Fintech Tracking: What Is the Impact of Affirm's Collaboration with Apple

Affirm's recent partnership with Apple Pay underscores the company's commitment to expanding its reach and simplifying the payment process for consumers. By integrating with Apple Pay, Affirm can tap into a vast user base of iOS users, enhancing the accessibility and convenience of its buy now, pay later (BNPL) services.

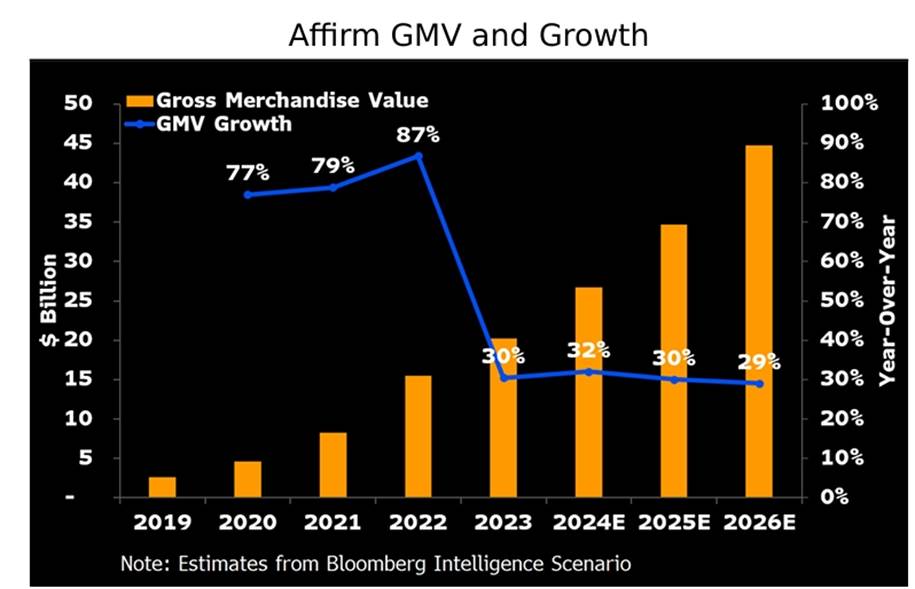

According to Bloomberg analyst Diksha Gera, Affirm could stabilize gross merchandise value (GMV) growth at about 30% in 2024-26, more than doubling volume to $44 billion and revenue to $3.5 billion by 2026, fueled by new partnerships with Apple and Shopify and the Affirm Card.

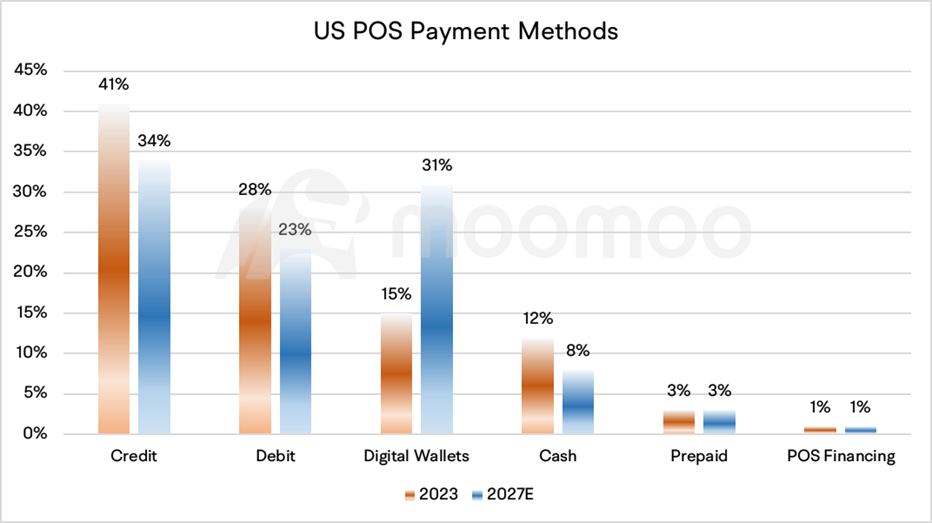

■ Digital payment is set to gain more market share

While Affirm's collaboration with Apple Pay is likely to enhance online sales volumes, the partnership's potential to develop its in-store mobile payment capabilities could be even more pivotal, as this represents a significant avenue of growth that the lender is actively pursuing.

Apple Pay itself is in a stage of rapid development. It has 60 million US users and is accepted at over 90% of US retailers, Capital One Shopping estimates. Credit cards and debit cards currently account for 69% of POS machine payments. Digital wallets represented by Apple Pay account for 15%, but the proportion is expected to soar to 31% in 2027. Affirm, which is bound to Apple Pay, is destined to benefit from the increase in the proportion of electronic payments.

■ Affirm takes a slow approach to debit cards

The expansion of Affirm's debit-card services is another strategic move that can broaden its customer base and foster user loyalty. According to the shareholder letter providing the report, Affirm customers who use the card have three times more transactions than customers overall. This could help it diversify away from a reliance on large e-commerce partnerships to generate volume, while also facilitating expansion into more frequent, lower-value purchases to boost addressable transactions.

Debit cards could become a user-acquisition tool due to the ubiquity of cards and ease of use across physical and online transactions. Affirm has already seen a rapid uptake in its card users, surpassing the one million mark shortly after March's close, with an average monthly addition of around 70,000 cardholders. This growth trajectory is promising when measured against Affirm's short-term ambition of reaching 40 million card users in the US, and it indicates significant potential for expansion within the broader addressable market of 240 million consumers.

