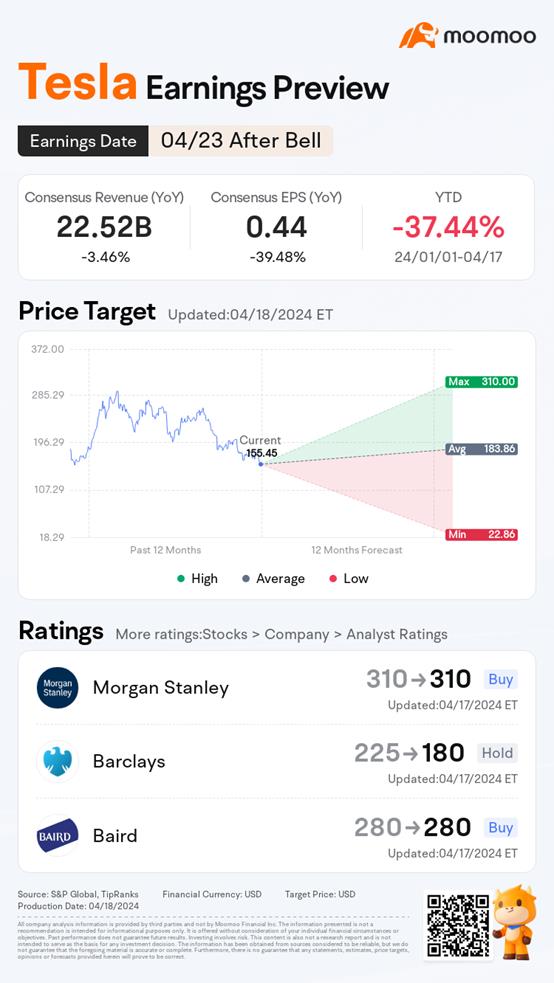

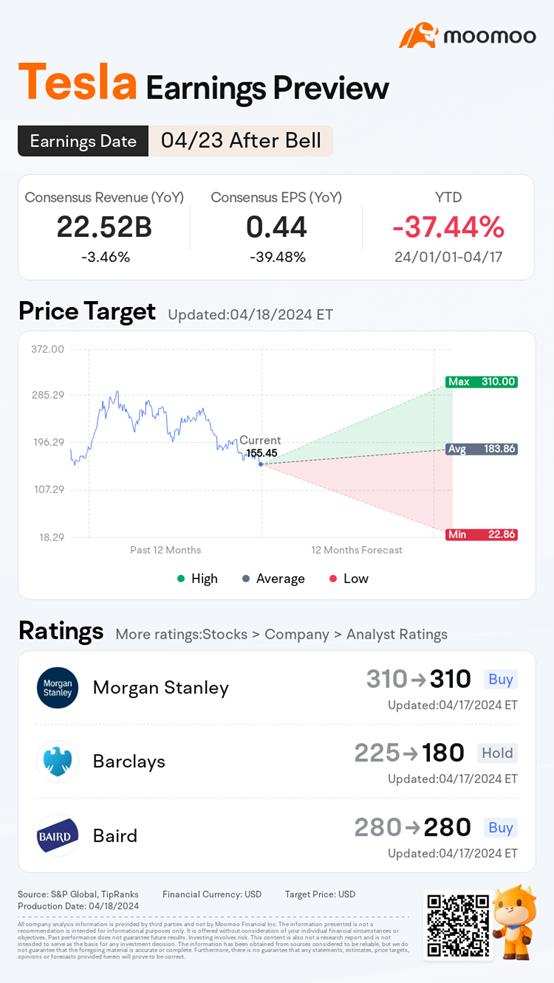

Earnings Preview: Analyst Downgrades and Lowers Q1 Profit Forecast for Tesla Ahead of Earnings Report

Tesla is scheduled to release its financial results post-market on April 23. Faced with falling sales and an intensifying price war for electric vehicles, Tesla has lost nearly 40% of its value in 2024.

Consensus Estimates

• This electric car maker is expected to post quarterly earnings of $0.44 per share in its upcoming report, which represents a year-over-year change of -39.48%.

• Revenues are expected to be $22.52 billion, down 3.46% from the year-ago quarter.

• Free cash flow is expected to be negative for the first quarter, marking the first occurrence since Q1 2020, according to Barclays.

• Over the last four quarters, the company has beaten consensus EPS estimates two times.

Tesla's Q1 earnings are expected to decline, along with negative free cash flow

Barclays analyst said Tesla’s first-quarter earnings call is “extra highly anticipated” and expects it to be a negative catalyst for the stock.

Barclays predict a negative free cash flow for the first quarter, marking the first occurrence since Q1 2020. This anticipated financial downturn is attributed to bloated inventories impacting working capital and a potential deterioration in gross margin, excluding regulatory credits. These factors could potentially revert Tesla's auto profitability to levels last seen in 2017. The company's significant unsold inventory, coupled with challenges in stimulating demand despite price reductions, has led to speculation that Tesla's delivery volume for 2024 could remain flat.

Wells Fargo analysts also said they expect a Q1 miss from Tesla, with expectations low after weak deliveries.

The strategic shift from Model 2 to Robotaxi raises concerns about Tesla's growth

Deutsche Bank downgraded the stock to "Hold" and cut its price target to $123 from $189, raising concerns over the electric automaker's increasing focus on its autonomous vehicle products when profit is under pressure.

Earlier this month, Reuters reported that Tesla decided to cancel its long-promised inexpensive car that investors hoped would drive growth, while continuing to develop Robotaxis on the same vehicle platform.

"The delay of Model 2 efforts creates the risk of no new vehicle in Tesla's consumer lineup for the foreseeable future, which would put downward pressure on its volume and pricing for many more years," Deutsche Bank analyst Emmanuel Rosner said.

Wedbush analysts also said It would be “a risky gamble if Tesla moved away from the Model 2 and went straight to Robotaxis”, and if Robotaxis are seen as the “magic model” to replace Model 2 the firm would view this as “a debacle negative for the Tesla story."

Tesla Q1 2024 Deliveries dragging down the stock

The electric vehicle (EV) maker delivered 386,810 vehicles in the first quarter of 2024, down about 8.5% from the same period in 2023, which could reflect declining EV demand. Tesla reportedly plans to slash its workforce by more than 10% as demand for EVs slows.

Wedbush Securities analysts said that "1Q deliveries was a nightmare quarter for Tesla with China and global EV demand remaining very soft coming out of the gates for 2024."

Meanwhile, UBS highlighted plateauing electric demand and more China competition as factors that could impact TSLA's near-to-mid-term growth. “In China, Tesla shows negative momentum year-on-year compared to premium and top-end Chinese electric vehicle brands.”UBS added.

Mooers, do you think the upcoming earnings report from Tesla will be a negative catalyst or a signal for a share rebound?

Source: Reuters, Investing, MarketWatch

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Tao Liu4 : In my opinion, Tesla is just a car building company, and Musk is an outright bragger, Tesla is worth only $80

2886 : relax bro, ride the wave..

Silverbat : Downgrade of the target prices during product transition is common and good chance to accumulate at dips.

Tan Chin Seng klang : buy more Tesla. it's super good

151241481 : Morgan Stanley an Baird say BUY!!!

Beerfootmonster : definitely