Earnings Volatility | As Earnings Season Revs Into High Gear, Options Markets Brace for Volatility

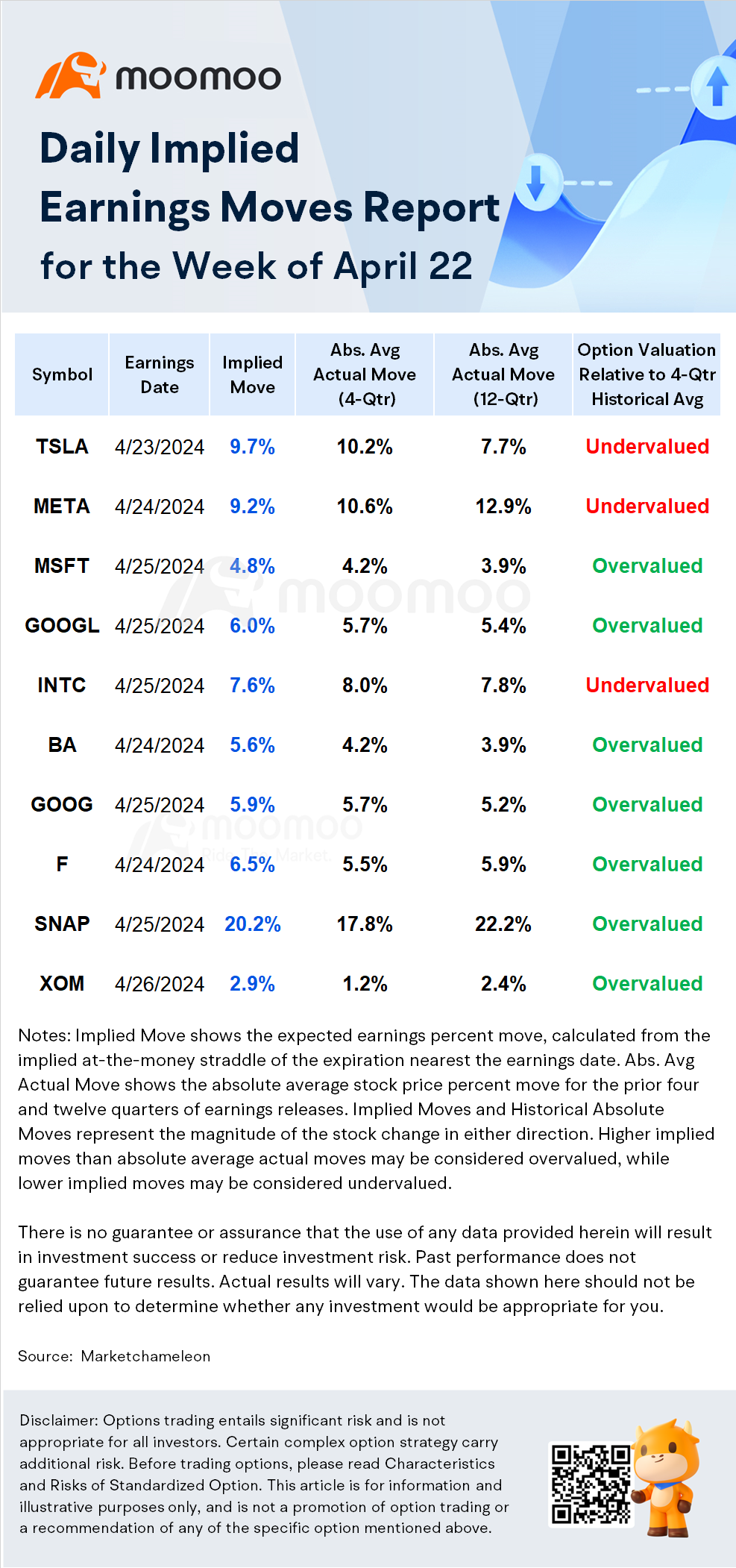

Stock prices may see larger-than-normal moves during earnings season, making it a potentially attractive time for options traders. For investors looking to trade against these moves, you should always keep track of how the options might shift after their earnings. Here are the top earnings and volatility for the week:

-Earnings Date: 4/23 After the bell

-Earnings Normalized Estimate: USD $36.199 billion, an increase of 26.37% YoY; EPS $4.32, up 96.32% YoY

