TSLA

Tesla

-- 421.060 NVDA

NVIDIA

-- 134.700 PLTR

Palantir

-- 80.550 AMD

Advanced Micro Devices

-- 119.210 QUBT

Quantum Computing

-- 17.620

@CasualInvestor: Tesla, Apple, Google, and Nvidia boast robust fundamentals. Hold them long-term, capitalizing on short-term market dips. Elections may stir markets, but savvy investors see them as opportunities. Keep an eye out for favorable entry points during stock dips. Read more>>

@Arrayfunction: Diversifying in uncertain times! Shifting some fixed income to junk bonds/consumer debt before MMFs' US treasuries turnover. Watching AI evolve from the sidelines. Auto sector outlook muted; sales uptick may be offset by lower loan margins. Read more>>

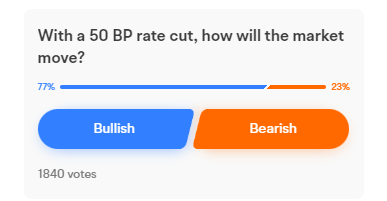

Echophi : Insightful, I wonder if the rate cut will cause inflation to spike![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Singh Rahul : The rate cut rally is already happening....

Rockyturki : Bullish on AI

CasualInvestor :