Market volatility in Chinese concept stocks? Trend-style strategies teach you how to invest in US and Hong Kong stocks conservatively.

Hong Kong stocks opened lower and continued downwards, with the Hang Seng Index dropping over 2,000 points at one point during the day, and the Technology Index dropping over 14%. By the closing bell, the Hang Seng Index in Hong Kong fell by 9.41%, the Hang Seng Technology Index dropped by 12.82%. China-affiliated brokerages, mainland real estate stocks, and semiconductor sectors all saw significant declines, with Ronshinechina falling by over 43%, Agile Group falling by over 41%, Kaisa Group falling by over 38%, Sunac falling by over 37%; China Merchants fell by over 36%, Swhy fell by over 35%, CICC fell by over 33%; Hua Hong Semi fell by over 23%, Semiconductor Manufacturing International Corporation fell by over 18%.

What is the reason for the pullback?

Analysts believe that there are mainly two reasons:

First, the expectation of a rate cut by the Federal Reserve has significantly weakened. Recently, the US dollar index and US bond yields have all risen, with the ten-year US bond yield reaching over 4% yesterday. However, today non-US currencies are rebounding across the board, especially the rebound of the Japanese yen leading to a sharp decline in the Asia-Pacific markets.

Secondly, Chinese assets have seen significant gains recently. Whether in Hong Kong stocks, FTSE A50 futures, or Chinese asset ETFs listed overseas, they have all generated high returns. Yesterday, A50's holding positions reached a historical high, often indicating increased volatility.

Analysts also believe that the direction of the Fed's interest rate policy may be an important reason for the plunge.

James Bullard, president of the Federal Reserve Bank of St. Louis, expressed support for a 50 basis point rate cut at the September FOMC monetary policy meeting. With time, a gradual rate cut will be appropriate. Both employment and inflation are in a 'good state,' with risks facing both targets being balanced. The policy path of the FOMC is 'slightly above' the median. PCE inflation is expected to converge towards 2% over the next few quarters. The cost of acting too hastily and aggressively easing is greater than the cost of acting too slowly.

For investors holding a large number of positions, it may be a good time to consider adopting collar strategies to protect their positions.

What is a collar strategy?

The collar strategy is similar to covered call strategy, but it usually takes longer to take effect, and requires a third position in addition to the two positions for covered calls (long position on the underlying asset + short position on the call), which is buying put options to hedge against losses from a drop in stock price. Thus, the three-legged is:

- Buying the underlying asset (stocks) ➞ profiting from future price increases of the underlying asset

- Buying put options ➞ protecting against a drop in the underlying stock price by providing insurance

- Selling call options ➞ providing financing for the aforementioned insurance

Combining these three positions together leads to both limited losses and profits. The limited losses come from holding long positions in put options, while the limited profits come from holding short positions in call options. The insurance effect generated by put options depends on the strike price and the option premium. Profits, on the other hand, depend on the (higher) strike price and the option premium received from selling options. Creating a good collar strategy requires skill. Typically, an increase in market volatility will benefit this strategy, especially when there is an increased demand for call options in a bull market, resulting in higher pricing relative to put options with the same expiration date and strike price.

Due to holding short positions in call options, investors should not expect high returns when considering a collar strategy. The collar strategy takes longer to take effect, making it difficult to achieve a high annualized return, such as over 20%. However, in terms of expenses relating to the underlying stocks, the risk of this strategy is relatively low. This is where the value of the collar strategy lies for investors.

When investors do not wish to incur significant losses in stock trading but also aim to profit from market gains over a longer period, a collar strategy can be considered. A simple approach is to hold onto this strategy and not actively manage it until the expiration date or very close to it before closing the position. Of course, the drawback of a longer holding period is also a downside of the collar strategy, as it requires investors to wait until closer to the expiration date to fully reap the benefits of this strategy. However, considering the low-risk nature of the collar strategy, the long holding period may be a cost worth paying for many investors.

From a position perspective, the structure of a collar strategy is:

Long stock positions + long put positions + short call positions = collar strategy

Analysis of Pros and Cons

Advantages:

- Provides investors with maximum protection when facing a decline in the underlying stock price.

When the price of the underlying asset fluctuates dramatically, this strategy has very low risk, and can even generate risk-free trades.

In terms of the trade-off between risk and return, this strategy can achieve a higher return on risk ratio.

Disadvantages:

This strategy will have better effects in the long term, so its effectiveness requires time and patience.

The maximum profit can only be obtained at the expiration date.

In terms of investment funds, only lower returns can be obtained.

Trading Steps

1. Buy or hold stocks (underlying assets);

2. Buy put options at-the-money (or out-of-the-money), which means buying put options with a strike price close to but lower than the current stock price.

3. Sell out-of-the-money call options, meaning selling call options with a strike price higher than the current stock price.

The closer the strike price of the put options is to the purchased underlying stocks, the better insurance investors can get when the stock price falls. Of course, the higher the insurance level, the higher the cost investors need to pay.

Entry (opening positions)

- Try to ensure that the future trend of the underlying stock isup, and try to confirm the presence of clear price support areas as much as possible.

Sell

On the expiration date, investors would hope to exercise the call options they hold to obtain the maximum profit.

If the underlying stock price remains below the call option's exercise price but above the stop-loss point, then let the call option expire unexercised to receive the full option premium.

The essence of the collar strategy is to set the put option's exercise price not less than the stop-loss point, thereby minimizing risk, allowing investors to comfortably hold the entire position until expiration.

If investors are using margin for trading, they need to close out this strategy when there is an urgent need for margin. In this regard, this strategy is not very suitable for situations requiring cash before the expiration date.

