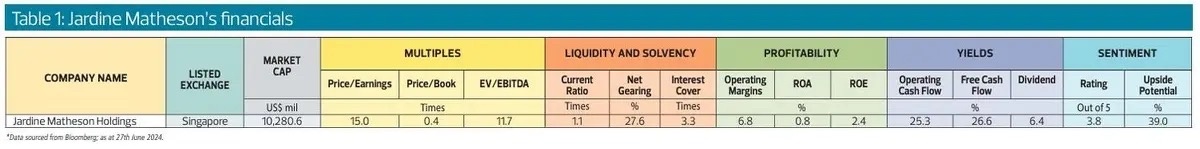

JM has the additional challenge of owning conglomerates. As at end-June, JM was trading at just 0.4 times P/NAV, and 15 times P/E. Its balance sheet is stable, with a low gearing ratio of 27.6%. On the operating front, the interest coverage ratio as of end-December 2023 was 3.3 times and the conglomerate reported free cash flow (see Table 1).