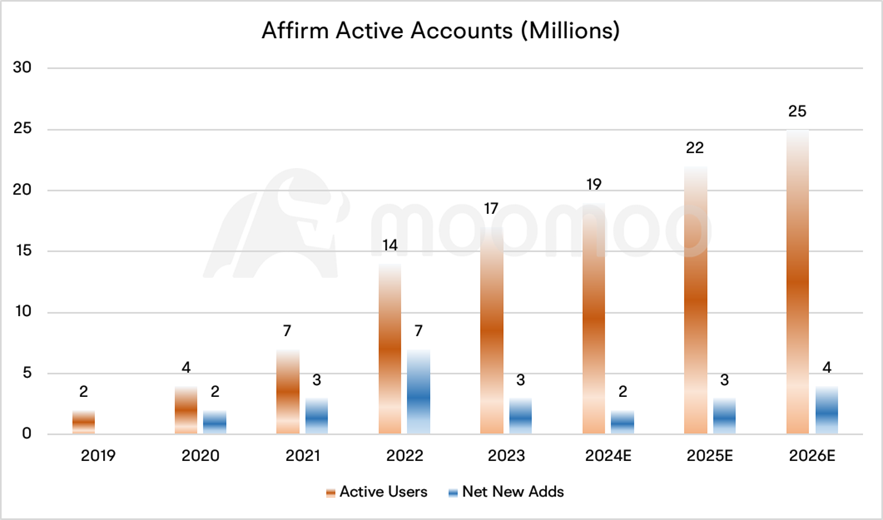

■ User base continues to grow

Gera said Affirm's strategic efforts could propel the company's user growth significantly, with an estimated addition of 9 million users by fiscal 2026. Its total active users are expected to rise to 25 million.

The company also collaborated with Shopify, which diversifies Affirm's revenue streams, and strengthens its position in the competitive BNPL market by leveraging Shopify's extensive merchant network.

Gera said the company's fiscal 2025 and 2026 revenue could exceed consensus by 5% and 7%, respectively, after two quarters of earnings beats.

■ Declining interest rates and more intense competition are key risk factors

Since Affirm has a high proportion of interest income, falling interest rates will have a negative impact on its interest income. However, the past year has seen Affirm renegotiate merchant contracts to include interest charges in place of the zero-interest loans that were previously offered. This shift opens the door to a more extended revenue runway, as the incorporation of interest fees could enhance long-term profitability. Additionally, lower interest rates might stimulate consumer spending, thereby boosting GMV.

Besides, the emergence of in-house financing options at major platforms like Amazon.com and Shopify could challenge Affirm's market position. However, Affirm is anticipated to maintain its competitive edge in product innovation, leveraging its history of investment in technology and growing network of partnerships.

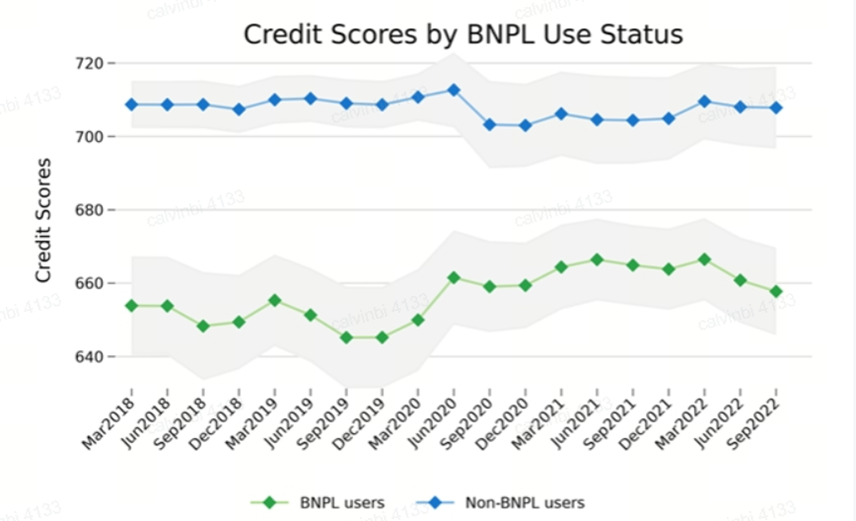

Since the most common reason people use BNPL is to make a purchase that would not usually fit in their budget, the repayment ability of people using BNPL may be slightly lower. Bob Hofmann, Risk Solutions & Consulting SME at Equifax, said there was a high concentration of subprime consumers (FICO Score 8 <670). To be exact, 91% of BNPL consumers in the analysis dataset had a FICO® Score 8 <670. Meanwhile, the average repayment window is five and a half months. If the economy weakens, Affirm's delinquency rate may rise.

There's another inherent risk that average order values might decline, which could outpace the gains from increased transaction volumes. Nevertheless, the prospect of heightened user engagement holds the promise of raising the average revenue per user (ARPU) overall. The key lies in Affirm's ability to continue enhancing its offerings and delivering value to both merchants and consumers, which could lead to a more robust and diversified revenue stream.

Source: Affirm, Capital One, Equifax, Bloomberg

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

bay78bay : wonder where this is going. could Apple be setting themselves up for a cellular service. hmmm