TSLA

Tesla

-- 462.280 NVDA

NVIDIA

-- 140.220 PLTR

Palantir

-- 82.380 MSTR

MicroStrategy

-- 358.180 AMD

Advanced Micro Devices

-- 126.290

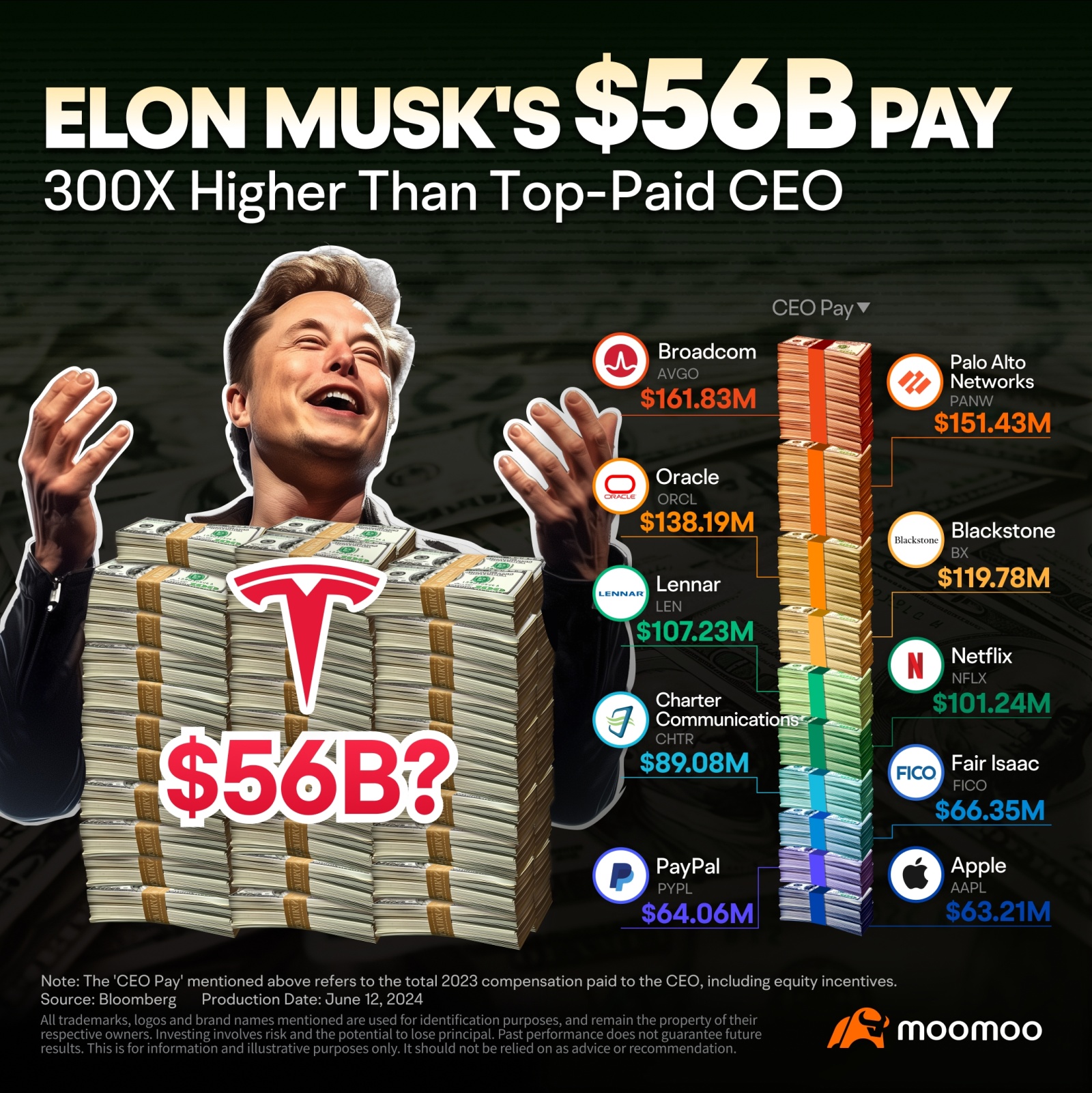

Look, Elon's done an extraordinary job; he's built one of the transformational companies of the age. But to ask for a $55 billion pay increase at precisely the time when you've missed quarterly numbers, growth is slowing down, and you've laid off 15% of the workforce is, I'd say, hubris to say the least."

How can shareholders renege on his pay package AFTER Elon and shareholders already have taken and overcome the risks associated with Tesla's rise to producing the top selling car in the world? Unconscionably!" Wood wrote.

Elon is not a typical executive, and Tesla is not a typical company," Denholm writes in a letter to shareholders filed with the Securities and Exchange Commission. "So, the typical way in which companies compensate key executives is not going to drive results for Tesla. Motivating someone like Elon requires something different."

What we recognized in 2018 and continue to recognize today is that one thing Elon most certainly does not have is unlimited time," Denholm says. "Nor does he face any shortage of ideas and other places he can make an incredible difference in the world. We want those ideas, that energy and that time to be at Tesla, for the benefit of you, our owners. But that requires reciprocal respect."

While Tesla may still be in position to benefit indirectly from AI advancements, we believe that most of the adjacent AI efforts could be concentrated within non-Tesla entities where Elon Musk has control," Jonas added.

Elon is the ultimate 'key man' of key man risk," Baron wrote. "Without his relentless drive and uncompromising standards, there would be no Tesla. Especially considering how he slept on the floor of Tesla's Fremont factory when the company was going through what he called 'production hell!'”

7Ah chialee1 : maybe

mhwtoh : Shame on moomoo Malaysia - can’t facilitate Malaysian investors to vote.

liang 79M : Whatever the outcome, it's a blow to stocks! Leave first if it's high...

chan1993 mhwtoh : Sg moomoo can vote

Guicho liang 79M :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)