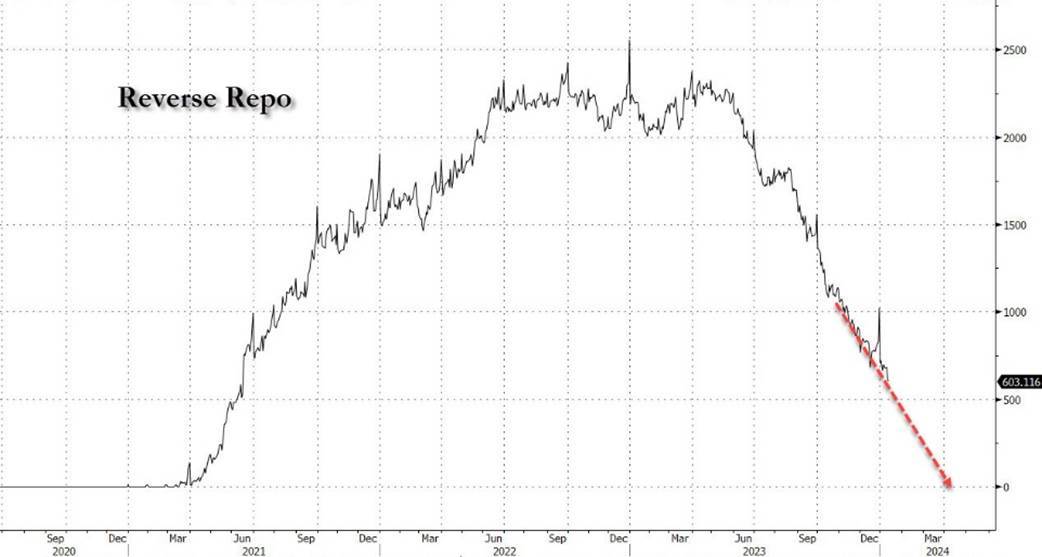

Recently, Nick Timiraos, as Powell's favorite media mouthpiece, confirmed that QT's days are now numbered, writing that "Fed officials are to start deliberations on slowing, though not ending, that so-called quantitative tightening as soon as their policy meeting this month. It could have important implications for financial markets."

Mr 1111 : Good

nice Lemur_8480 : 1. Will the move to slow down or bring down QT will affect Malaysian economic growth?

2. If yes to 1, what will be the affects and the severity?

3. What are the opportunities for investors or traders if QT is ended?

Let’s get some learning points from Moomoo on this subject and current situation.

funny Hamster_8432 : Too bad they’re adding one trillion per month