EBITDA rests on 3 key metrics

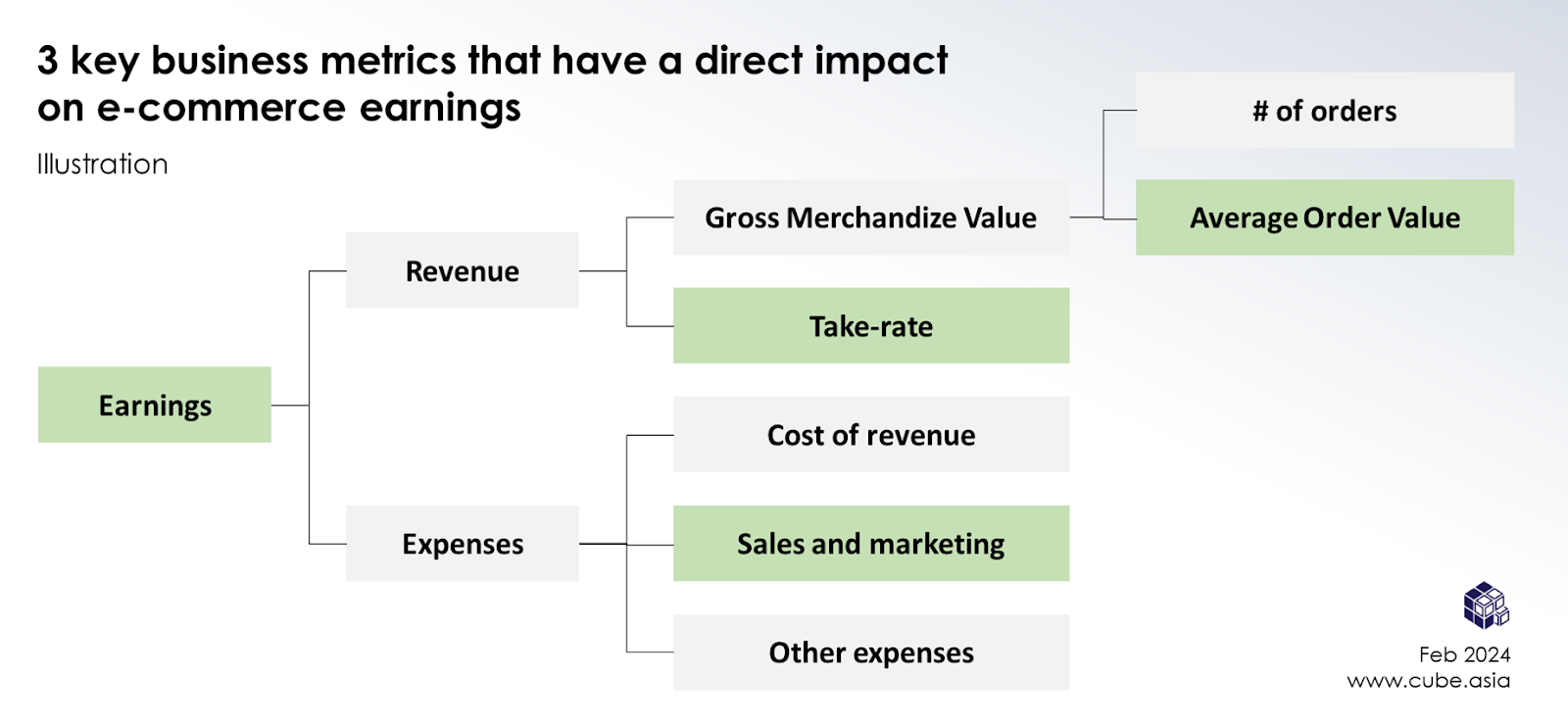

E-commerce is a complex business and there are many interdependent factors that can impact earnings.

There are however three metrics that we have found worthwhile to watch when the latest earnings report comes out:

Average Order Value = reported GMV / reported # of transactions,

3P Take rate = reported 3P revenues / reported 3P GMV, and

Sales and marketing spend % = reported sales and marketing expense / reported GMV

We have selected these metrics for a deeper dive because they have a direct impact on the earnings (as shown in the chart below) and are directly influenced by internal strategic decisions that Shopee can make, as opposed to being more dependent on external market conditions.

There are however three metrics that we have found worthwhile to watch when the latest earnings report comes out:

Average Order Value = reported GMV / reported # of transactions,

3P Take rate = reported 3P revenues / reported 3P GMV, and

Sales and marketing spend % = reported sales and marketing expense / reported GMV

We have selected these metrics for a deeper dive because they have a direct impact on the earnings (as shown in the chart below) and are directly influenced by internal strategic decisions that Shopee can make, as opposed to being more dependent on external market conditions.

Average Order Value (AOV)

AOV serves as a crucial metric of consumer spending within each transaction or basket, especially for multi-category e-commerce like Shopee. It is calculated as the total sales figure for a given period divided by the number of orders in the same period.

The chart on the next page plots Shopee’s AOV and EBITDA profitability per order by quarter going back to 2019.

One immediate takeaway is that Shopee’s AOV has been declining steadily over time. This trend briefly paused in the early days of the COVID pandemic in Q1 2020, as changes in e-commerce activity led to more bulk purchases. However, the AOV quickly returned to its declining pattern after this unique moment.

Another significant period occurred between Q4 2022 and Q2 2023 when the company made several moves to optimize profitability and reached EBITDA profitability in three consecutive quarters with AOVs of more than $10, but both AOV and EBITDA have come back down since then.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Tesla 1st : Looking forward to the next level of earnings, $62