![]() AI semiconductors doing well, heading for the highest profit in two years.

AI semiconductors doing well, heading for the highest profit in two years.At the 1st quarter earnings release on August 8,

The company revised its full-year performance outlook upward.Done.

Investment in cutting-edge memory such as HBM (High Bandwidth Memory) used in AI servers is strong. Recovery is also seen in the smart phone and personal computer sectors.is expected to reach 478 billion yen, a 31.3% increase compared to the previous year, marking the highest profit in 2 years.

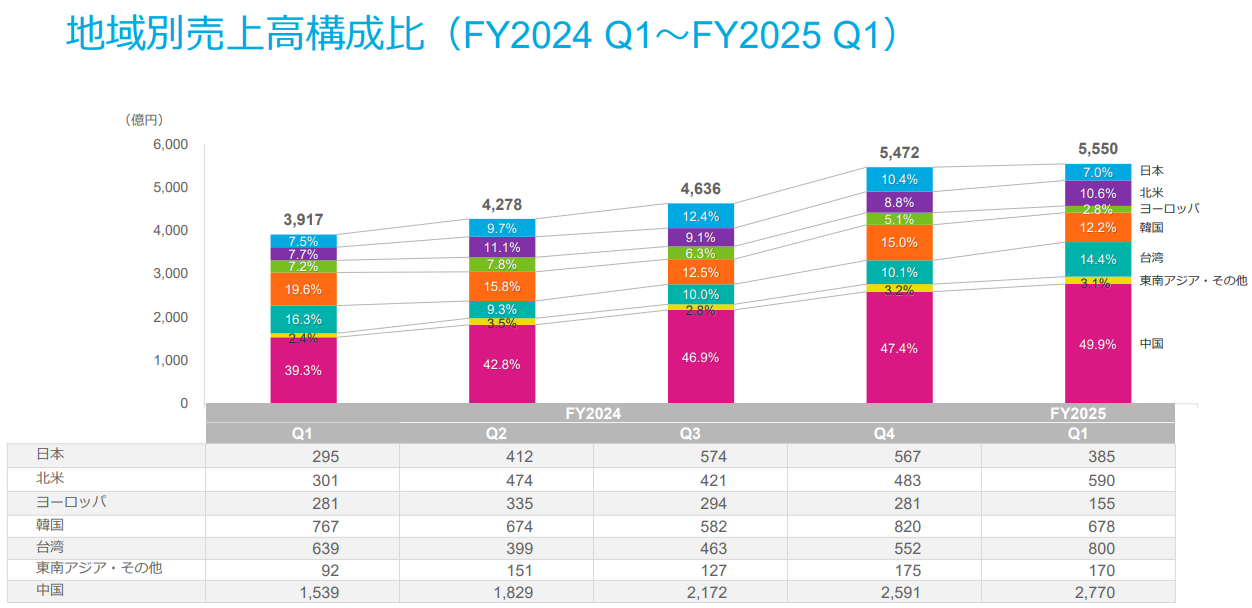

Operating revenue, operating profit, and operating margin are all at record highs.Efforts to increase self-sufficiency in semiconductors in China, a major sales market, are active, and in Q1, emerging manufacturers purchased manufacturing equipment ahead of schedule, resulting in an increase in the China sales ratio overall.

The full-year net profit is expected to increase by 31.3% compared to the previous year to 478 billion yen, achieving the highest profit in 2 years.Becoming.

Sales and operating income, as well as operating margin, are all at record highs.So, in Q1, due to early purchases of manufacturing equipment by emerging manufacturers, the sales ratio in China accounted for 49.9% of the total.

49.9%.(Refer to the graph below: the company's earnings report). However, this is due to an acceleration of the initial plan, and the ratio is expected to decrease in the second half. There is a possibility that the high plateau continued in the 2Q, but the company is

The company stated that the China ratio will be in the 30% range in Q4..

HONDA N-ONE : The target range is too wide.

tenrancai : The counter is too high to step over...