NVDA

NVIDIA

-- 131.760 TSLA

Tesla

-- 396.360 RGTI

Rigetti Computing

-- 8.9500 AMD

Advanced Micro Devices

-- 116.090 PLTR

Palantir

-- 65.910

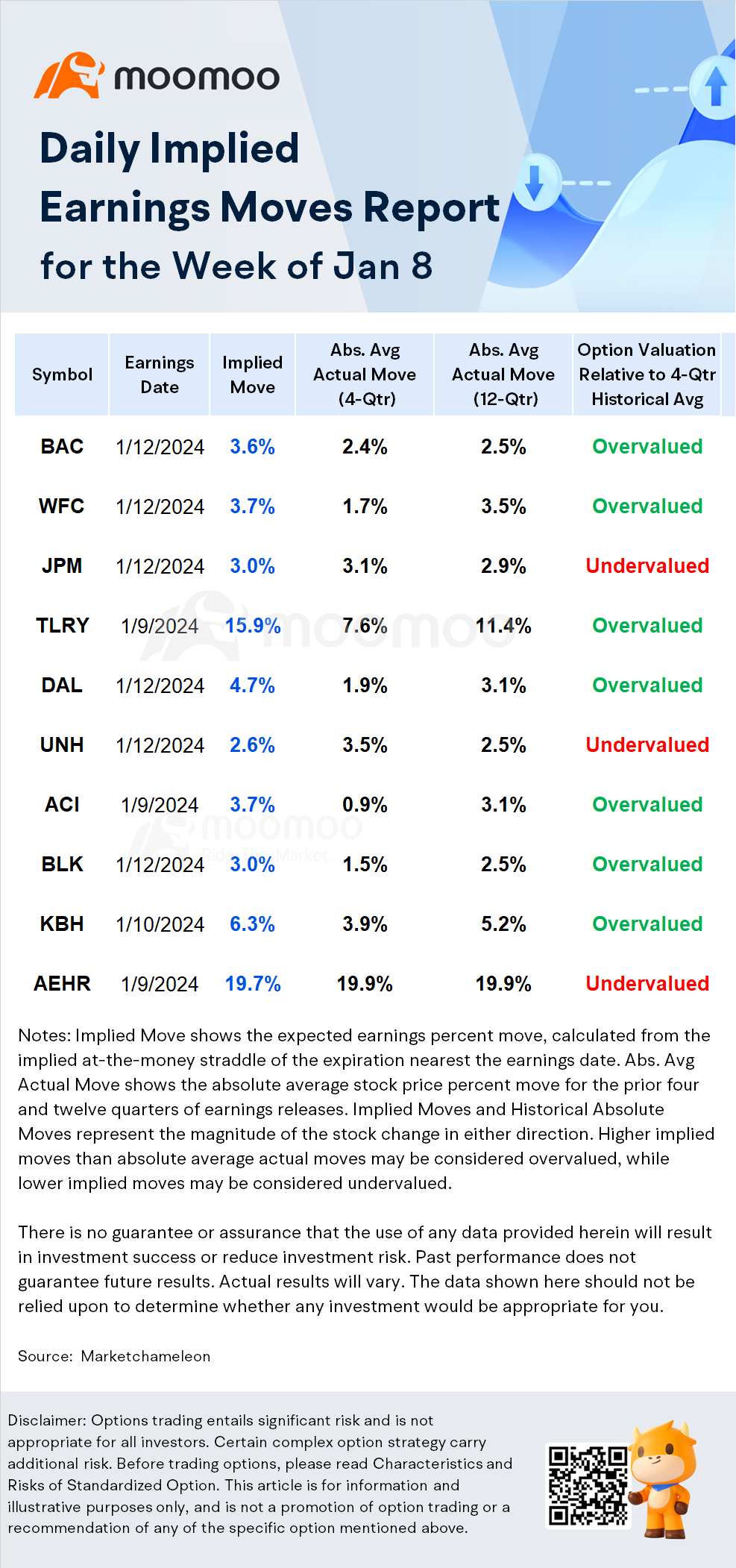

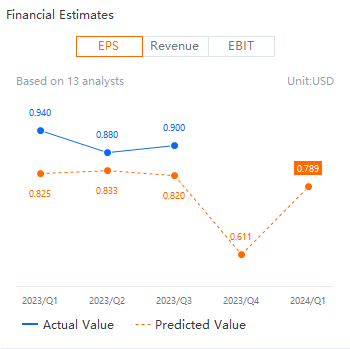

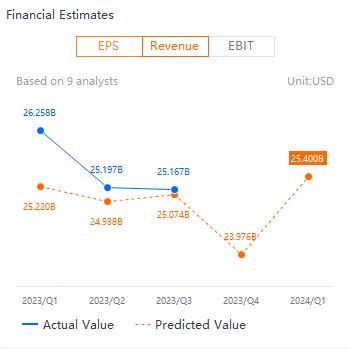

For Bank of America, the biggest questions remain its exposure to underwater bonds purchased when interest rates were low. A related question is what to expect from net interest income and expenses this year," CNBC banks reporter Hugh Son says.

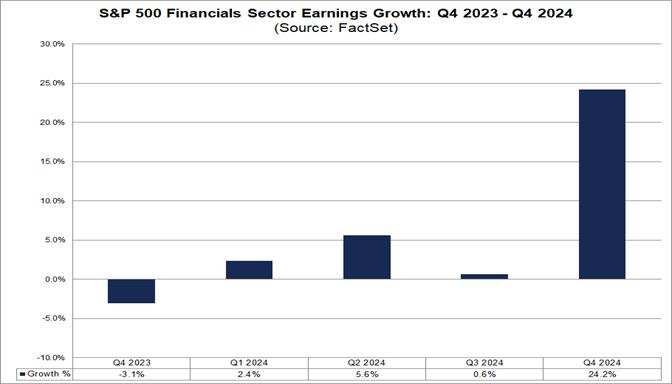

It seems the big banks are feeling the squeeze on net interest income, it is having a negative effect on revenues and forward guidance in this group," said Brian Mulberry, client portfolio manager at Zacks Investment Management. "Lack of loan demand, lack of M&A activity and very little IPO business is hurting the more profitable activities of the larger banks in addition to paying out 5% to money market depositors."

FearGreed : Nice summary!

HendrixG :