From Partnership to Breakup: The Story Behind Walmart’s Sale of JD.com Shares

Walmart has sold all its JD.com shares, cashing out $3.6 billion and ending their 8-year partnership. In 2016, Walmart and JD.com announced a strategic partnership and Walmart bought 145 million JD.com shares for about $1.5 billion, which was about 5% of JD.com at the time. Walmart didn’t join JD.com’s board or get involved in its management, acting mainly as a financial investor. Now, Walmart wants to focus its resources on its China business and Sam’s Club, putting funds into faster-growing areas.

Over the 8 years, Walmart’s stock has gone up 208%, while JD.com’s stock has only increased by 3.05%. JD.com’s stock hit a peak in February 2021 and has since fallen by 73%, while Walmart’s stock has risen more than 50%.

Despite JD.com’s revenue and profitability improvements, its stock market performance has been poor, reflecting investor worries about the economy.

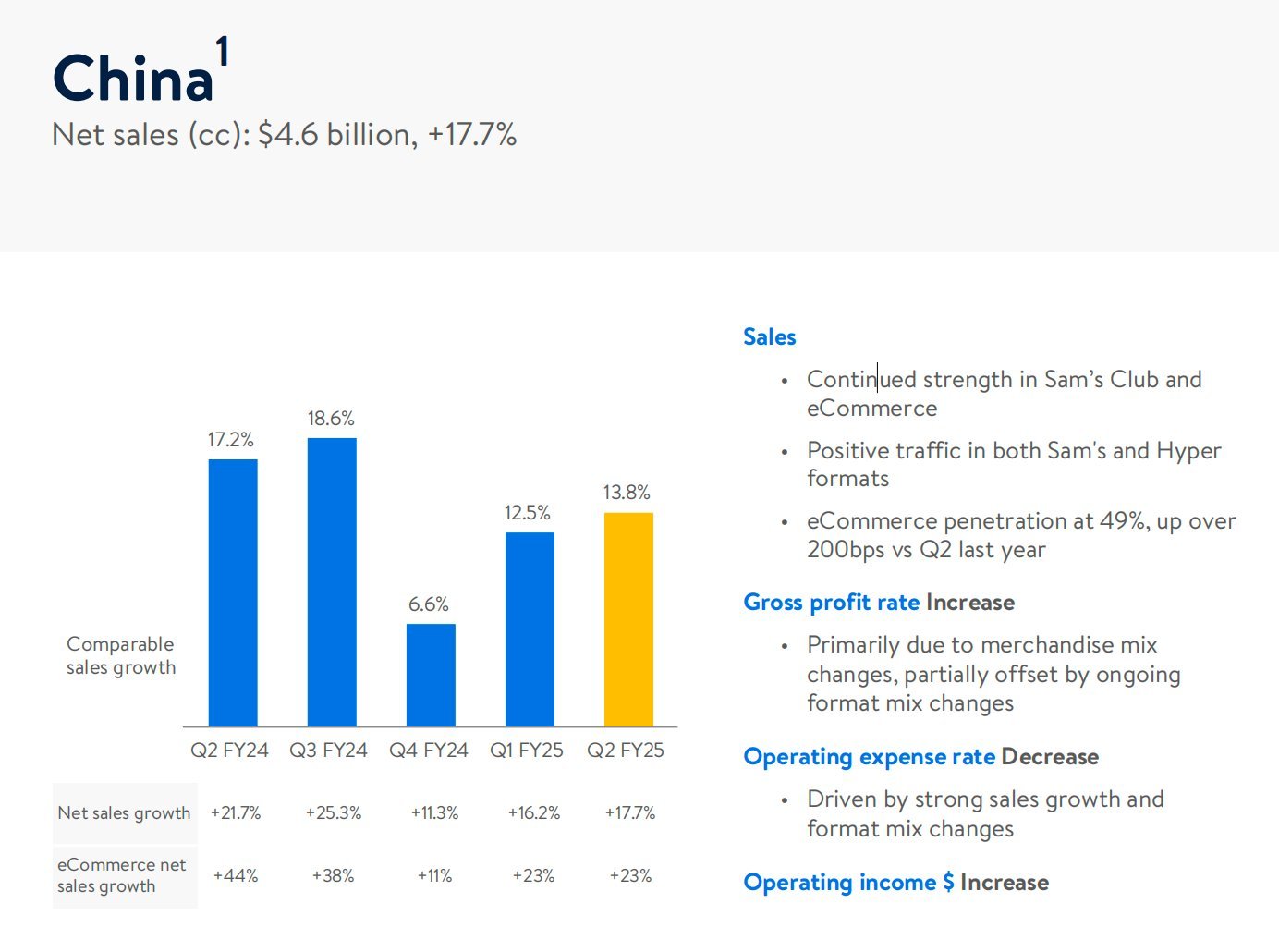

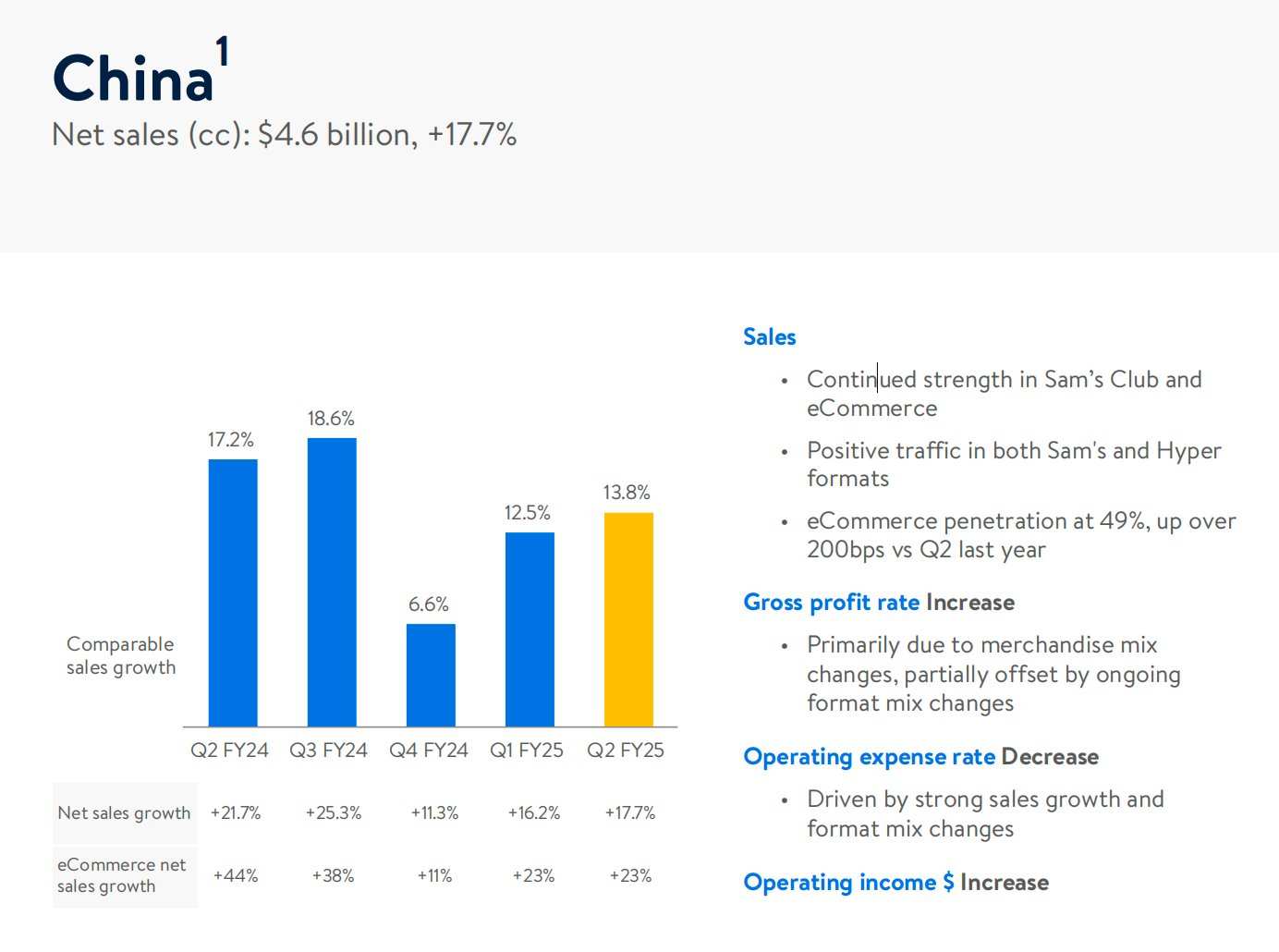

Walmart’s latest report for Q2 2024 shows a global revenue increase of 4.8%, with China sales up 17.7%, and e-commerce sales growing by 23%. Walmart’s PE ratio is 38, while JD.com’s is only 8, showing Walmart is valued much higher by the market.

Walmart has been shutting down unprofitable stores in China since 2019, shifting focus to higher-end Sam’s Club and e-commerce. This decision to sell JD.com shares and reallocate resources highlights Walmart’s dissatisfaction with JD.com’s performance and its strategic shift.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

102188459 : Tq

105379936 : Nice info

104993903 : Good