Earnings Catalyst

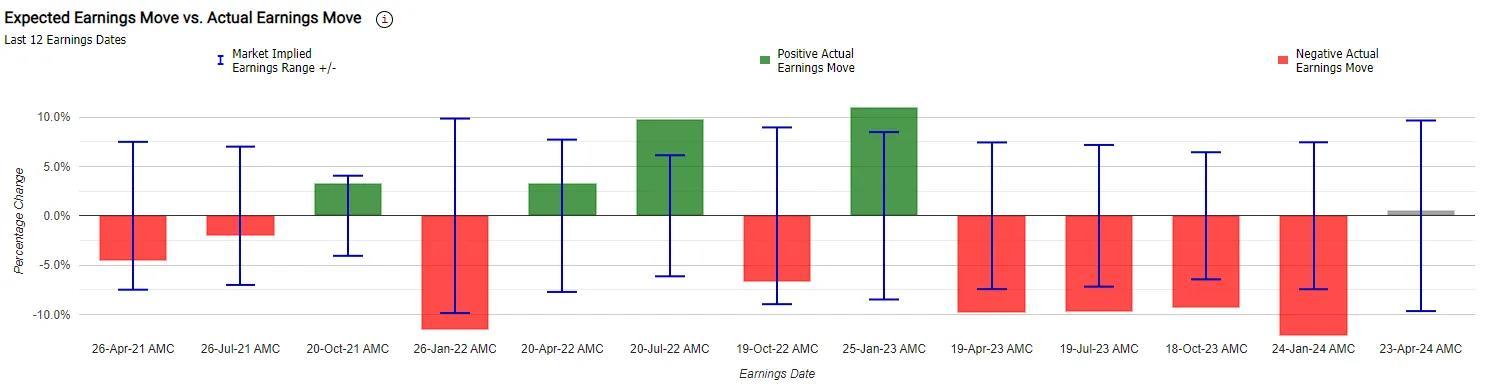

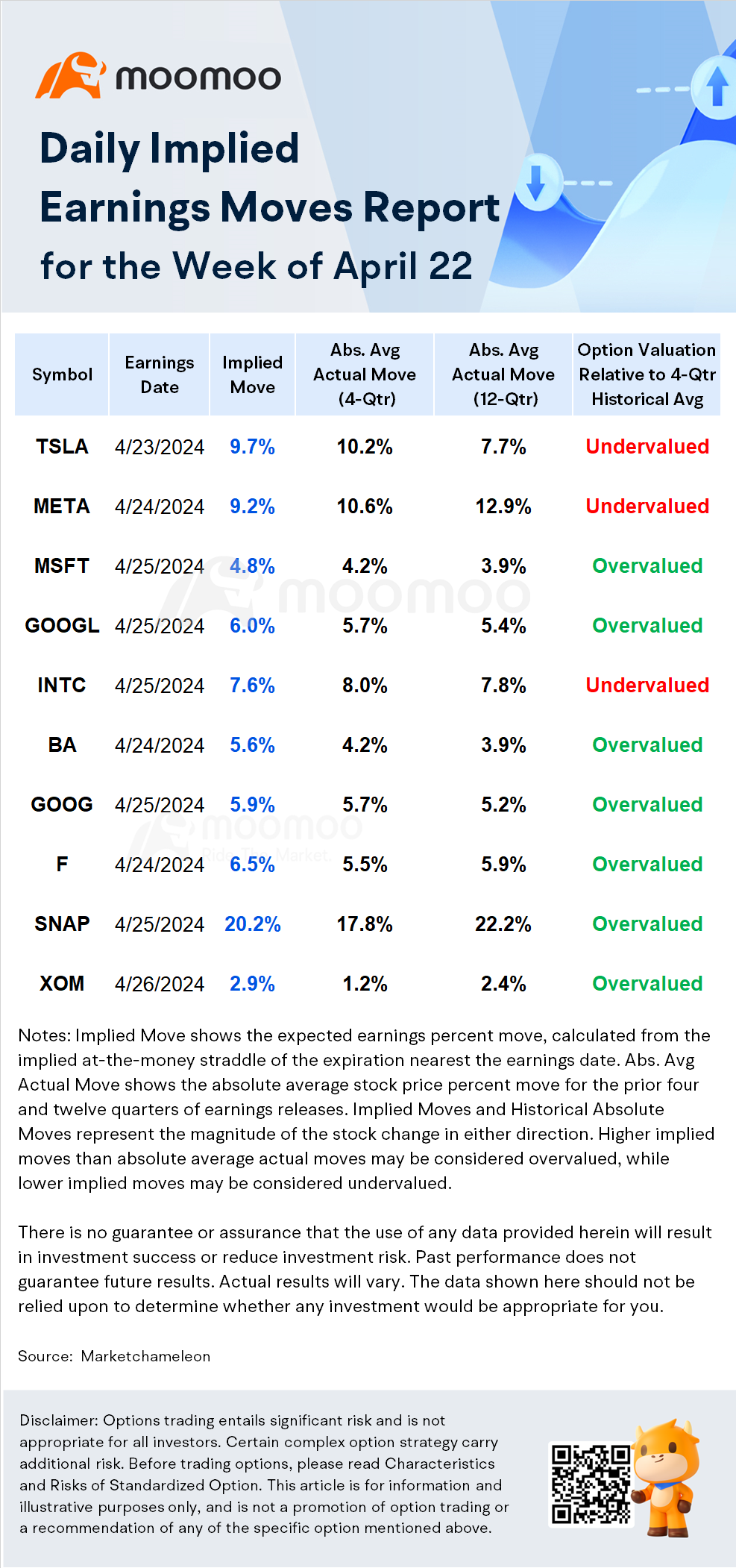

According to the options market, Tesla is currently facing an implied move of ±9.7%, suggesting that options traders are betting on a post-earnings one-day price swing of up to 9.7%. This points to a slight undervaluation of options prices. Historical analysis shows that in the past 12 earnings releases, Tesla's stock more frequently experienced declines post-earnings, with the last four quarters showing declines of -9.8%, -9.7%, -9.3%, and -12.1%, respectively.

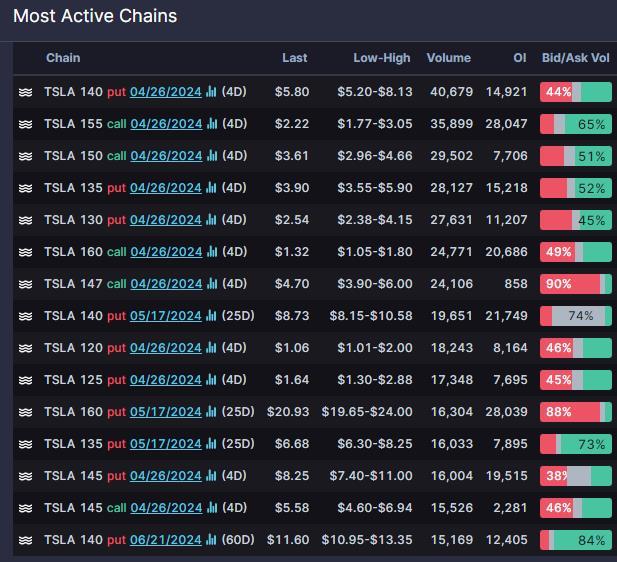

For Tesla, the options market is painting a picture of investor caution; puts expiring this week are marked by higher implied volatility, reflecting a bearish sentiment as evidenced by the volatility skew. Amidst this wary outlook, there's noteworthy activity on Tesla's options chain: puts at the $140 strike price and calls at strike prices of $155 and $150 expiring this Friday are seeing a surge in trading volume, signaling a mix of hedging and speculative plays as traders position themselves ahead of the earnings announcement.

Tesla's stock has fallen over 40% since the beginning of the year, impacted by Q1 deliveries that are vastly missing expectations and layoffs. Earlier this month, Tesla announced Q1 deliveries of 386,800 vehicles worldwide, significantly below forecasts and marking the first quarter-over-quarter decline since 2020.

Investors will be looking to hear from Elon Musk during the earnings call for reasons behind cost-cutting measures, future strategies, product roadmaps, and overall vision to weather the potential storm of weakening global demand in 2024, as per Dan Ives, an analyst at Wedbush.

-Earnings Date: 4/24 After the bell

-Earnings Normalized Estimate: USD $36.199 billion, an increase of 26.37% YoY; EPS $4.32, up 96.32% YoY

