Earnings Review | Microsoft Reports a Weak Outlook Although AI Cloud Elevates Its Earnings

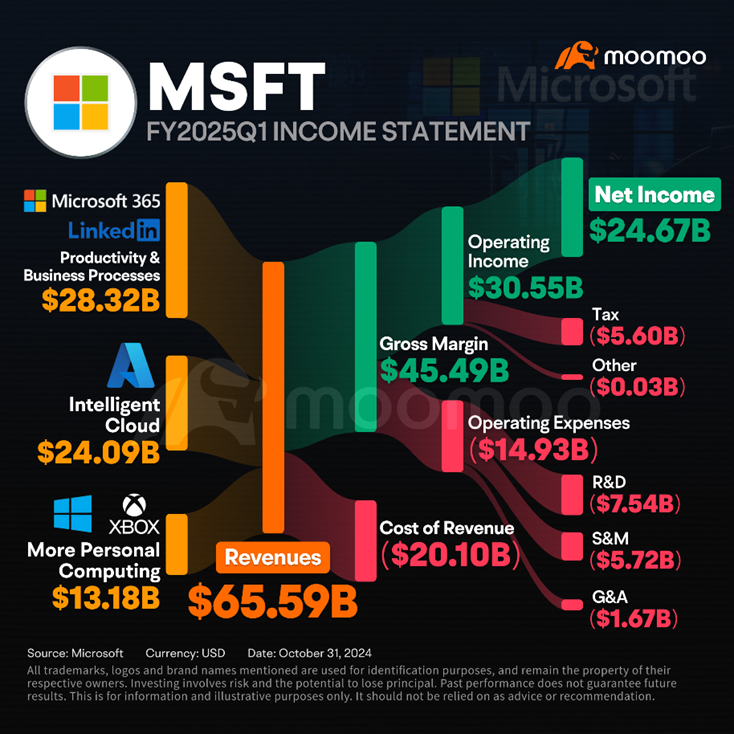

Microsoft released its first-quarter earnings report for the fiscal year 2025 after the close of U.S. stock markets on Wednesday. The data revealed that Microsoft's quarterly revenue reached $65.585 billion, a 16% increase year-over-year, with earnings per share at $3.30, up 10% from the previous year. Both figures surpassed market expectations. Notably, Microsoft's cloud business grew rapidly by 22% year-over-year, demonstrating pleasing results from its investments in AI.

However, due to weak earnings guidance and continued concerns over rising capital expenditures, which Wall Street is very "concerned" about, Microsoft's stock price fell by more than 5% on Thursday.

Looking at the earnings by division, Microsoft's Intelligent Cloud revenue was $24.092 billion for the first quarter, up 20% year-over-year and slightly above analysts' expectations of $24.04 billion.

Productivity and Business Processes brought in $28.317 billion, up 12% and above the forecast of $27.9 billion. Microsoft 365 commercial products and cloud services rose by 13%; consumer products and services grew by 5%; LinkedIn increased by 10%, and Dynamics products and cloud services by 14%.

The More Personal Computing segment reported revenues of $13.176 billion, up 17% and exceeding analysts' predictions of $12.56 billion. This included a 2% increase in Windows OEM and devices, a 61% rise in Xbox content and services, and an 18% growth in search and news advertising revenue.

▶ AI cloud revenue exceeded expectations. Can the growth rate be sustained?

In the fiercely competitive cloud infrastructure market, Microsoft demonstrated robust growth. EPS earnings and net profits reached the highest in Microsoft's over fifty-year history, with cloud revenue growing 22% to $24 billion in this quarter. In comparison, Google reported a 35% annual growth in cloud business, reaching revenues of $11.35 billion.

This performance was significantly aided by Azure and other cloud services. Azure's growth rate for the quarter was 33%, slightly down from 35% in the previous quarter but still well above Wall Street's expectation of 30%. AI services, contributing 12% to the growth, also pleasantly surprised the market.

However, the message conveyed by executives during the earnings call was mixed. Microsoft CEO Satya Nadella mentioned that the company's AI business is expected to achieve $10 billion in annual revenue next quarter, potentially becoming the fastest in Microsoft's history to reach the $10 billion revenue milestone.

Yet, Microsoft CFO Amy Hood forecasted that Azure's growth rate would further slow to 31%-32% next quarter (Q2 of Fiscal Year 2025), below the analyst expectation of 32.25%.

▶ Capital expenditures continue to expand: good or bad?

As the AI trend surges and tech giants fiercely compete, Microsoft continues to invest heavily, not only in startups like OpenAI but also in data centers and other AI infrastructure. However, such substantial investments raise concerns about the prolonged payback period.

In the previous fiscal quarter, Microsoft's stock price significantly dropped after hours due to Azure's revenue growth falling short of expectations and a 77.6% surge in capital expenditures to $19 billion, raising concerns about the lengthy ROI period for AI investments.

In this quarter, Microsoft continued its strategic AI investment layout. Capital expenditures for the quarter reached $20 billion, continuing to rise quarter-over-quarter. The CFO stated that the profit margin for commercial cloud is expected to narrow, reiterating that capital expenditures would increase.

The massive expenditures on AI have both pros and cons for the company. Gil Luria, an analyst at DA Davidson & Co., mentioned, "We were initially concerned that their investments in data center construction might drag down profit margins. However, this has not occurred yet; they have managed to cut enough costs in other areas."

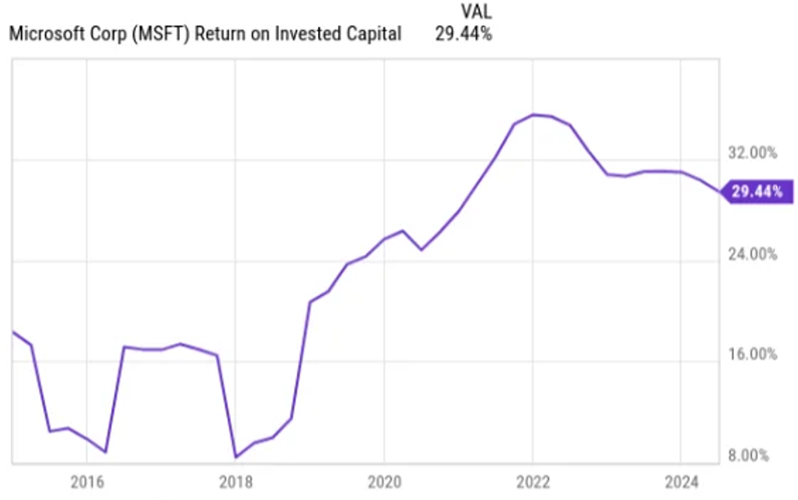

Data shows Microsoft's long-term return on invested capital (ROIC) has been robust, with a 29.44% in 2024; although it has fallen from the 2022 peak, it remains around a high level of 30%.

Analysts at research institution Hunter Wolf Research also state that Microsoft's substantial investments in cloud computing and artificial intelligence are helping it seize market growth opportunities and consolidate its position as a dominant force in AI. The firm remains optimistic about Microsoft maintaining double-digit revenue and profit growth, giving it a "strong buy" rating with a one-year target price of $550 per share.

According to moomoo statistics, the comprehensive rating for Microsoft from major Wall Street firms over the past three months is "strongly recommended," with an average target price of $502.51, which still represents a 16% upside from its most recent closing price.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

joemamaa : cool