FuboTV Options Volume Jumps 10-Fold as Stock Soars After Disney Deal

$FuboTV (FUBO.US)$'s options volume jumped more than 10-fold as the stock soared after the company agreed to combine with $Disney (DIS.US)$'s Hulu+ Live TV business.

Shares jumped 11% to $5.57 by noon Tuesday, extending its 251% surge the previous day when the deal was announced. Under the agreement, Fubo, which will own 30% of the combined virtual multichannel video programming (MVPD) company, will operate the new entity. Together, the two businesses that will merge will have a combined over 6.2 million subscribers in North America.

The transaction paves the way for a meaningful generation of earnings before interest, taxes, depreciation, and amortization (EBITDA), JPMorgan analysts including Nikhil Aluru said in a note yesterday.

"We view the transaction favorably as it resolves Fubo’s imminent balance sheet challenges, provides the business with more scale (and an improved EBITDA outlook), and offers the ability to package into a skinnier sports tier (reducing a key risk over time),"

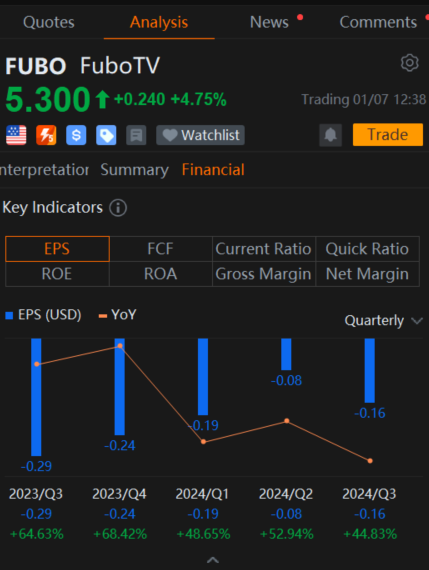

The company has been burning cash since the fourth quarter of 2019, data compiled by Bloomberg showed. While losses are narrowing, the company still reported a negative adjusted EBITDA of $27.6 million in its latest financial results for the quarter that ended Sept. 30.

The fortune of the internet TV service provider is turning after the stock tumbled 60% last year, touching a record low of $1.10 in June. Shares that have been languishing below $2 since early last year are now up 282% in the first two days of the week. They traded at $5.32 at 12:52 p.m.

The company's brightening prospects are boosting the appeal of its options. More than 497,400 call and put options changed hands so far making FuboTV the fifth most active stock option, behind $NVIDIA (NVDA.US)$, $Tesla (TSLA.US)$, $Palantir (PLTR.US)$ and $Micron Technology (MU.US)$. That's more than 10 times the FuboTV's average options volume of 46,415 over the past 20 days, Bloomberg data showed.

More than three-quarters of the volume so far seen across 12 expiration dates stretching through Jan. 15, 2027, are call options. The most popular contract linked to FuboTV is the call option that gives the holders the right to buy the stock at $7 by the end of next week. The price of those calls surged as much as 156% to $1.15 early Tuesday. The contract touched that intraday high when the share price rose to as high as $6.45, just 55 cents below the strike price.

Under the deal, Fubo agreed to settle all litigation related to Venue Sports, the previously announced sports streaming platform planned by ESPN, $Fox Corp-A (FOXA.US)$ and $Warner Bros Discovery (WBD.US)$. Fubo also settled all ligitation with Fox and Warner Bros.

As part of the deal, Disney, Fox, and Warner Bros. will pay a total of $220 million to Fubo, according to a press release Monday. Disney also committed to provide Fubo with a $145 million term loan as part of the deal, it stated.

The transaction "meaningfully resolves questions around Fubo's balance sheet and long-term viability," the JPMorgan analysts said. The cash payment from the transaction will boost Fubo's liquidity, they said.

Share your thoughts on Fubo in the comment section. Do you see Fubo sustaining its share price rally, or is the stock now overvalued? Let your voice be counted by voting below.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Buy n Die Together❤ :

IDigress : This is such a great article! I’ve learned option analysis via moomoo now. BTW I’ve made 10k trading this just yesterday