Earnings Catalyst

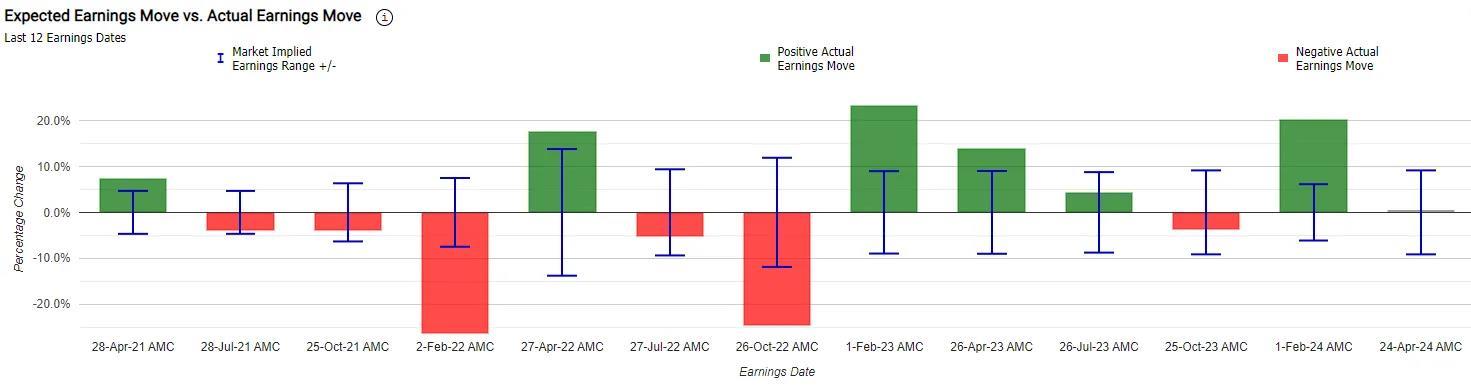

Meta's implied move stands at ±9.2%, which is smaller compared to historical post-earnings stock price movements, suggesting a slight undervaluation in option pricing. The stock's average move after earnings over the past 12 reports has been close to ±13%. Since 2023, Meta has consistently performed well on earnings days, with the stock rising over 20% following annual reports in both 2023 and 2024, with one exception on Oct 25, 2023.

Analysts are focusing on Meta's strong advertising revenue growth. CFRA analysts expect the Q1 earnings report to show a 26% increase in advertising revenue, "potentially peaking the growth rate."

With a user base of 3 billion, Meta is integrating generative AI extensively into its global advertising business, offering a new AI-driven ad delivery model to its users, contributing to the stock's recent all-time highs. Year-to-date, Meta's stock has risen by 36%, with Wall Street's average target price of $553.7, indicating a potential upside of 15%.

-Earnings Date: 4/25 After the bell

-Earnings Normalized Estimate: USD $60.857 billion, up 15.14% YoY; EPS $2.83, a 15.43% increase YoY

Earnings Catalyst

Microsoft's options data is implying a move of ±4.8%, slightly above the average move of ±3.9% over the past 12 quarters. Historical earnings day performance indicates an almost equal probability of post-earnings moves up or down, with a maximum gain of 7.2% (Q2 2023) and a maximum loss of -7.7% (Q3 2022).

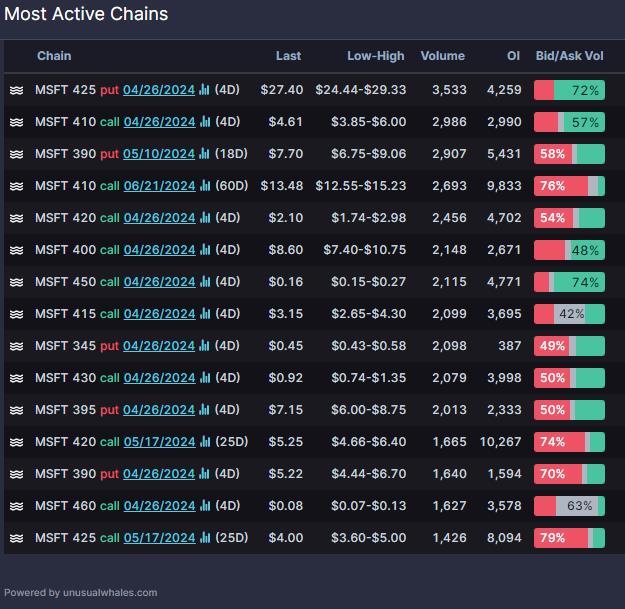

Market sentiment appears to be leaning bearish on Microsoft, according to volatility skew. The most actively traded options are $425, $390 put, and $410 calls expiring this Friday.

Don't Get Crushed by Earnings. Here are things you should know before considering a trade.

Knowing the IV Crush

Before significant corporate events such as earnings announcements, product launches, or clinical trial results, implied volatility tends to increase. However, after the news has been released, the implied volatility can drop significantly due to the sudden clarity in the market and the stock price reaction to the news. This phenomenon is referred to as IV crush.

IV Crush And Option PricesIV crush can lead to a decrease in option prices because the Implied volatility is lowered dramatically. This decrease in option prices due to IV crush can be a risk for options traders who have purchased options at a higher price with the expectation of making a profit from a significant move in the underlying stock price. Conversely, IV crush may not be as prevalent if the option is undervalued and the stock price moves drastically, which can pose a risk for option sellers. It's important for traders to be aware of IV crush and factor it into their trading strategy when considering options trades around significant corporate events.

Not all options are affected equally by an IV crush. IV crush affects short-term option prices more than long-term option prices.

Nonetheless, it's important to note that trading options always involve risks, and investors should consult with a financial advisor before making any trades.

Source: Dow Jones, Market Chameleon, Bloomberg

Disclaimer:

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The data and information provided has been obtained from sources considered to be reliable, but Moomoo Financial and its affiliates do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

FearGreed : Bounce week, Meta to save the market.

73391169 : help me with a robotic