buying options. Moomoo offers this investment tool for everyone to get started. But before starting, you need to understand what options are first.

What are Options?

An option implies granting the buyer a right to purchase or sell a certain underlying asset, including stocks, market indices, currencies, or commodities, etc., to the option seller at a predetermined price within a specified period.

Call Option

A call option allows the buyer the right to buy 100 shares at the strike price before the contract expires.

If you are bullish on a stock's price and buy a call option, you will make money when the stock price rises, and lose money when the stock price falls.

For example, with AAPL: when the AAPL stock price is at $130, you buy a call option expiring next month, and purchase the call option contract at $1.55 per share. In other words, each 100-share call option contract costs $155. If the stock price rises above $130 before expiration, you can exercise the right to buy 100 shares at $130, and then sell them at the market price, earning the difference from the price increase.

Put Option

A put option allows the buyer the right to sell 100 shares at the strike price before the contract expires.

If you are bearish on a stock and think its price will fall, you can buy a put option. When the stock price falls, you will make money, and when the stock price rises, you will lose money.

Using AAPL as an example again: when the AAPL stock price is at $120, you buy a put option expiring next month. If the stock price falls below $120 before expiration, you have the right to exercise the put option contract to buy AAPL shares at a cheaper price in the market and sell them at $120, earning the difference from the price drop.

Options Trading Indicators

1. Option Premium

This is the cost or price of an options trade, mainly composed of intrinsic value + time value. For stock options traded on the exchange, the price is usually calculated per share, the seller receives the option premium.

2. Strike Price

Strike price is the predetermined price at which the underlying asset can be purchased or sold.

3. Expiration Date

The expiration Date is the last date on which the buyer can exercise the right to purchase or sell the underlying.

4. Volatility

These include: Delta, Gamma, and Theta. Through these technical analysis tools, you can see the price changes in a specific period. The faster the price changes, the higher the volatility; conversely, the slower the price changes, the lower the volatility.

5. Leverage

Leverage determines how much money you can make. The higher the leverage, the better. You can check the leverage ratio on Moomoo.

Risks of Options

When trading options, one must never focus solely on high returns; the substantial risks involved cannot be ignored, otherwise, one could lose their entire fortune in a matter of minutes!

Risk of Loss

The option buyer has rights, while the seller bears obligations, so comparatively, the buyer's risk is lower than the seller's. The buyer's risk is limited to the premium paid for the option, whereas the seller could face unlimited risk.

American Options and European Options

Additionally, options can generally be divided into two different exercise methods: European and American options.

European options: Can only be exercised at expiration.

American options: Allow exercise at any time before expiration.

Moomoo app provides both European and American options, and you can choose according to your own abilities.

Price Risk of Purchase

Basically, the change in the purchase price (option premium) depends mainly on three factors: underlying stock price, remaining time to expiration, and implied volatility. To prevent sudden spikes in option premium prices, you can use the "Option Price Calculator" in the Moomoo app to evaluate before buying and selling options, to avoid going over budget due to sudden increases in option premium amounts.

In addition, the "Option Price Calculator" can:

1. Determine if the actual option price is reasonable

2. Calculate the option price on a future date

3. Calculate the best timing for opening and closing positions

Where Can You Invest in Options to Make Money?

On Moomoo app, you can invest in options for different assets, including stock options, index options, and commodity options. Download the Moomoo app, select the asset you want to invest in, and click "Trade"!

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

tanvi : Enjoy reading your post. Please elaborate more on the "Option Price Calculator ".

How do you determine the price is reasonable for buying/selling call and put options on what date?

How do you tell it is the best timing for opening and closing the positions?

tanvi : Also, why are you not trading on MooMoo?

samuelqy tanvi : Hey, it looks like a charm, but its not. If you’re not ready to lose all your money, don’t mess around options

Easy Money_JW OP tanvi : Thank you for enjoying the post! You can compare the option's current price to its intrinsic value and time value to determine if it's priced reasonably.

Easy Money_JW OP samuelqy :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Kmartin1744 : Nice

Thomas W6 : Is there somewhere to read up on options and how theybwork

73766516rys samuelqy : How risky is option?

Arrayfunction : Thank you for going through your process

71840268 : great!

View more comments...