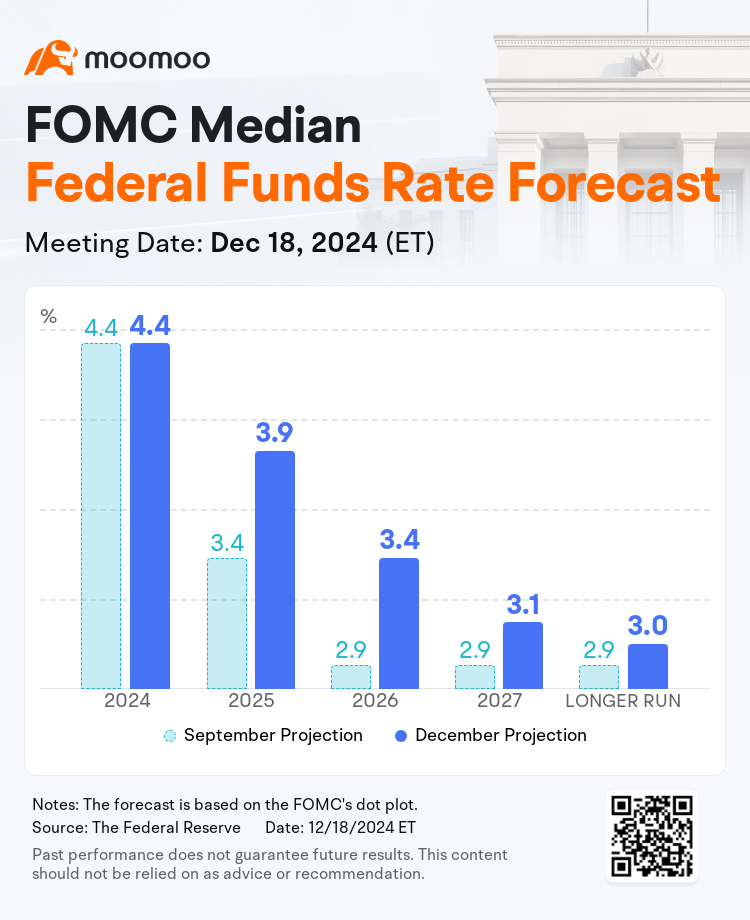

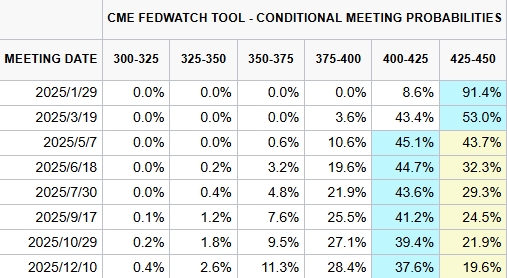

As widely expected, the Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by 25 basis points to 4.25%–4.5%. However, as Chairman Jerome Powell noted during the press conference, monetary policy has now entered a "new phase," during which the committee will adopt a more cautious approach.

104088143 : How is it?