Facebook Parent Meta Sees Bullish Put Option Positions Ahead of Earnings

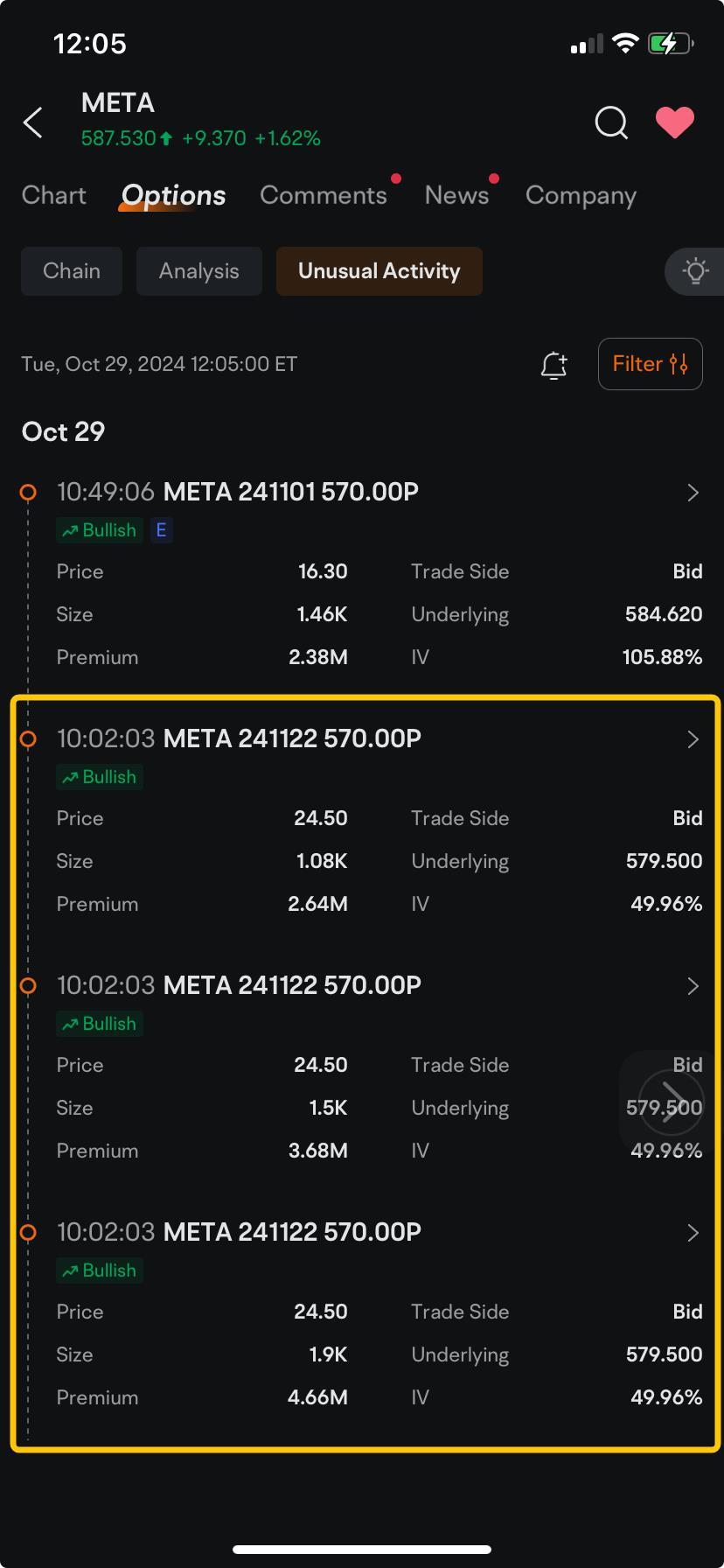

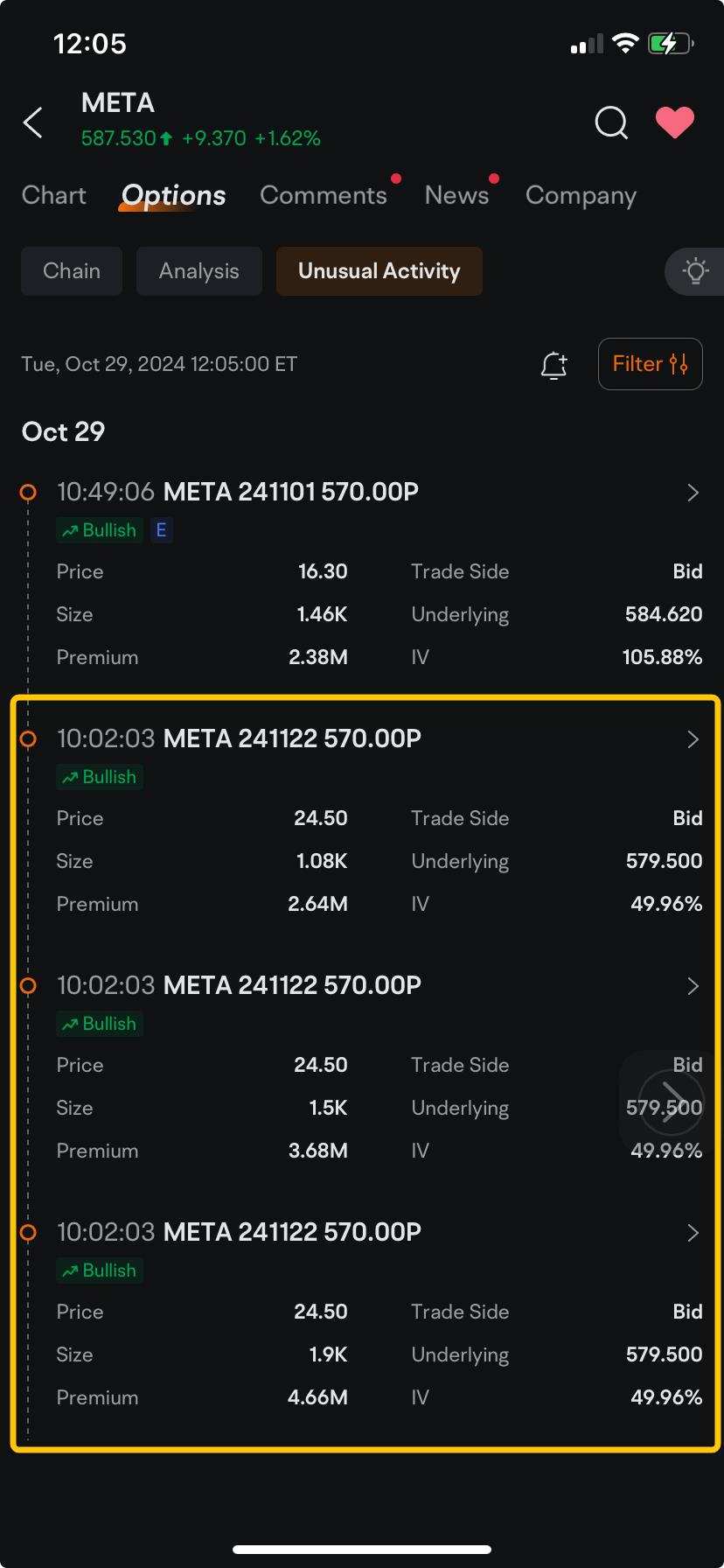

$Meta Platforms (META.US)$ saw more than $13 million in combined bullish unusual put option trades a day before the release of earnings for the social media giant that has surpassed expectations for six straight quarters.

Three of the four unusual option trades were posted at 10:02:03 a.m. New York time Tuesday. An active seller or sellers collected a premium of $10.97 million for the put options that give the holders the right to sell a combined 447,600 Meta shares at $570 by Nov. 22.

(For the options market page, click here.)

Those contracts, which were sold at $24.50 per share, could be profitable for the seller if Meta's shares stay above that strike price of $570 when they expire, rendering the put options worthless. Shares traded at $588.07, up 1.7% at 11:13 a.m. Each of the put option covers 100 shares.

The bullish trades were posted as Meta shares resumed their rally toward a record high amid optimism that the company's edge in deploying AI for ad targeting will continue to drive revenue higher. The stock climbed 66% this year, almost triple the pace of gains for the $NASDAQ 100 Index (.NDX.US)$ and the $S&P 500 Index (.SPX.US)$.

On average, analysts expect Facebook parent Meta to report tomorrow an 18% growth in revenue to $40.25 billion for the third quarter, according to estimates compiled by Bloomberg. Advertising revenue is seen rising to $39.7 billion, from $33.6 billion a year earlier. Earnings are forecast to grow to $5.25 per share for the third quarter, from $4.39 a year earlier, estimates show.

"Meta is executing best across the group & has earned the right to spend big on AI, with strong core operating results, early AI benefits in engagement & monetization, & clarity on the AI product roadmap," JPMorgan analysts wrote in a note Oct. 11. "Meta is the best owned name in the group & we expect continued strong revenue growth driven by AI investments, Reels, Click-to-Message, Shop Ads & Video," they cite as they reviewed the prospects of Magnificent Seven stocks.

Tuesday's share price gain took Meta above the middle line of the Bollinger band. While that signals to some who study chart that the trend could be relatively bullish, six other technical indicators found on the moomoo app are signaling that the stock could be overbought and the trend may be turning bearish.

Share your thoughts on Meta in the comments section below. And if you have a price forecast, please vote below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

101550592 :

J Servai (JLAPT) : $iShares Bitcoin Trust (IBIT.US)$

Supermengg :

Adrianlim90 : 1

102405503 No limit : lead

ChrissyGee : I don't see $Meta Platforms (META.US)$ surpass on $600 before year is out