Expansion of AI infrastructure investments centered around NVIDIA $NVDA and its impact on the stock market.

Current status and long-term outlook of AI infrastructure investments.

Investment in AI infrastructure is currently a top priority in the technology sector. Eric Swartz (Voya Investment Management) points out, "The construction of AI infrastructure is far from complete, and the growth prospects can be very bright in the coming years." Furthermore, this trend has only "recently emerged from the dugout," and growth in AI hardware stocks is expected in the medium to long term.

According to Needham's report, investment in datacenter infrastructure necessary to support AI generation could eventually reach $6 trillion (approximately ¥870 trillion). This massive investment scale suggests that AI infrastructure construction is a large-scale project that will span a long period.

Expectations for NVIDIA $NVDA's earnings and stock price trends.

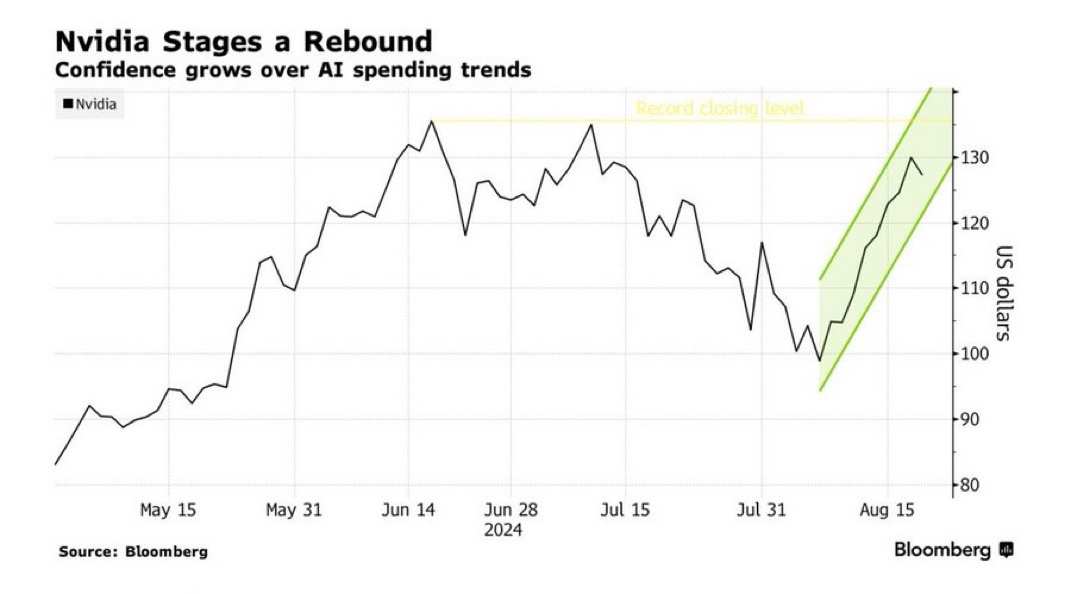

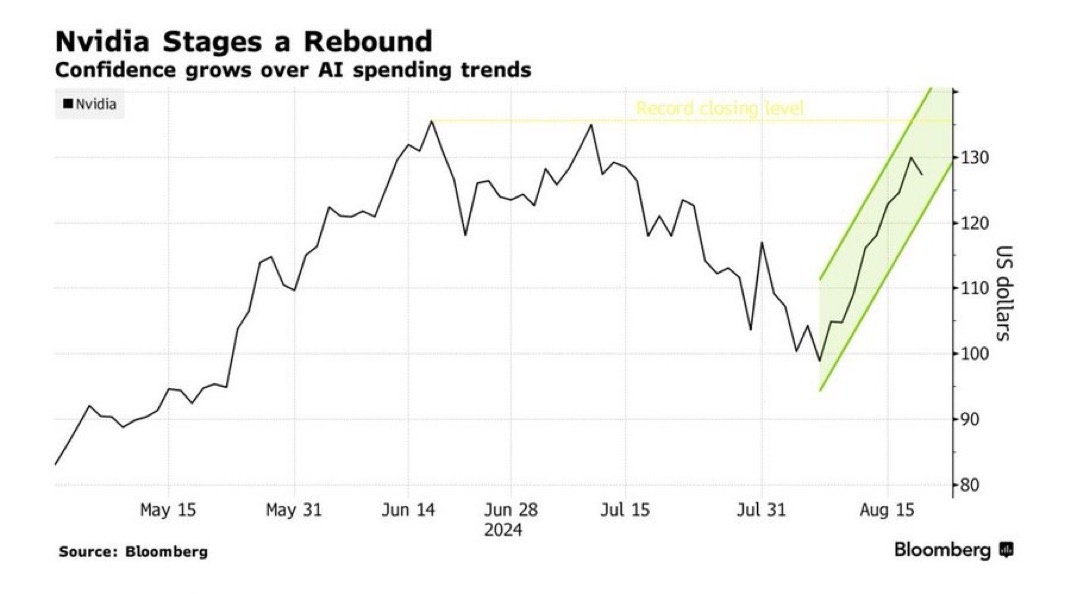

Next week's earnings announcement for NVIDIA $NVDA is likely to reaffirm the strength of AI demand and potentially push the stock price back to record highs. The company's stock has recovered nearly 30% from its recent lows and is close to reaching its all-time high. Analyst Charlie Chan of Morgan Stanley expects NVIDIA's earnings to "dispel concerns and encourage recovery in the stock prices of the entire AI supply chain."

AI investment commitments of major technology companies.

Major technology companies such as Microsoft $MSFT, Amazon $AMZN, Alphabet $GOOGL, Meta $META, etc., which account for more than 40% of NVIDIA's revenue, are emphasizing their commitment to AI investment in their earnings reports. The CEOs of these companies are demonstrating a willingness to overspend rather than risk underinvesting in AI technology.

Mr. Bryant Bankronkite (Allspring Global Investments) stated, "Large companies like these have no limits on resources, so if missing out on AI could jeopardize their competitive advantage, they are willing to invest in AI for as many years as necessary."

4️⃣ Valuation and risk of AI hardware-related stocks

AI hardware-related stocks are currently trading at high valuations. This reflects expectations of continued AI spending, but also entails risks. Mr. Bankronkite pointed out that "NVIDIA's valuation can be justified if it can ensure the sustainability of earnings trends," but also noted that "companies that are spending might be rewarded while hardware companies only face negatives if the spending stops."

5️⃣ Views of investors and analysts

Ms. Solicia Marcheli, Chief Investment Officer for the Americas at UBS Global Wealth Management, predicts that by 2025, capital investments by major tech companies could increase by up to 25%. This significantly exceeds the consensus forecast of 10-15% growth and is expected to have a positive impact particularly for AI enablers in the semiconductor sector.

On the other hand, Morgan Stanley has indicated that the current spending pace is sustainable. The average capital intensity for equipment investments as a percentage of revenue is around 25%, which is considered a "healthy level." Additionally, the capital expenditure-to-EBITDA ratio demonstrates that there is "sufficient cash flow to support the spending."

📍 Expansion of AI investments and their impact on the market

Large-scale investments in AI infrastructure have brought significant growth opportunities to AI hardware-related companies such as NVIDIA $NVDA. The strong commitment of major technology companies and the expansion forecasts of long-term market size suggest the sustainability of investments in this field.

However, there are also risk factors such as high valuations and concerns about ROI on AI investments. Investors need to carefully evaluate AI-related stocks from a long-term perspective, considering the competitiveness, financial situation, and market trends of individual companies.

Future focus areas include NVIDIA's earnings results and their impact on the market, specific outcomes of major technology companies' AI investments, and the impact of changes in the macroeconomic environment on AI investments. By comprehensively analyzing these factors, it will be possible to more accurately evaluate the long-term trends of AI infrastructure investments and the investment value of related companies.

Investment in AI infrastructure is currently a top priority in the technology sector. Eric Swartz (Voya Investment Management) points out, "The construction of AI infrastructure is far from complete, and the growth prospects can be very bright in the coming years." Furthermore, this trend has only "recently emerged from the dugout," and growth in AI hardware stocks is expected in the medium to long term.

According to Needham's report, investment in datacenter infrastructure necessary to support AI generation could eventually reach $6 trillion (approximately ¥870 trillion). This massive investment scale suggests that AI infrastructure construction is a large-scale project that will span a long period.

Expectations for NVIDIA $NVDA's earnings and stock price trends.

Next week's earnings announcement for NVIDIA $NVDA is likely to reaffirm the strength of AI demand and potentially push the stock price back to record highs. The company's stock has recovered nearly 30% from its recent lows and is close to reaching its all-time high. Analyst Charlie Chan of Morgan Stanley expects NVIDIA's earnings to "dispel concerns and encourage recovery in the stock prices of the entire AI supply chain."

AI investment commitments of major technology companies.

Major technology companies such as Microsoft $MSFT, Amazon $AMZN, Alphabet $GOOGL, Meta $META, etc., which account for more than 40% of NVIDIA's revenue, are emphasizing their commitment to AI investment in their earnings reports. The CEOs of these companies are demonstrating a willingness to overspend rather than risk underinvesting in AI technology.

Mr. Bryant Bankronkite (Allspring Global Investments) stated, "Large companies like these have no limits on resources, so if missing out on AI could jeopardize their competitive advantage, they are willing to invest in AI for as many years as necessary."

4️⃣ Valuation and risk of AI hardware-related stocks

AI hardware-related stocks are currently trading at high valuations. This reflects expectations of continued AI spending, but also entails risks. Mr. Bankronkite pointed out that "NVIDIA's valuation can be justified if it can ensure the sustainability of earnings trends," but also noted that "companies that are spending might be rewarded while hardware companies only face negatives if the spending stops."

5️⃣ Views of investors and analysts

Ms. Solicia Marcheli, Chief Investment Officer for the Americas at UBS Global Wealth Management, predicts that by 2025, capital investments by major tech companies could increase by up to 25%. This significantly exceeds the consensus forecast of 10-15% growth and is expected to have a positive impact particularly for AI enablers in the semiconductor sector.

On the other hand, Morgan Stanley has indicated that the current spending pace is sustainable. The average capital intensity for equipment investments as a percentage of revenue is around 25%, which is considered a "healthy level." Additionally, the capital expenditure-to-EBITDA ratio demonstrates that there is "sufficient cash flow to support the spending."

📍 Expansion of AI investments and their impact on the market

Large-scale investments in AI infrastructure have brought significant growth opportunities to AI hardware-related companies such as NVIDIA $NVDA. The strong commitment of major technology companies and the expansion forecasts of long-term market size suggest the sustainability of investments in this field.

However, there are also risk factors such as high valuations and concerns about ROI on AI investments. Investors need to carefully evaluate AI-related stocks from a long-term perspective, considering the competitiveness, financial situation, and market trends of individual companies.

Future focus areas include NVIDIA's earnings results and their impact on the market, specific outcomes of major technology companies' AI investments, and the impact of changes in the macroeconomic environment on AI investments. By comprehensively analyzing these factors, it will be possible to more accurately evaluate the long-term trends of AI infrastructure investments and the investment value of related companies.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment