Follow Nvidia's Lead in Investing in Small-Cap AI Stocks

This year, the hottest AI trends may be shifting from "hard tech" to practical application scenarios. AI advertising marketing leader $Applovin (APP.US)$'s stock soared by 745% year-to-date, $Palantir (PLTR.US)$ has seen a substantial increase of 290%, while AI chip giant $NVIDIA (NVDA.US)$ has risen by 179%.

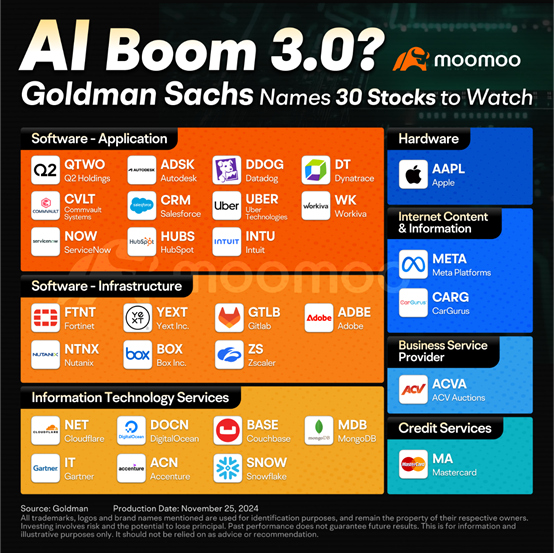

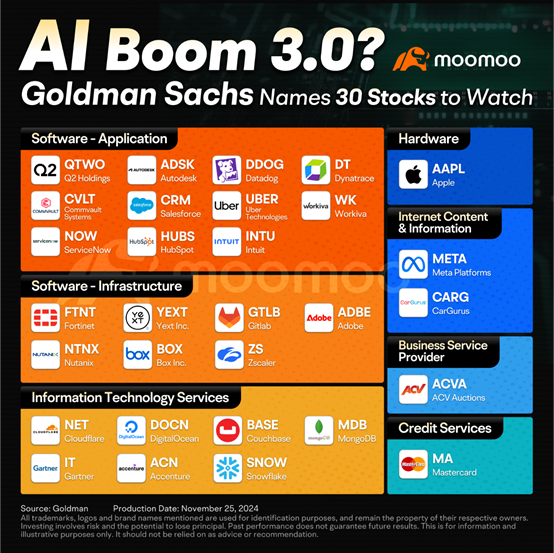

Goldman Sachs also pointed out in a previous report that by 2025, investors are expected to shift from AI infrastructure to a broader "third phase" of AI application promotion and monetization.

In addition to mid-to-large AI companies, Nvidia has also been investing in several small-cap AI stocks this year, which are worth paying attention to.

Nvidia invests in Small-Cap AI stocks

According to 13F filing, Artificial Intelligence kingpin $NVIDIA (NVDA.US)$ disclosing its holdings in AI application stocks. Nvidia has disclosed a new investment in $Applied Digital (APLD.US)$, a digital infrastructure solutions provider. Applied Digital's share price has soared by 40% since the disclosure.

$Applied Digital (APLD.US)$ designs, builds and operates next-generation data centers and cloud infrastructure for high-performance computing and artificial intelligence industries. As of Sept. 30, Nvidia owned 7.72 million shares, worth around $63.66 million, in Applied Digital. That equates to a roughly 3% stake in the Dallas-based company.

Additionally, Nvidia maintained its investment stakes in $Arm Holdings (ARM.US)$ (1.96 million shares), Nano-X Imaging (59,632 shares), $Recursion Pharmaceuticals (RXRX.US)$ (7.71 million shares), $Serve Robotics (SERV.US)$ (3.73 million shares) and $SoundHound AI (SOUN.US)$ (1.73 million shares).

Since Nvidia disclosed its investment in $SoundHound AI (SOUN.US)$, SoundHound AI shares have surged by 48.48%. The voice AI innovator, which allows companies to create customized conversational experiences, has seen its stock skyrocket by 340% year-to-date.

H.C. Wainwright analyst Scott Buck reiterated his buy rating on SoundHound AI stock, saying that SoundHound stock also should continue to attract investor attention because of its exposure to the artificial intelligence megatrend.

SoundHound's technology is used by companies to interact with customers in call centers and restaurant drive-thrus. Its voice-response technology also can be found in cars and televisions.

In a client note, Buck said, “We expect the company to continue to execute against its strategy in coming quarters, growing revenue, expanding gross margin, and pushing towards positive adjusted EBITDA, which, in our view, should push shares higher."

AI infrastructure player $NEBIUS (NBIS.US)$ is raising $700 million through a private placement from a group of investors that includes $NVIDIA (NVDA.US)$. Following this news, Nebius' stock price surged 17.1% on Monday.

The Netherlands-based Nebius Group said in a news release that the funding will support additional capacity for its plan to offer cloud-based computing power for training and running AI models.

Nebius previously announced plans to invest $1 billion in developing AI-related infrastructure in Europe, which it rents to other enterprises. The firm is competing with cloud-computing giants such as $Amazon (AMZN.US)$ and $Microsoft (MSFT.US)$, among others.

Nebius is also expanding to the U.S. The company last month announced the launch of its first data center with Nvidia GPUs in Kansas City. The firm is also in "advanced discussions" for a second GPU cluster in the U.S. that it hopes will come online next year. It also has a large-scale data center in Finland.

Along with the deal, Nebius raised its sales outlook. The company now expects its annualized revenue run rate to reach between $750 million and $1 billion by the end of 2025, up from previous guidance of $500 million to $1 billion.

However, investors should remain cautious. Smaller-cap stocks like $Applied Digital (APLD.US)$ and $SoundHound AI (SOUN.US)$, especially those with valuations based on future growth assumptions, are highly sensitive to broader market conditions. If the market encounters turbulence, Applied Digital could see a sharp pullback, as high-momentum sectors like AI often experience disproportionate sell-offs during periods of uncertainty.

Source: IBD, Tipranks

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104088143 : How is it?

Marie Thermidor : Thanks for everything you have been doing

103358297 : Thank you. Very informative

72237976 : Thank you.

105742796 Learner : Thank you. I’m really learning a lot of new things.

Anthony Emoghene : Thank You for the wonderful information.

Adrianlim90 : 1