FOMC preview: 25 or 50bps? predict and win the reward!

Happy Monday, Mooers!![]()

![]()

The September FOMC meeting is approaching, and the market generally believes that a rate cut is highly likely, which will be a significant turning point in this year's monetary policy. ![]()

![]()

How will interest rate cuts affect the stock market? How will the S&P 500 index react? Come on mooers,![]() let's try to predict its possible direction!

let's try to predict its possible direction!![]()

Prediction time!

Drop your insights in the comments section:

– What impact would a rate cut have on your daily life? Would you still keep your savings in the bank?![]()

![]()

– An equal share of 5,000 points: For mooers who correctly guess the S&P 500 Index PERFORMANCE at 4:00 PM ET on September 18 / 4:00 AM SGT on September 19 (e.g., if 50 mooers make a correct guess, they will each get 100 points!)

– We will select the 5 mooers with high-quality comments, and each will receive 100 points.

*Your comment has a chance to earn rewards if it receives likes and reply from others!

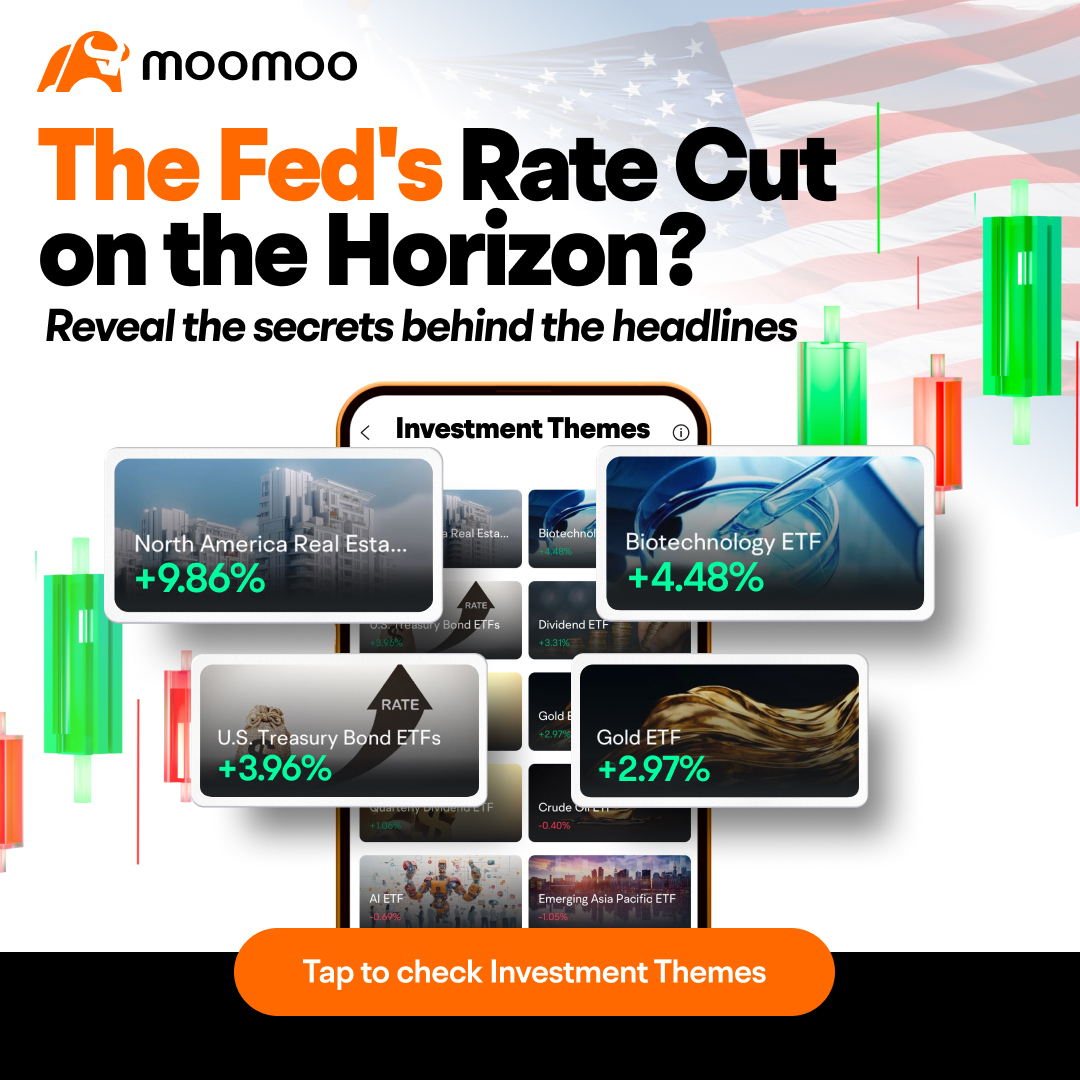

For more investment opportunities related to interest rate cuts and associated portfolios, you can try clicking on the image below to view them>>

Important Information: Before investing in an ETF, you should read both its summary prospectus and its full prospectus, which provide detailed information on the ETF’s investment objective, principal investment strategies, risks, costs, and historical performance (if any). You can find prospectuses on the websites of the financial firms that sponsor a particular ETF, as well as through your broker. A Word About Risk: Investment returns will fluctuate and are subject to market volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost. ETFs are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, international securities, commodities, fixed income, and more. An ETF may trade at a premium or discount to its net asset value (NAV).

📅 Stay Tuned for the Live Stream:

We'll provide a live stream link in our community so you won't miss any exciting moments.

2024 FOMC Meeting

Sep 19 02:30

🗣️ Come join our discussion and share your exclusive picks; there's a chance to earn even more points!

Disclaimer: This presentation is for information and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Before investing, please consult a licensed professional. See this link for more information.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Khin8858 : the market been waiting for very long on the cut

102362254 : I’m hoping for lower interest rates on my mortgage, which would reduce my monthly payments and give me more disposable income. While a rate cut could lower the interest on my savings, I’d still keep some in the bank for security but consider shifting part of it to higher-yield investments. Lower rates might also make borrowing more appealing, but I’d carefully evaluate these options based on the broader economic outlook and my personal financial goals.

mr_cashcow : Would you still keep your savings in the bank?

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Yes but only a small sum for emergencies, most of my cash are being allocated to other vehicles that generates high yields, gotta put those idle money to work

Wonder : I think FED will start with a 25bp cut, the mkt may dip first (as the expectation has been priced in) followed by positive sentiments driving up the mkt.

With rate cuts in the horizon, I will consider keeping some funds in high yield interest rate account that offers promo cash rebate as well. My balanced approach includes low risk investments.

Au62 : The economy of the USA is still very healthy, and I don't think there will be an interest rate cut in September.

Lucas Cheah : A Fed rate cut can have an impact on my daily life where my mortgage would be cheaper. However, it would also reduce returns on savings accounts, making them less attractive for holding large sums of money. While keeping some savings in the bank for emergencies remains essential, the diminished returns would push me to explore alternative investments such as bonds, stocks, or real estate to achieve higher yields.

Choca_bella : Ready

70852907 102362254 : Well Said…I 2nd That Motion…

Ziggz420 : Think there will be a small rate cut probably around.25 to .37 and yes I'll keep a nice chunk of money in savings but will purchase a couple CDs to get higher interest rate honestly believed I had more time before rate cut I suppose there's a possibility it actually goes up or stays same rate but I doubt it believe a rate cut is coming it's been that time to jump start economy and try to curb this run away inflation. Market itself will most likely dip at 1st early in day after announcement and then recover or go up 2-4 points by end of trading day

Ziggz420 Au62 : maybe compared to Asia but we are hurting a lot news just isn't telling the true story

View more comments...