Everything You Need to Know About Dividend Investing!

I've received a lot of questions about dividend investing from mooers, including how dividends work, how to invest, and how to check returns. So, I've put together an article "Everything You Need to Know About Dividend Investing" based on past answers to help everyone better understand dividend investing.![]()

As we all know, companies can earn profits through two methods: one is value brought by stock price growth, and the other is dividends paid out to shareholders from company earnings. To gain value from stock price growth![]() , we need the ability to identify potential growth factors involving evaluating things such as:

, we need the ability to identify potential growth factors involving evaluating things such as:

❶ The company's qualifications, operational strength, and potential for growth

❷ Whether the industry and macro environment benefit the company's development

❸ Managing our portfolio positions, predicting buying and selling points, and considering short-term market movements, among others.

❷ Whether the industry and macro environment benefit the company's development

❸ Managing our portfolio positions, predicting buying and selling points, and considering short-term market movements, among others.

On the other hand, gaining returns from dividends is relatively simple. We just need to screen for companies with stable operations and sustainable dividend payouts. Of course, while other factors should also be considered, stable operations and sustainable dividends are comparatively more important. High dividend companies often represent a stable and substantial source of profits, which can partially offset risks associated with fluctuations in stock prices.

Furthermore, these two methods are not mutually exclusive, investors can adjust their portfolios according to current market environments, diversifying their investments to possess the ability to resist risks and achieve returns.

So, how does one go about high dividend investing, and how can it be done on moomoo? We'll break it down into two parts for explanation.

Part 1: How to Invest in High Dividend Stocks

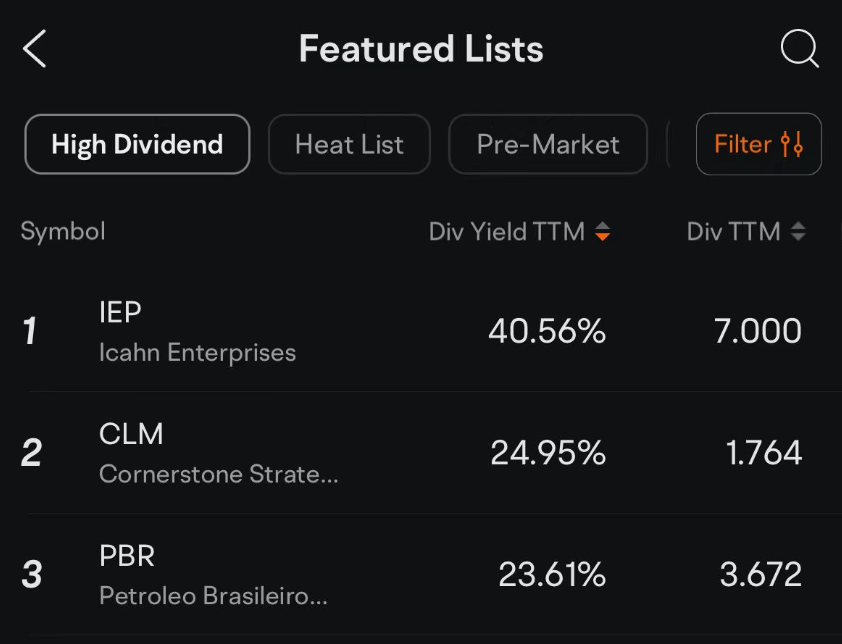

Some investors may directly buy from moomoo's high dividend ranking list. Is this a wise choice?

The answer is definitely not recommended. The reason is that only considering high dividends ignores the stability of the company's operations, leading to potential decent dividend returns but also a significant drop in stock prices.

For example, IEP, the highest dividend-paying company in the US stock market for the past 12 months, paid out 40.56% in dividends only to experience a 58.61% drop in stock price this year. Therefore, this investment is not worth it.

There are actually two common strategies for investing in high dividend stocks, which are the "Dog of Dow " and "Dividend Aristocrats".

Dogs of the Dow: Discover High Dividend Blue Chip Stocks. The Dogs of the Dow, introduced by money manager and author Michael B. O'Higgins in 1991, is a stock-picking strategy that selects the top ten highest dividend-yielding stocks from the $Dow Jones Industrial Average (.DJI.US)$ annually.

While the market experienced a downturn in 2022, the Dogs of the Dow portfolio performed well, rising by 2.2% including dividends. In contrast, the Dow Jones Industrial Average fell by 8.8%, while the S&P 500 and Nasdaq plummeted even further.

The other strategy is The Dividend Aristocrats, similar to Dogs of the Dow, Dividend Aristocrats is an index designed to measure the performance of $S&P 500 Index (.SPX.US)$ companies that have increased dividend payments every year for the last 25 consecutive years.

