Fear & Greed and VIX (volatility) indexes with Gold/Silver

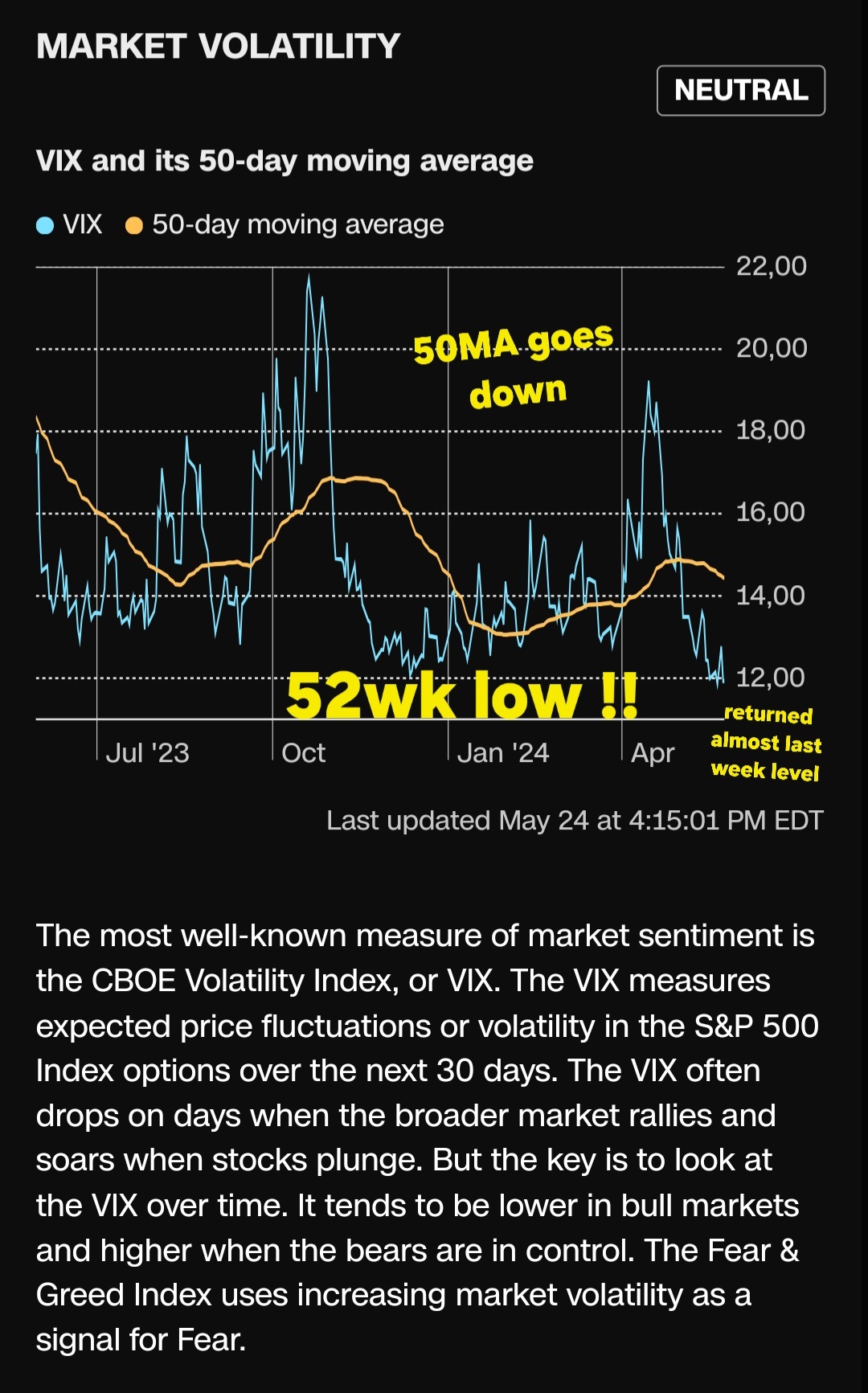

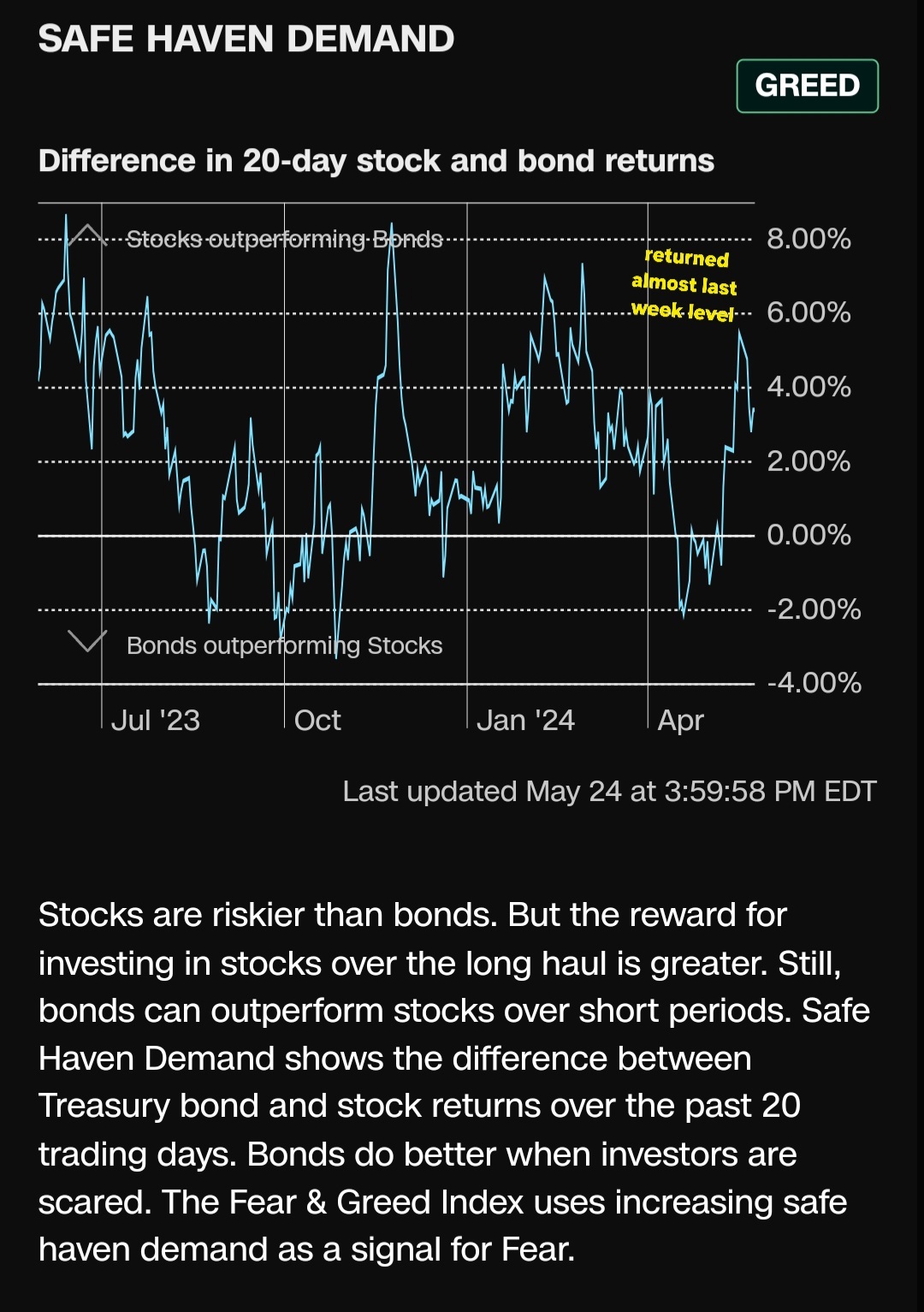

$CBOE Volatility S&P 500 Index (.VIX.US)$ The Fear & Greed index returns to the neutral zone after being Greed for 1 week. The volatility of the VIX index market has reached its low of 52wk. We are still below the psychological lign of $14. After a recent ATH the price of gold seems to have fallen a little but the indicators are bullish. And Silver seems surpass gold. The record is 1979's 15-to-1 gold/silver ratio...

link to "Fear & Greed index": Fear and Greed Index - Investor Sentiment | CNN

$Gold Futures(FEB5) (GCmain.US)$ $Silver Futures(MAR5) (SImain.US)$ $XAU/USD (XAUUSD.CFD)$ $XAG/USD (XAGUSD.FX)$ $E-micro Gold Futures(FEB5) (MGCmain.US)$ $Micro Silver Futures(MAR5) (SILmain.US)$ $SPDR Gold ETF (GLD.US)$ $VanEck Junior Gold Miners ETF (GDXJ.US)$ $Sprott Junior Gold Miners Etf (SGDJ.US)$ $Sprott Gold Miners ETF (SGDM.US)$ $VanEck Gold Miners Equity ETF (GDX.US)$ $Sprott Physical Gold and Silver Trust (CEF.US)$ $Sprott Physical Gold Trust (PHYS.US)$ $iShares Silver Trust (SLV.US)$ $Sprott Physical Silver Trust (PSLV.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Dow Jones Industrial Average (.DJI.US)$ $Nasdaq Composite Index (.IXIC.US)$ $Russell 2000 Index (.RUT.US)$ $Invesco QQQ Trust (QQQ.US)$

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment