Fed cuts 50 bps - Dawn of a Bull Market has begun

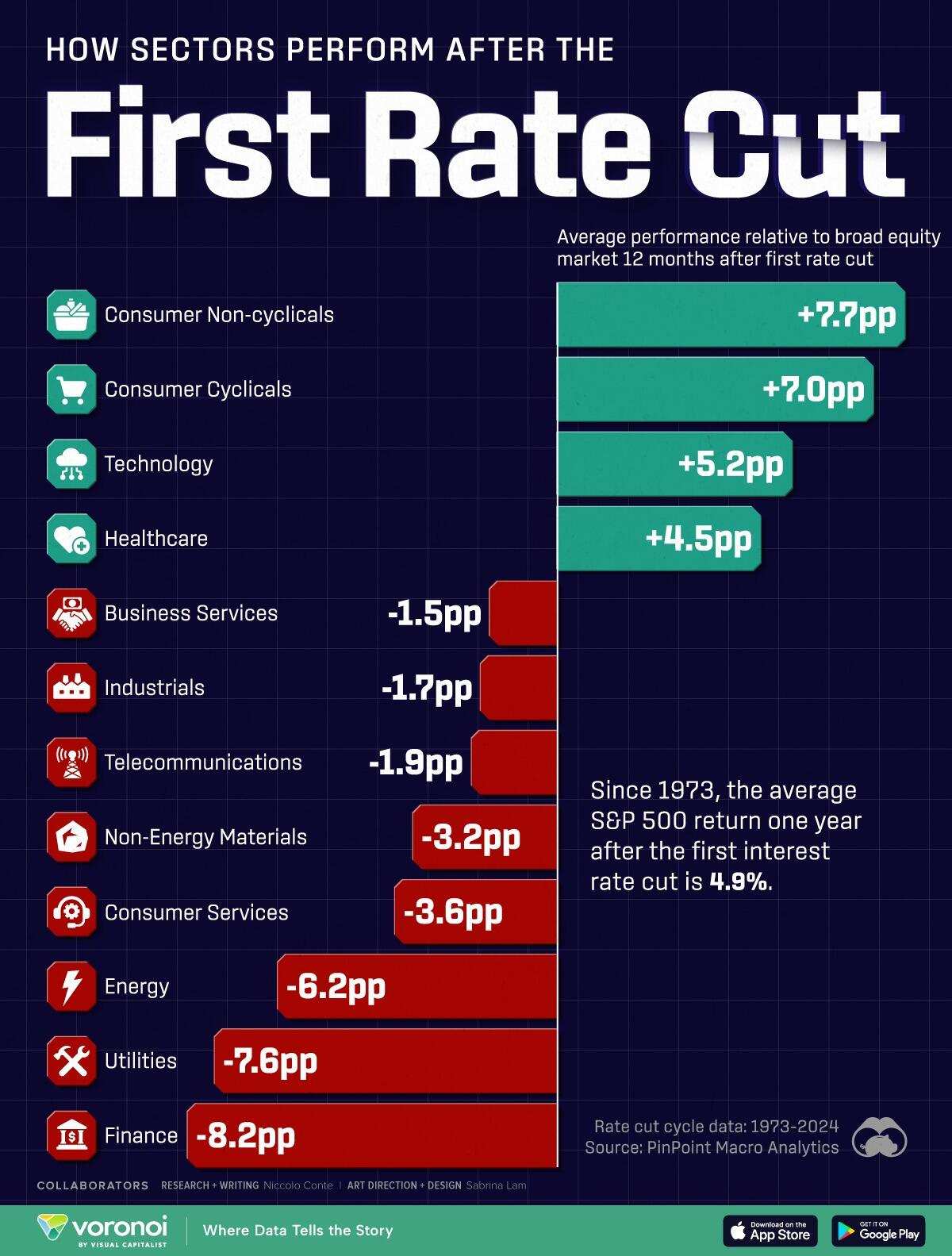

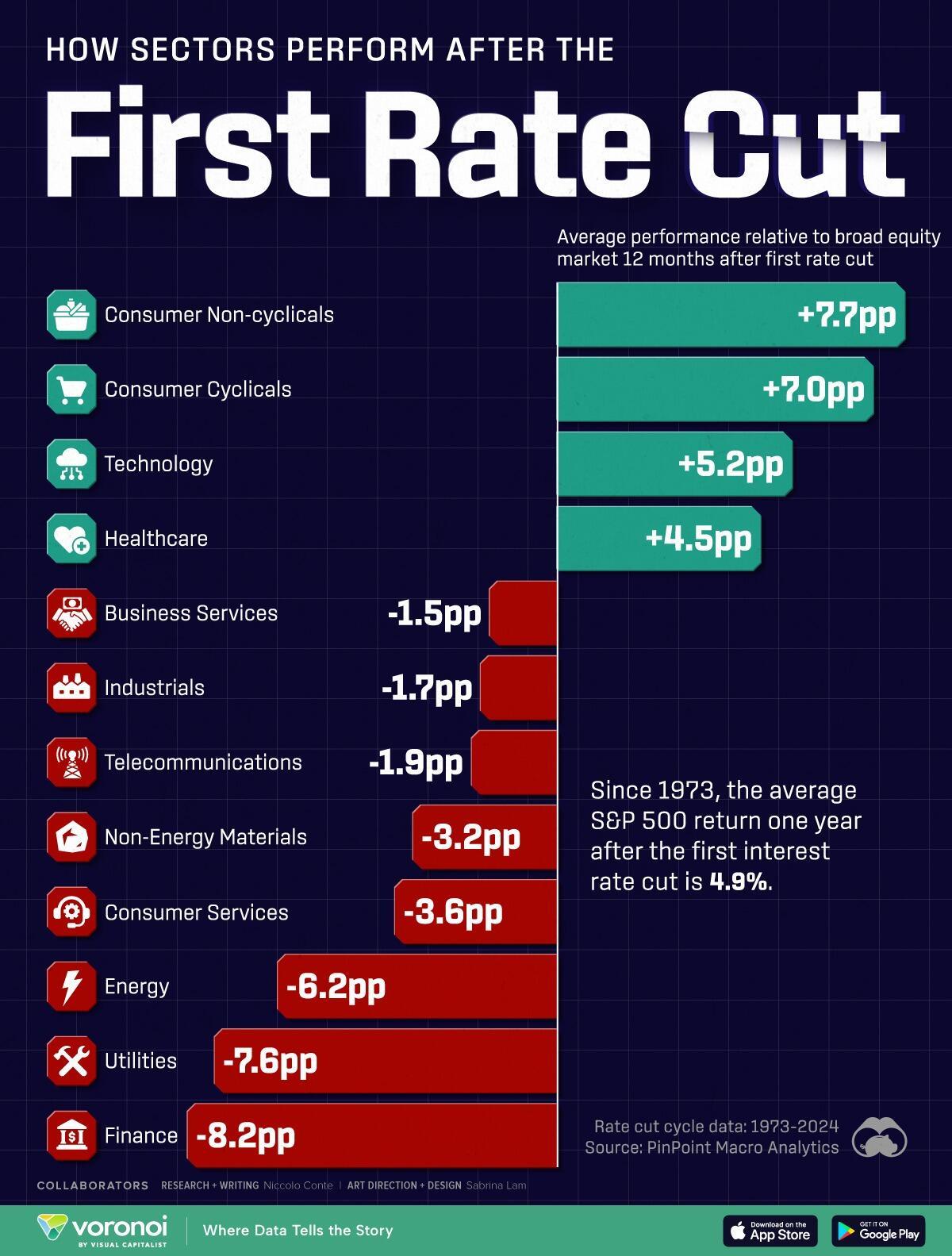

1) Based on some sources, Consumer, Technology, REIT and Healthcare related stocks will outperform. However not all stocks will be bullish. It will also depend on the company's value and growth. Note that the data is based on the 12 months average performance after the first Fed rate cut.

2) The stock market is still very volatile. Many uncertainties can crash market. Imminent risks include China-US tension, US presidential election, US recession, Ukraine-Russian conflict escalation, Oil price surge etc. Hence it is important not to panic sell (fear).

3) US inflation rate may go up and FOMC can reverse the decision to cut rate further. Banks may delay cutting interest rate and quantitative easing may take longer than expected. It is critical to be patient.

4) My outlook is bullish and will continue my 4D trading - "Discipline" and avoid FOMO buy (greed). Trading options (puts/calls) to take advantage of the current bullish trend.

Bottom line

My portfolio which is mainly Tech ETFs and Mega cap tech stocks are increasing in value and making profit. This is the result of taking a long position of value stocks. If FOMC decides to cut rate further in Q4, the "Dawn of a Bull market" has begun.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment