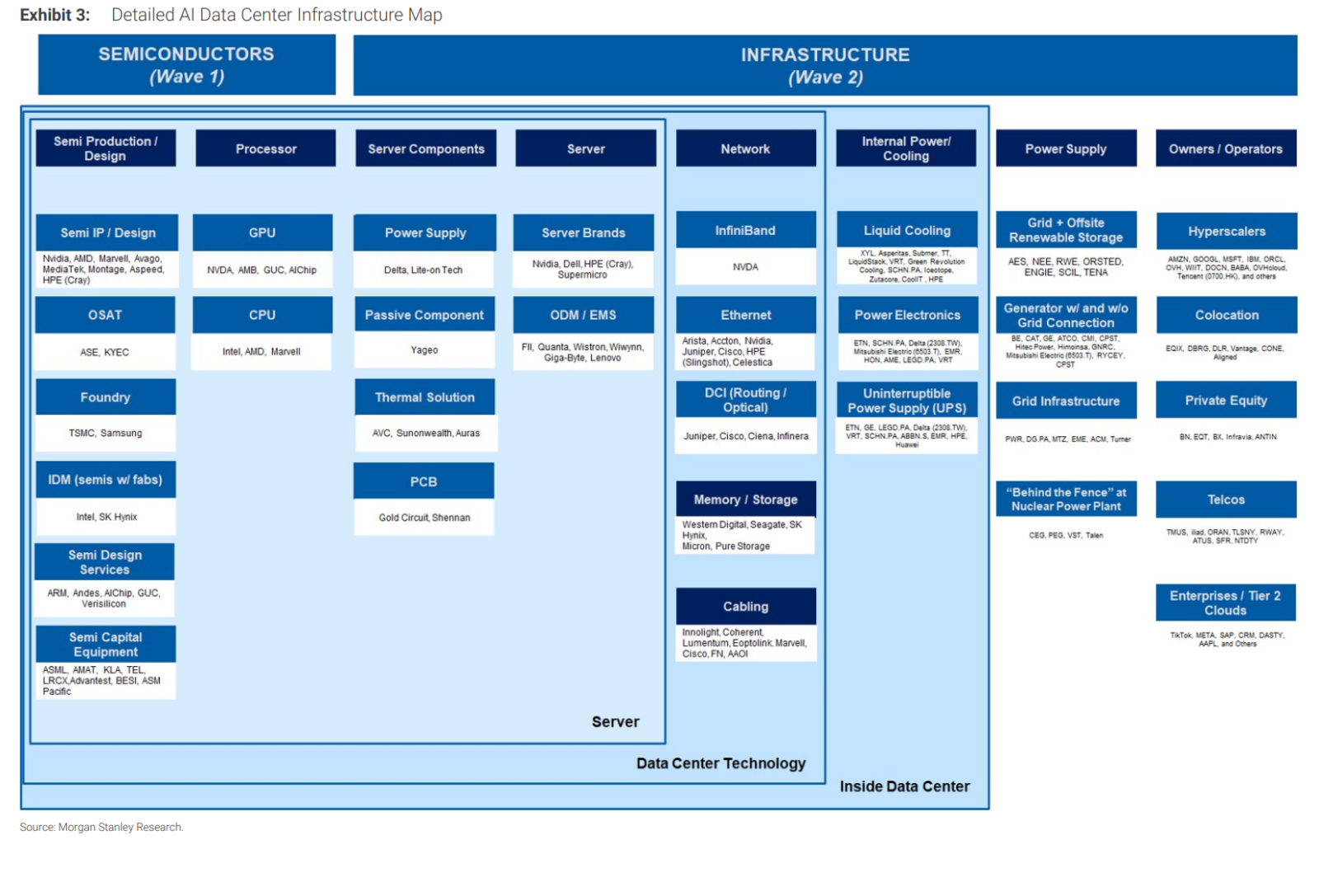

Besides, Morgan Stanley's latest research this month shows that, compared to the rapid increase of the semiconductor sector, growth for other companies in the data center technology sector is slower (median growth is only 20%), suggesting plenty of investment and value growth potential in the future. It points out that, the next wave of investment will focus more on other infrastructure for AI data centers, such as servers, network equipment, cooling systems, data storage, and even physical real estate.

10baggerbamm : can you provide me a link to where that chart came from I'm trying to enlarge it to get all the names and they're very very blurry and hard to read thank you in advance

vcballer2005 : yes please provide chart. also this seems like another way to liquidate more cash from retail investors.

Andrew 168 : So many companies. Can suggest etf?

Moomoo News Global OP 10baggerbamm : Thank you for your attention to moomoo news! We have re-uploaded a clearer picture and hope it will be helpful.

Moomoo News Global OP vcballer2005 : Thank you for your attention to moomoo news. We have re-uploaded a clearer picture and hope it will be helpful.

70663815 : What about MX

frank Crane_3546 Andrew 168 : SOXL