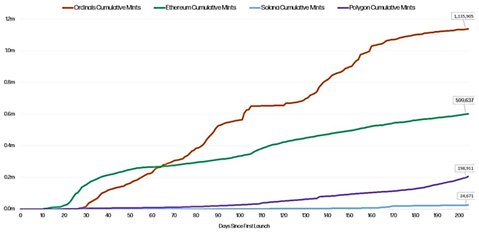

2. The rise of the Bitcoin ecosystem may be another factor influencing. After its hard fork in 2017, the Bitcoin community remained relatively dormant. Despite advancements like the Lightning Network, it didn't significantly attract market interest. In contrast, Ethereum experienced rapid expansion with the surges in DeFi, NFTs, public blockchains, and layer 2 solutions. By early 2023, with the spike in usage of Ordinals—a method for embedding digital content, such as images and videos, on the Bitcoin blockchain—many new and existing protocols began to increase on Bitcoin, fueling strong development in its ecosystem.

EZ_money : not going to help a i. bot

104457743 : Very insightful