Experienced investors will increase and establish positions on the three 'legs' in response to the fluctuation of the underlying stock price, enabling them to gain additional profits before the expiration date.

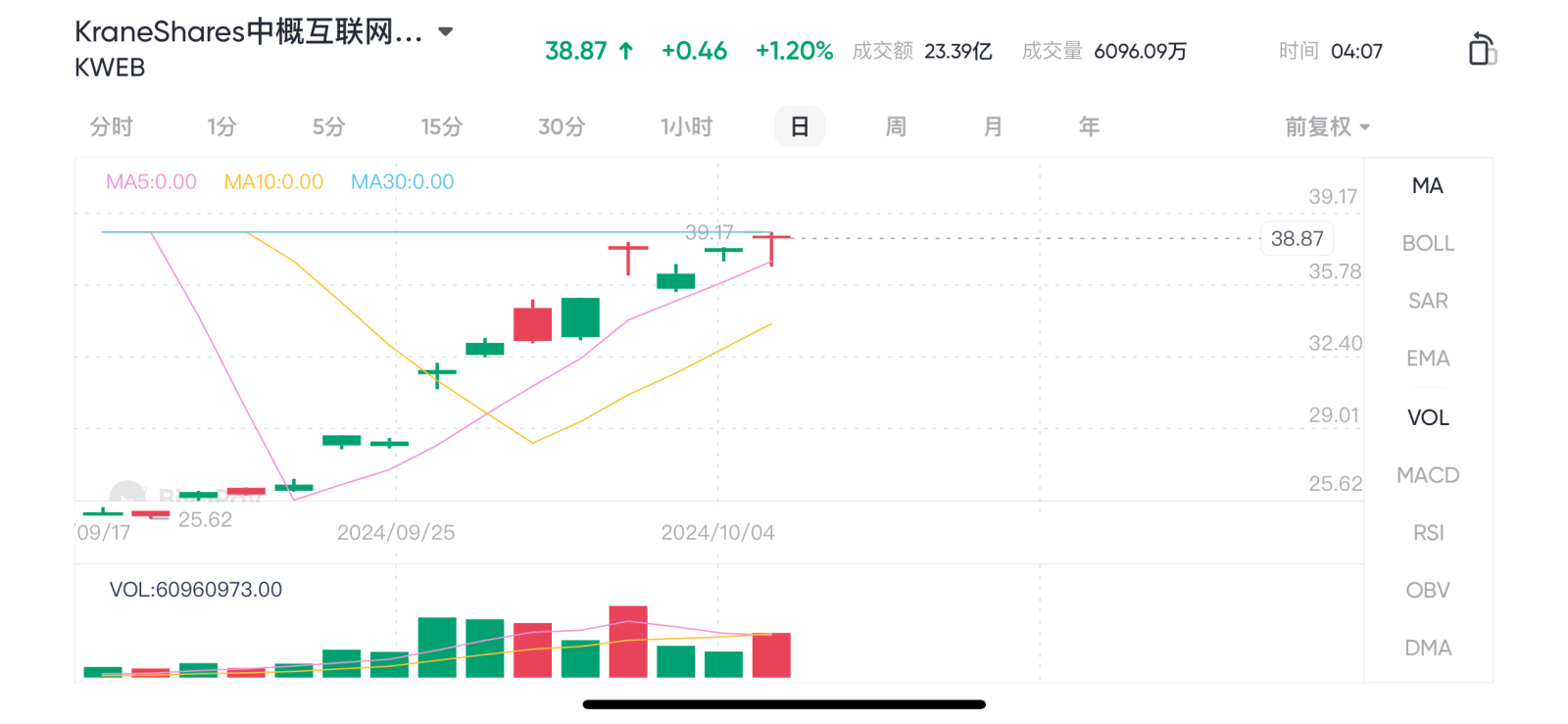

Taking KWEB stocks as an example, the collar option strategy is as follows:

Assuming an investor holds 100 shares of KraneShares' China International Internet ETF (KWEB) priced at $38.87 per share, when uncertain about the near-term price changes and looking to secure their position, they can buy insurance using the collar strategy.

In addition, US stock options trading is a significant financial tool for investors, offering leverage and risk management possibilities. Choosing a suitable US stock options trading platform is crucial. Firstly, the platform should have advanced security features and a good regulatory record, ensuring trading safety and fund protection. Secondly, the user interface should be intuitive, user-friendly, support quick order execution, and provide comprehensive market data and analytical tools to help investors make wise decisions.

Below is an example of how to operate on the BiyaPay platform:

In the first step, investors can sell a call option with a strike price of $40 and an expiration date of November 8th for $2.52, receiving $252.

The income and expenses of the two options largely offset each other, with a total cost of $0 but an income of $19. With this approach, investors establish a protective strategy at a low cost.

In the second step, investors can buy a put option with a strike price of $37.5 and an expiration date of November 8th for $2.33, costing $233.

The ultimate protective effect of the strategy is that if KWEB falls below the put option's strike price of $37.5, regardless of how low it drops, the loss will be capped.

The maximum loss = put option strike price - underlying asset purchase price + call option premium - put option premium, which is $156. Regardless of how much KWEB falls before the option contract expires, even if it drops to $1, the investor's maximum loss will only be $156.

In addition to locking in the maximum loss, this strategy also maintains the ability for the investment portfolio to gain profits. When the underlying asset rises to the call option's strike price of $40, the portfolio achieves maximum gains.

From the case, it is clear that this strategy provides investors with the ability to secure the 'fruits of victory' on KWEB and guard against risks. After the short-term volatility ends, investors can also unwind this strategy to continue in the direction of calls or puts.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment