Energy, Weapons, and Oil Climb on Warned Iran Strikes, While Strikes Hit Transportation | Moovin Stonks

Good morning, traders. Happy Tuesday, October 1, the first day of the fourth quarter. The market is falling after breaking news from that Iran is preparing to attack Isreal. Risk assets climbed: silver and gold climbed 1% and Oil futures jumped 3%.

Right after 9:40 am, U.S. White House officials released a statement that Iran was preparing to hit Israel with Ballistic missiles.

My name is Kevin Travers; here stonks and stories mooving the U.S. stock market today.

$Northrop Grumman (NOC.US)$, $Lockheed Martin (LMT.US)$, and $RTX Corp (RTX.US)$ climbed alongside other defense stocks on the news of an imminent attack.

$ZIM Integrated Shipping (ZIM.US)$ and other shipping stocks fell after the Longshoremen union declared a strike Monday night. They want a 60-70% increase in wages. "This is going down in history what we're doing here," Harold Daggett, head of the union told reporters Monday night.

Speaking of strikes, $Boeing (BA.US)$ fell 2.6% early Tuesday, after a Bloomberg report that the aerospace giant is considering raising at least $10 billion by issuing new shares, as it works to bolster cash reserves that have been depleted by a strike.

Shares of $United Natural Foods (UNFI.US)$ jumped 25% after the company unexpectedly turned a small adjusted quarterly profit as volume trends improved. The grocery wholesaler said before the bell that sales were up 10% at $8.16 billion in the quarter ended Aug. 3, topping analyst projections for $7.94 billion.

$Charles Schwab (SCHW.US)$ said Tuesday that Chief Executive Walt Bettinger has notified the company about his decision to retire, effective Dec. 31. The company has named President Rick Wurster as Bettinger's successor in the CEO role, effective Jan. 1.

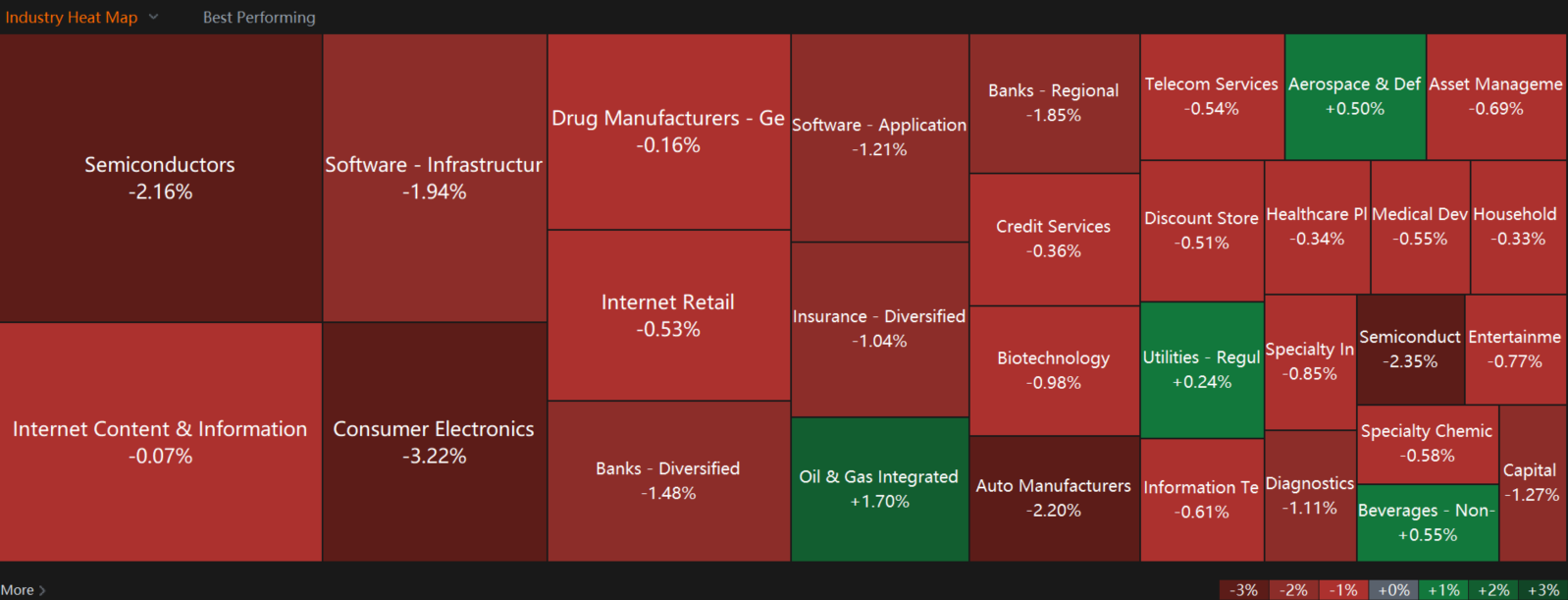

Within industries tracked by moomoo, energy stocks and defense were leading while Semiconductors and tech fell. $NVIDIA (NVDA.US)$ fell 3%, $Tesla (TSLA.US)$ fell 4.7% one day before its delivaries release.

$Crude Oil Futures(FEB5) (CLmain.US)$ climbed 3%, $Bitcoin (BTC.CC)$ hovered $62k, Gold and silver climbed. $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$ and the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ fell.

Just past 10:45 am ET the market was falling while the VIX volitlity index jumped 20%. The $S&P 500 Index (.SPX.US)$ fell 1%, the $Dow Jones Industrial Average (.DJI.US)$ fell 0.53%, and the $Nasdaq Composite Index (.IXIC.US)$ fell 1.66%.

In macro, US JOLTs Job Openings came in at 8M for August, compared to estimates of 7.6M.

ISM PMI for September came in lower than forecast, at the same level of last month. With a number below 50, it shows manufacturers spent less than previously on input costs, which can be bad for growth but good for a decrease in inflation.

Interested in Options? To see these stocks and more on the options page, click here. Want to learn more about options, check out moomoo education with this link. Click here to join our exclusive options chat with personal callouts from our resident expert, Invest with Sarge.

Yesterday, one user said that economic data should be good before an election and that it can be modified to a more accurate recording after an election.

Traders, what do you think, is the market in 2024 about following the herd? What you watching on the stock market today? What is the herd following? Let me know in the comments below!

Disclaimer: This content is for informational use only and is not a recommendation or endorsement of any particular investment or strategy. Indexes are unmanaged and cannot be directly invested into. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors' financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances, before making any investment decisions. Past performance does not indicate or guarantee future success. Moomoo makes no representation or warranty as to its adequacy, or timeliness for any particular purpose of the above content. The data and information provided has been obtained from sources considered to be reliable, but moomoo does not guarantee that the foregoing material is accurate or complete. See the link in the Moovers Community post for more information.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

kyneo :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

BelleWeather : Madness, whee!

溫馨提示 : How about gold

Clement Lemons : okk

101550592 :

Kevin Travers OP 溫馨提示 : Hahah got it

EZ_money : gold did too the real king

the real king  followed by real currency.... silver

followed by real currency.... silver

Alen Kok : Good

liquidgold : Anyone tracking Uranium?

Kevin Travers OP liquidgold : The moomoo industry list is up about 2.33% $Uranium (LIST2430.US)$

View more comments...