Earnings Volatility | Red-Hot Nvidia Options Activity to Watch Ahead of Earnings Release

Implied volatility often spikes before a company releases its earnings, as market uncertainty drives up demand for options from speculators and hedgers. This heightened demand inflates both the implied volatility and the price of the options. Following the earnings announcement, implied volatility generally returns to normal levels.

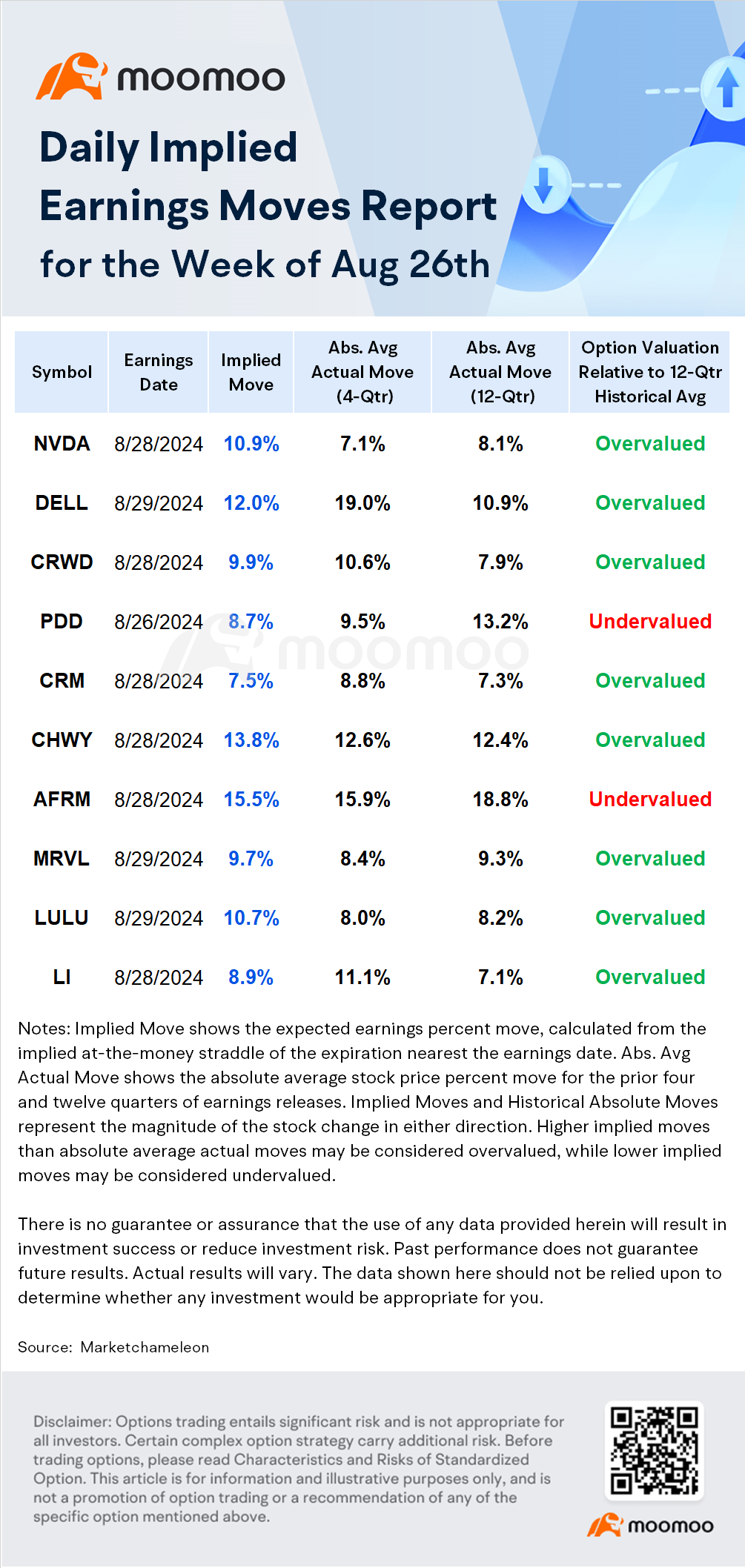

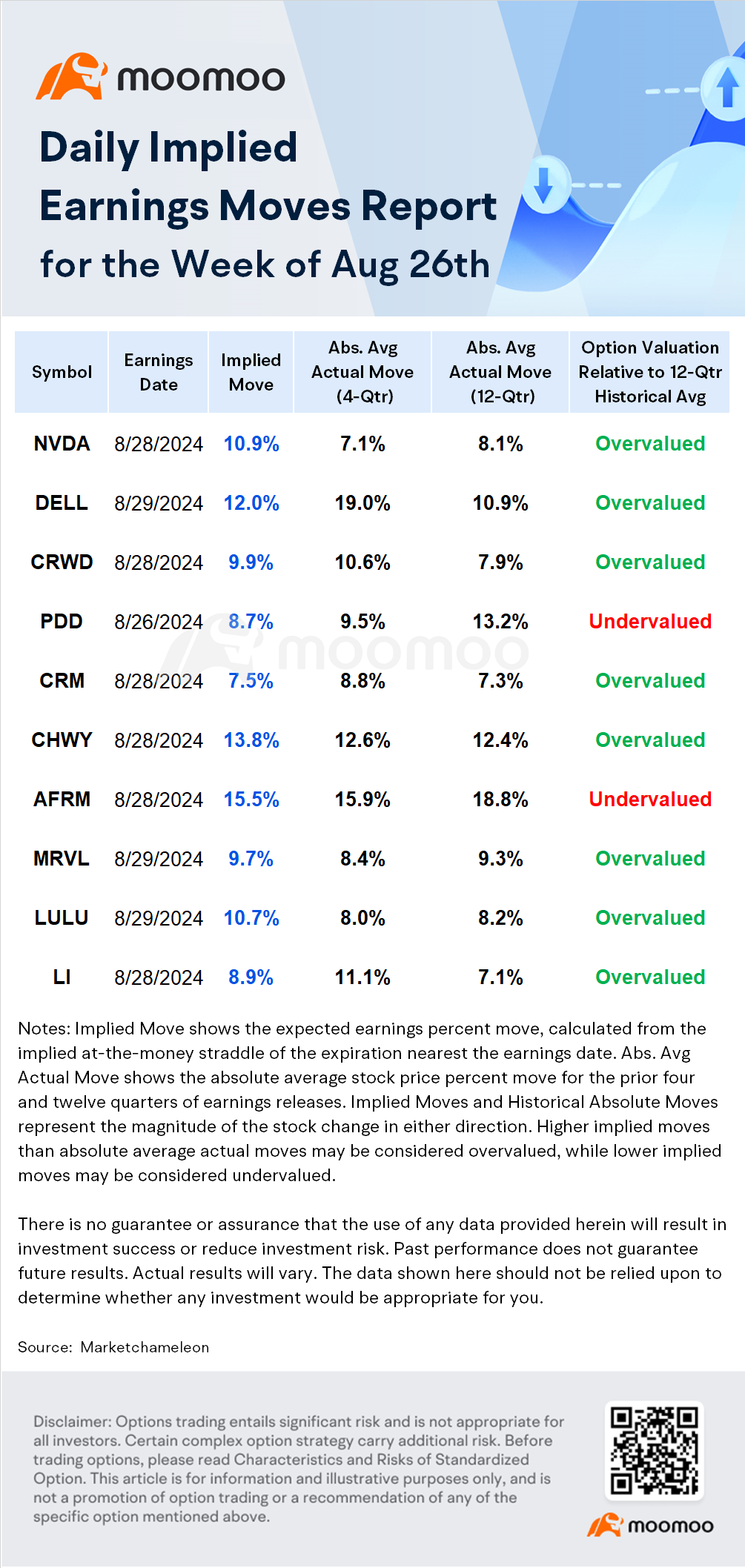

Here are the top earnings and volatility for the week:

-Earnings Release Date: August 28, 2024 AMC

-Earnings Forecast:

Over the past 12 quarters, the options market has been notably off-target when estimating the earnings-related price swings for NVDA stock, misconstruing the expected volatility 58% of the time. While the options market projected an average earnings move of ±7.8%, the actual price action was slightly more pronounced, with an average move of ±8.1% following earnings releases. This discrepancy indicates that NVDA shares have consistently demonstrated slightly higher volatility in response to earnings than predicted by options traders.

In the lead-up to NVDA's earnings announcements, the average anticipated move sat at ±7.2%, closely aligning with the actual average move of ±7.3%, a marginal difference of just 0.1%. Upon market opening post-earnings, NVDA stocks experienced an average gap of ±6.0%, with subsequent intraday drifts averaging around ±2.8%. Historical data also reveal extreme swings during regular trading hours post-earnings, with the largest surge reaching +31.0% and the deepest plunge hitting -20.1%. Options strategies like the straddle have yielded an average one-day return of +0.3%. Despite a general downward trend in NVDA's stock price before earnings reports—with declines in the one-week, three-day, two-day, and one-day periods—the fortnight preceding earnings has typically seen an average climb of 3.9%. Post-earnings performance has been more optimistic, with NVDA shares advancing after 9 of the last 12 earnings announcements, averaging a notable first-day post-earnings gain of 6.2%.

