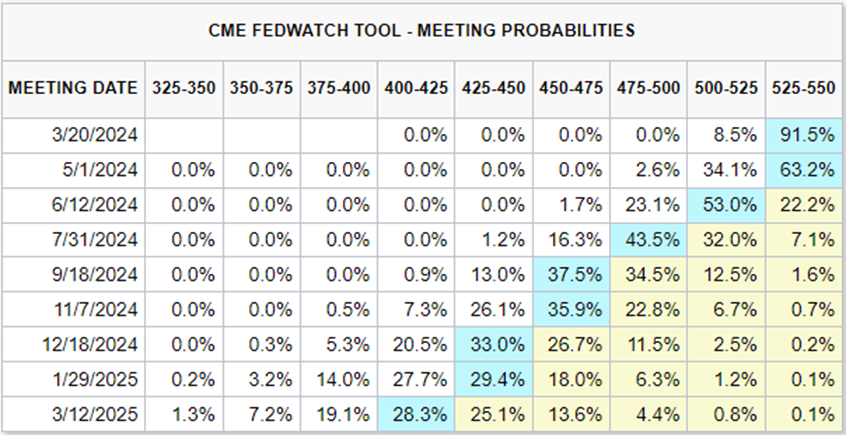

Jawad Mian, the founder of Stray Reflections, a macro consultancy firm that works with global hedge funds and portfolio managers, pointed out in a report that it is worth remembering that during the 2008-2009 period, to combat the economic recession, the Federal Reserve lowered the federal funds rate to near-zero levels. However, while the market was early to anticipate the Fed to start hiking rates, this ultra-low interest rate environment persisted for a lengthy period, with the Fed not beginning to raise rates until December 2015.

potsy52 : CD gww saw a ww

Mitotek Jr : Good information

Erica Houston : thank you

70652726 : thank you

102556055 70652726 : y

Aurora in Helsinki : It is good information. Thanks-