The index was launched in 2005 and there is a total of 68 stocks included in this index in 2023. There are strict screening criteria:

• The company must be a member of the S&P 500 Index.

• Constituents must have increased dividend payments every year for at least 25 consecutive years.

• Market capitalization must exceed USD$3 billion.

• The average daily trading volume over the past 3 months should be at least USD$5 million.

• Constituents must have increased dividend payments every year for at least 25 consecutive years.

• Market capitalization must exceed USD$3 billion.

• The average daily trading volume over the past 3 months should be at least USD$5 million.

It is relatively rare to see a company that not only pays dividends consistently but continuously increases the size of its payouts to shareholders.

The logic behind these strategies is to select companies with higher dividends from blue-chip stocks (old-established companies with mature businesses and stable operational performance).

This mindset can be applied in different markets. For instance, in Malaysia, we can screen among the top 30 companies on $FTSE Bursa Malaysia KLCI Index (.KLSE.MY)$, while in Singapore, we can track the top 30 companies on $FTSE Singapore Straits Time Index (.STI.SG)$.

Part 2: How to Receive Dividends

There are generally 4 dates to pay attention to when it comes to dividend distribution for ordinary dividends ( special dividends may refer to the company's announcement):

➊ Announcement date: announces when dividends will be distributed and what's the amount.

❷ Ex-dividend date: deducts dividends from stock prices. If investors hold stocks on this day, they can receive dividends.

❸ Record date: records the investor's holding information. Only registered holders can receive dividends. Since stock settlement takes T+2 days, the record date is typically two days after the ex-dividend date.

❹ Payment date: distributes dividends.

Investors need to buy stocks before the ex-dividend date, which means that they need to hold stocks before opening on that day (after-hours trading on the previous day or pre-market trading on the current day will also count towards the ex-dividend date). Therefore, it is necessary to ensure that stocks are held one day before the ex-dividend date.

The payment date is when dividends are distributed. In moomoo, it usually takes one trading day to arrive in the account.

Dividends are usually paid in cash and can be viewed by filtering Company Action in the Funds Details.

Alternatively, dividends may be paid in the form of stocks, such as for every 10 shares held, shareholders may receive 1 share. If the company the investor has invested in holds shares in other companies, the shareholder may also receive these shares. After distribution, it will be displayed in the shareholder's holdings.

Updating…

Feel free to ask questions about dividend investing you've encountered in the comments section, and cici will keep updating it in this post!![]()

![]()

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

KellyNg9 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) thanks for sharing

thanks for sharing

SpyderCall : good stuff

103414029 : Have confidence in everything you say!

snoopy123 : thanks Cici, i have a friend who vowed never to opt for "scrip dividends" coz this may likely lead to "odd lots" but when you think of it, scrip dividends do give you the benefit of "compounding" your returns (vs. taking cash dividends) and they may sometimes even offer a discount for the issue price of new shares. any thoughts to share?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

snoopy123 : [SG] btw, for CDP there is a possibility for shareholders to opt for partial scrip dividends (i.e. receive some dividends in shares and some in cash), thus reducing the "risk" of odd lots but moomoo currently does not provide this option. would it be possible for moomoo to consider this? thank you.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

snoopy123 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) ohh... and the manner by which scrip dividends are credited in the moomoo app also seems somewhat lacking, as the scrip shares were somehow surreptitiously credited into your [positions] without any "trace" whatsoever in the [history]..

ohh... and the manner by which scrip dividends are credited in the moomoo app also seems somewhat lacking, as the scrip shares were somehow surreptitiously credited into your [positions] without any "trace" whatsoever in the [history]..

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

understand that this may be due to the fact that scrip shares were not routed from a normal "trade" (buy/sell) per se but perhaps there could be a better way of tracking our portfolio where scrip shares crediting and P/L calculations are concerned?

alas, all this could also just be a result of my own ignorance and so would appreciate if Cici can kindly help unlock this mystery..

Invest With Cici OP snoopy123 : As I know, if the listed company supports scrip dividend, moomoo SG will send an email notification after confirming the user’s eligibility and you can follow the email guidelines to submit the instructions. Please pay attention to the follow-up news notification.

If certain stocks have been specified as cash or stock dividends only, this means you can not make your choice at will. Moomoo SG will not inform you otherwise.

snoopy123 Invest With Cici OP : yes, what i am saying is, the email from moomoo only offers either full scrip or full cash (default) and does not give "partial scrip/cash" as an option although CDP allow you to state how many shares you want to use for "partial scrip".![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Invest With Cici OP snoopy123 : Ohh got ya, will give feedback to the relevant colleagues to evaluate whether or not to support the different options that exist at the same time.

Invest With Cici OP snoopy123 : Regarding the question of “how to know that the shares have been distributed”, cici just asked the product colleague, and it is expected that the notification of the change of the relevant assets will be added in Q1 next year.