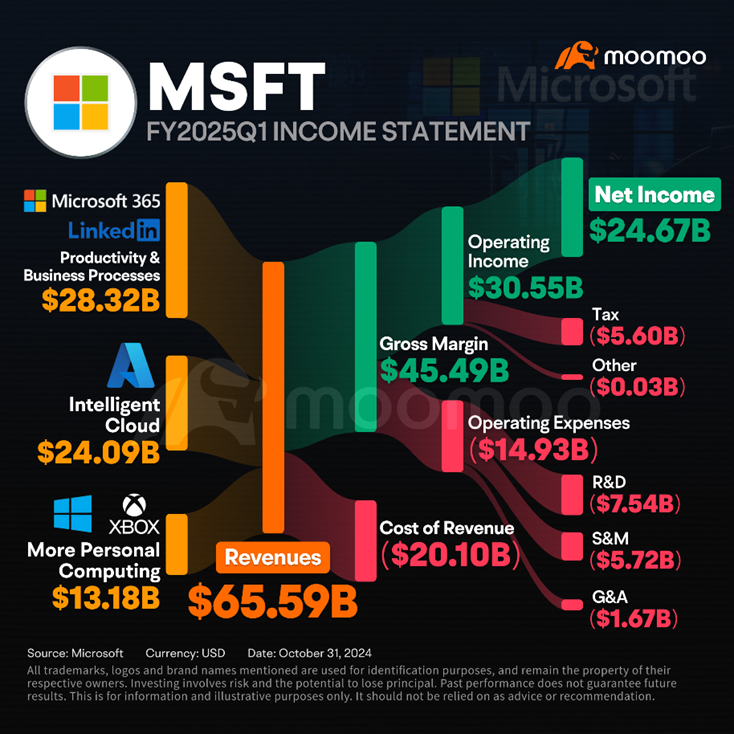

Microsoft released its first-quarter earnings report for the fiscal year 2025 after the close of U.S. stock markets on Wednesday. The data revealed that Microsoft's quarterly revenue reached $65.585 billion, a 16% increase year-over-year, with earnings per share at $3.30, up 10% from the previous year. Both figures surpassed market expectations. Notably, Microsoft's cloud business grew rapidly by 22% year-over-year, demonstrating pleasing results from its investments in AI.

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

joemamaa : cool