In the options market, a phenomenon known as "skew" refers to the pricing disparity between bullish and bearish options. This disparity arises when there is a difference in demand, leading to a situation where one side of the bet may be priced higher than its opposite, even if other parameters such as strike price and expiration are the same.

Susquehanna analyst Christopher Jacobson observed this skew in Nvidia's options, noting a tendency towards optimism. According to his analysis, the market had priced in an 8% probability of Nvidia's stock plummeting by 19% or more following the earnings report. In contrast, the likelihood of a significant rally of at least 19% was perceived to be higher, with options reflecting an 11% chance of such an event. This skew towards the upside suggests that traders might be leaning more towards a bullish scenario for Nvidia post-earnings.

Last Friday witnessed a significant uptick in options market activity, with the greatest surge in open interest concentrated on the 65, 60, and 70 strike puts, as well as the 150 strike calls—all set to expire this upcoming Friday, following Nvidia's earnings release. Although the probability of Nvidia's share price dropping to these levels within such a short timeframe remains slim, the heightened interest in these options suggests a growing appetite for hedging strategies among traders, indicating a cautious stance in anticipation of the earnings announcement.

-Earnings Release Date: August 29, 2024 AMC

-Earnings Forecast:

In the latest quarter, the options market's forecast for DELL's post-earnings price movement was a swing of ±12.5%, but the actual result was a sharper decline of -17.9%. When reviewing the past 13 quarters, it appears that the options market has underestimated the volatility of DELL's earnings reactions 46% of the time. The average projected move was ±8.1%, yet the real price shifts averaged a more substantial 10.2% in absolute terms, underscoring the tendency for DELL's stock to exhibit greater volatility around earnings than what options traders anticipated.

In the run-up to DELL's earnings announcements, the consensus among options traders was an average expected earnings move of ±8.9%. However, the actual average move came in slightly lower at ±8.2%, which is 0.7% less than anticipated. The initial market reaction, or opening gap, typically saw an average move of ±6.5%, with subsequent intraday trading showing a further average movement of ±2.2%. Notably, during regular trading hours following the earnings release, DELL shares have experienced significant swings, with the most substantial rise reaching +38.5% and the deepest drop being -22.9%. For those employing options straddles, the average one-day return was a notable +17.9%, reflecting the heightened volatility and the potential for gains from such strategies in response to DELL's earnings outcomes.

-Earnings Release Date: August 28, 2024 AMC

-Earnings Forecast:

In anticipation of CRWD's earnings reports, options traders predicted an average earnings move of ±10.3%. However, the actual price movement post-earnings release has been consistently more muted, averaging ±8.7%, which falls short of expectations by 1.6%. The immediate reaction at market opening, known as the opening gap, averaged ±8.1%, followed by an average intraday stock drift of ±3.8%.

Historically, in the trading sessions following the earnings announcements, CRWD experienced its most significant upward price swing of +24.5%, while the largest decline recorded was -21.1%. Options strategies based on straddles, which profit from significant stock movements regardless of direction, have not been particularly successful, with an average one-day return of -11.4%.

Analyzing the past 12 quarters, the options market has tended to overestimate the volatility of CRWD's earnings response 58% of the time. While the average expected post-earnings price fluctuation was ±9.8%, the actual movements averaged only 7.9% in absolute terms. This consistent overestimation by the options market highlights a pattern where CRWD's stock volatility in response to earnings has been less dramatic than traders have predicted.

$Microsoft (MSFT.US)$ announced last Friday its plans to convene a cybersecurity summit on September 10, bringing together various industry players, including CrowdStrike. The focus of the meeting will be to devise strategies to bolster the security and resilience of systems for their mutual clientele.

This collaborative effort gains particular relevance in the wake of last month's CrowdStrike service disruption, highlighting the urgency of a united approach to cybersecurity. Aidan Marcuss, Microsoft's Vice President of Windows and Devices, emphasized in a recent blog post the importance of the summit in fostering cooperation. The goal is to identify actionable measures that can enhance the overall security posture and robustness of customer systems, as well as to establish best practices for safe software deployment. This development is expected to exert considerable pressure on CrowdStrike's financial performance in the current quarter. In light of this, investors are advised to exercise heightened vigilance, particularly with regard to the potential disclosure of further unfavorable news that could impact the company's earnings.

Source: Bloomberg, Market Chameleon, FactSet, Dow Jones

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103815185 : Everything I do is wrong.

102188459 : Thank you

103539497 : hi

54088 FROM RWS : wow

104327919HO : ok