Earnings Preview: Will Barrick Boost Its Gold Production in 2024, Ending Years of Decline?

Investors could look to $Barrick Gold Corp (ABX.CA)$'s earnings results this week for clues as to whether the world's second-largest gold producer could reverse the decline in production of the precious metal to fully capture the benefits of rising prices.

An increase in production in 2024 can deliver positive earnings momentum for Barrick, "enabling the company to boost its dividend and share buybacks, rewarding investors for their patience," Bloomberg Intelligence analysts Grant Sporre and Emannuel Munjeri said in a note in September.

$XAU/USD (XAUUSD.CFD)$ surged to a record $2,146.79 an ounce in December 2023 and has stayed above $2,000 this year. $Barrick Gold (GOLD.US)$ can "nudge the balance sheet back into a net-cash position" under a $2,000 an gold scenario, swinging from a small net-debt position, Bloomberg Intelligence analysts said.

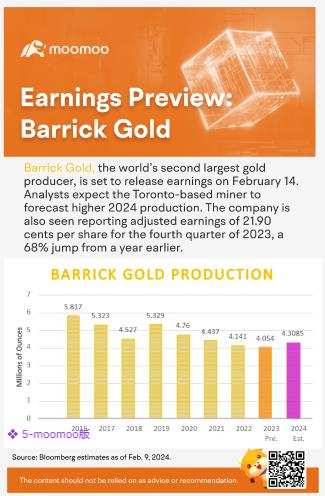

On average, analysts expect Barrick to boost production to 4.3 million ounces in 2024, according to estimates compiled by Bloomberg as of Feb. 9. That would end four annual declines in production that saw Barrick reporting preliminary output of 4.05 million in ounces last year.

For the last quarter of 2023, the company is expected to report adjusted earnings of 21.9 cents a share, up 68% from a year earlier, according to estimates compiled by Bloomberg. Revenue is seen rising 12% to $3.1 billion, the average estimate showed.

Boosting production has been a major challenge in an industry where producers are forced to contend with political risks in jurisdictions where they extract gold and other metals. About half of Barrick's production is from areas with higher sovereign risk, but the compoany has a good track record of working with local governments, Morningstar analyst Jon Mills said in a note Aug. 9.

Barrick shares have tumbled 17% in Toronto trading this year, underperforming the $S&P/TSX Composite Index (.SPTSX.CA)$ index's 0.5%. The stock's adjusted return on invested capital (ROIC) is below its weighted average cost of capital (WACC), according to the Morningstar note.

Finding the right opportunity is a big challenge for Barrick, which has sought to avoid paying a premium for acquisitions. The reversal of fortune for Canadian miner $First Quantum Minerals Ltd (FM.CA)$ may present that opportunity for Barrick, which is also seeking a bigger share of the copper market. While copper is First Quantum's primary product, it also produces gold from its Kansanshi and Guelb Moghrein projects, according to its website.

First Quantum saw its market capital shrink by more than half in the past year after its Cobre Panama project, one of the world's largest open-pit copper mines, was forced to shut down following a ruling from Panama's top court that the contract was unconstitutional, Reuters reported.

Barrick has spoken to some of First Quantum Mineral's major investors to gauge support for a potential takeover after the Canadian copper miner was forced to close its flagship mine, Bloomberg reported.

Disclaimer: This article is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content. See this link is for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Malik ritduan : ok